今年穩定幣總市值增長約46%,這種加密貨幣正在鞏固其在全球貿易中更爲持久的地位。

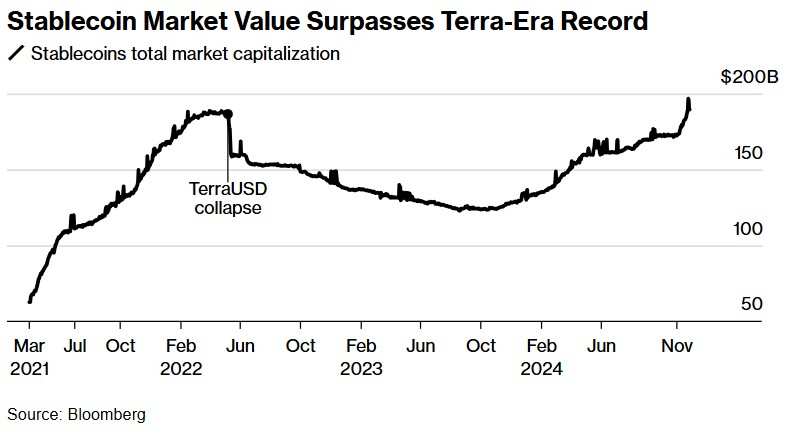

智通財經APP獲悉,在2022年穩定幣TerraUSD引發的那場臭名昭著的「穩定幣崩潰事件」重創市場情緒後,穩定幣市場的整體市場價值緩緩步入回升曲線,並在近日快速增長,達到了全新的高度。根據DeFiLlama的統計數據,截至上週日,全球穩定幣的市值今年已大幅增長46%,總市值超越1900億美元,達到歷史新高水平。

穩定幣(Stablecoins)也是一種加密貨幣,旨在保持價格與法定貨幣(通常是美元)長期一致。在過去一段時間,它們的主要用途是作爲交易員們將資金轉入和轉出其他加密貨幣的渠道。但現在越來越多的投資者樂觀地認爲,隨着大力支持加密貨幣發展的特朗普重返白白宮,穩定幣可能將在全球商業以及貿易體系中發揮更重要的作用,特別是作爲跨境支付的穩定支付工具。

穩定幣市值超越Terra時代曾創下的歷史紀錄

穩定幣市值超越Terra時代曾創下的歷史紀錄

Tether,發行了世界上最大規模的穩定幣USDT,這種加密貨幣的流通規模飆升至近1330億美元,佔穩定幣市場總量的大約70%。該公司希望通過進軍包括大宗商品交易在內的更多新領域來擴大穩定幣USDT的使用範圍。據了解,該公司最近宣佈爲其在中東的第一筆原油交易提供資金支持。

與此同時,市值高達700億美元的金融科技巨頭Stripe在10月表示,計劃以11億美元收購聚焦於穩定幣的初創公司Bridge,這將是有史以來規模最大的數字資產初創公司收購案之一。此外,包括PayPal在內的其他傳統金融科技公司也開始涉足穩定幣領域。

這些金融科技巨頭對於穩定幣的全面接納預期,可能有助於避免2022年5月TerraUSD崩潰後出現的那種加密貨幣市場暴跌。與Do Kwon創立的Terra區塊鏈相關的穩定幣的崩潰事件,在穩定幣市場上造成了高達190億美元市場價值的缺口,對於維繫價值穩定的穩定幣市場來說這種震盪非常罕見,這一缺口甚至花了兩年半以上的時間才得以填補。

近期穩定幣價值跟隨比特幣等加密貨幣價格暴漲而迅速飆升,主要因唐納德·特朗普在美國總統大選中大獲全勝,引發了加密貨幣市場的上漲狂潮。特朗普曾一度對加密貨幣行業持懷疑態度,但現在他承諾將實施更有利的政策,支持加密貨幣行業發展。特朗普在競選期間全面擁抱數字資產,並表示要將美國打造成「加密貨幣之都」以及「比特幣超級大國」。

根據CoinGecko的統計數據,自美國大選以來,加密貨幣市場的總價值已增長近萬億美元,突破3.2萬億美元大關,在全球股票榜單中,則僅次於蘋果與英偉達這兩大「超級巨無霸」,意味着將加密貨幣市場視作一隻股票的話,其市值僅次於英偉達與蘋果,遙遙領先於亞馬遜、谷歌、Meta、特斯拉以及沙特阿美等一衆全球最頂級上市公司。

加密貨幣市場的領頭羊比特幣在上週一度逼近10萬美元史詩級大關,但隨後有所回落,當前比特幣的交易價格徘徊在93,500美元附近。

比特幣市值目前徘徊在1.8萬億美元附近,長期以來爲最大規模加密貨幣。華爾街投資機構Ned Davis Research近日將比特幣升級爲「僅限做多交易」,並認爲,比特幣有望在明年春天飆升至12萬美元以上。渣打銀行數字資產研究全球主管Geoff Kendrick則認爲,特朗普贏得美國總統大選後,比特幣的價格將在今年年底達到12.5萬美元,到2025年底將達到20萬美元。