①科創50指數今日大增3.61%,多隻芯片ETF成交額大增,其中科創芯片ETF基金(588290)成交額環比增長232%。②跌停的高位股有研新材獲華鑫證券上海宛平南路營業部買入3.09億。

滬深股通今日合計成交1827.01億,其中賽力斯和寧德時代分居滬股通和深股通成交額個股首位。板塊主力資金方面,計算機板塊主力資金淨流入居首。ETF成交方面,香港證券ETF(513090)成交額位居首位。期指持倉方面,IF、IC、IM期指主力合約空頭加倉數量大於多頭。龍虎榜方面,東方鋯業獲機構買入超6000萬;光華科技獲機構買入超6000萬;臻鐳科技遭機構賣出超8000萬;匯金科技遭機構賣出超4000萬;國光電器遭招商證券福州六一中路營業部賣出2.01億;生意寶獲國泰君安三亞迎賓路買入1.69億;利歐股份獲三家一線遊資席位合計買入超2.6億;湯姆貓獲一家量化席位買入超6000萬。

一、滬深股通前十大成交

今日滬股通總成交金額爲855.72億,深股通總成交金額爲971.29億。

今日滬股通總成交金額爲855.72億,深股通總成交金額爲971.29億。

從滬股通前十大成交個股來看,賽力斯位居首位;貴州茅台和中信證券分居二、三位。

從滬股通前十大成交個股來看,賽力斯位居首位;貴州茅台和中信證券分居二、三位。從深股通前十大成交個股來看,寧德時代位居首位;東方財富和立訊精密分居二、三位。

二、板塊個股主力大單資金

從板塊表現來看,IP經濟、遊戲、風電、衛星導航等板塊漲幅居前,石油加工、化肥、供銷社等板塊跌幅居前。

從主力板塊資金監控數據來看,計算機板塊主力資金淨流入居首。

從主力板塊資金監控數據來看,計算機板塊主力資金淨流入居首。板塊資金流出方面,醫藥板塊主力資金淨流出居首。

從個股主力資金監控數據來看,主力資金淨流入前十的個股所屬板塊較爲雜亂,東方財富淨流入居首。

從個股主力資金監控數據來看,主力資金淨流入前十的個股所屬板塊較爲雜亂,東方財富淨流入居首。主力資金流出前十的個股所屬板塊較爲雜亂,江淮汽車淨流出居首。

三、ETF成交

從成交額前十的ETF來看,香港證券ETF(513090)成交額位居首位;科創50ETF(588000)成交額位居第二位。

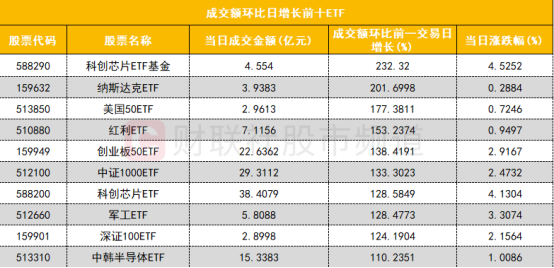

從成交額前十的ETF來看,香港證券ETF(513090)成交額位居首位;科創50ETF(588000)成交額位居第二位。 從成交額環比增長前十的ETF來看,科創芯片ETF基金(588290)成交額環比增長232%位居首位;納斯達克ETF(159632)成交額環比增長201%位居次席。

從成交額環比增長前十的ETF來看,科創芯片ETF基金(588290)成交額環比增長232%位居首位;納斯達克ETF(159632)成交額環比增長201%位居次席。四、期指持倉

四大期指主力合約中,IH合約多空雙方均減倉,多頭減倉數量較多;IF、IC、IM合約多空雙方均加倉,空頭加倉數量均略多。

四大期指主力合約中,IH合約多空雙方均減倉,多頭減倉數量較多;IF、IC、IM合約多空雙方均加倉,空頭加倉數量均略多。五、龍虎榜

1、機構

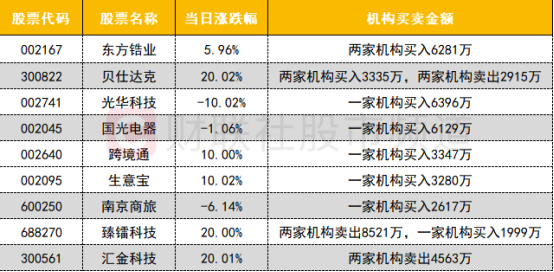

今日龍虎榜機構活躍度一般,買入方面,東方鋯業獲機構買入超6000萬;光華科技獲機構買入超6000萬;國光電器獲機構買入超6000萬。

今日龍虎榜機構活躍度一般,買入方面,東方鋯業獲機構買入超6000萬;光華科技獲機構買入超6000萬;國光電器獲機構買入超6000萬。賣出方面,衛星導航概念股臻鐳科技遭機構賣出超8000萬;互利網金融概念股匯金科技遭機構賣出超4000萬。

2、遊資

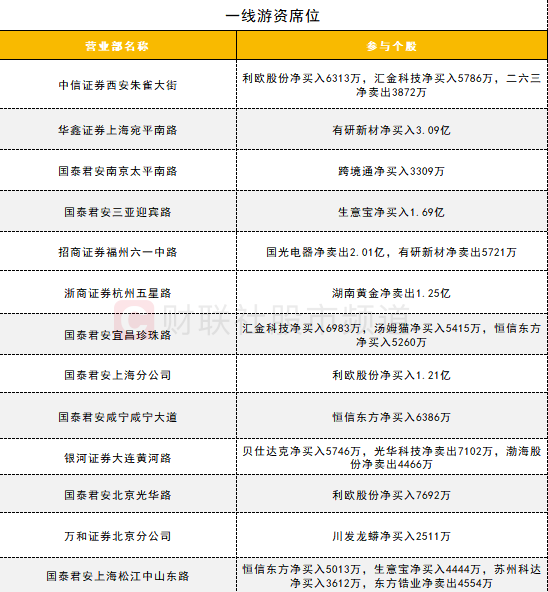

一線遊資活躍度一般,高位股有研新材獲華鑫證券上海宛平南路營業部買入3.09億;國光電器遭招商證券福州六一中路營業部賣出2.01億;生意寶獲國泰君安三亞迎賓路買入1.69億;反包漲停的利歐股份獲三家一線遊資席位合計買入超2.6億。

一線遊資活躍度一般,高位股有研新材獲華鑫證券上海宛平南路營業部買入3.09億;國光電器遭招商證券福州六一中路營業部賣出2.01億;生意寶獲國泰君安三亞迎賓路買入1.69億;反包漲停的利歐股份獲三家一線遊資席位合計買入超2.6億。 量化資金活躍度一般,IP經濟概念股湯姆貓獲一家量化席位買入超6000萬。

量化資金活躍度一般,IP經濟概念股湯姆貓獲一家量化席位買入超6000萬。

今日沪股通总成交金额为855.72亿,深股通总成交金额为971.29亿。

今日沪股通总成交金额为855.72亿,深股通总成交金额为971.29亿。