①Ping An Life Insurance announced a large undisclosed investment in unlisted equity, with an investment amount of RMB 3.75 billion, involving two companies, Zhejiang Yingde and Hangzhou Yingde. ②The relevant information shows that this investment is related to the integration trade changes between the domestic industrial gas leader Hangyang Industrial Gas and Gas Power Technology. ③As of now, Sunshine Life Insurance has not yet released a disclosure announcement regarding a large undisclosed investment in unlisted equities.

On the evening of November 26, China Ping An Life Insurance Co., Ltd. (referred to as 'Ping An Life') announced on its official website the 'Announcement of Information Disclosure on Large Undisclosed Equity Investment (Agreement Signing Stage)', showing that the company is engaged in a major investment initiative.

According to the announcement, Ping An Life signed the 'Acquisition Agreement of Zhejiang Yingde Holdings Group Co., Ltd.' and the 'Shareholders Agreement of Hangzhou Yingde Gas Co., Ltd.' with Zhejiang Yingde Holdings Group Co., Ltd. and Hangzhou Yingde Gas Co., Ltd. on November 21, 2024, with an investment amount of RMB 3.75 billion, marking the first investment. The report did not disclose further investment details.

On November 27, a reporter from Cailian News contacted relevant personnel at Ping An Life Insurance and learned that the above-mentioned investment is still in the agreement signing stage, and there is currently no more information to disclose. After the subsequent delivery is completed, complete information on the symbol and equity ownership will be disclosed.

On November 27, a reporter from Cailian News contacted relevant personnel at Ping An Life Insurance and learned that the above-mentioned investment is still in the agreement signing stage, and there is currently no more information to disclose. After the subsequent delivery is completed, complete information on the symbol and equity ownership will be disclosed.

Cailian News reporters noted that more related information indicates that the aforementioned investment may be related to the recent market focus on the domestic industrial gas leader Hangyang Group Co., Ltd. (stock abbreviation 'Hangyang Shares') and the integration trade changes of Gas Power Technology.

Tianyancha data shows that in addition to Ping An Life, Sunshine Life Insurance also participated in the capital increase of Hangzhou Yingde. However, as of now, Cailian News reporters have not found any disclosure announcements related to large undisclosed investments in unlisted equities on the official website of Sunshine Life Insurance.

Recent changes in domestic industrial gas leader integration trade.

It is understood that in 2017, the well-known Asian private equity investment fund Temasek Investment Group privatized the domestic industrial gas leader Yingde Gas, and in 2018, obtained control of Baosteel Gas, integrating Yingde Gas and Baosteel Gas into Gas Power Technology. In 2021, Gas Power Technology submitted an application to the Hong Kong Stock Exchange, but ultimately failed to successfully go public. According to the Gas Power Technology prospectus, the company ranks first in the domestic industrial gas industry.

In May 2023, Hangzhou Oxygen Plant Group, the fifth largest industrial gas company in China, announced that the company's indirect controlling shareholder Hangzhou State-owned Capital Investment Operation Co., Ltd. (referred to as "Hangzhou Capital"), together with other investors, Yingde Hong Kong, and Gas Power Technology, signed an agreement. It was agreed that Hangzhou Capital and other investors would establish a special purpose vehicle company (SPV1), and through SPV1 acquire 100% equity of Zhejiang Yingde Holding Group Co., Ltd. owned by Yingde Hong Kong as mentioned in the above-mentioned Ping An Life announcement.

At the time of the announcement, it was stated that after the acquisition, Hangzhou Capital would become the largest shareholder of SPV1, holding 30% of its shares. Hangzhou Capital committed at that time to promote the asset restructuring between SPV1 and Hangzhou Oxygen Plant Group within 36 months after the completion of the transaction.

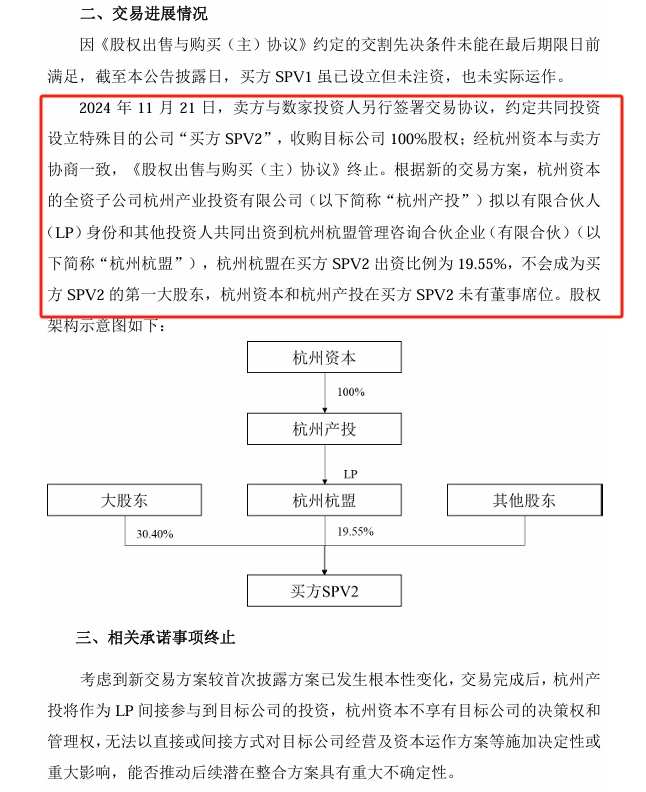

However, on November 22 of this year, Hangzhou Oxygen Plant Group announced that due to the failure to meet the preconditions for delivery as agreed in the previous agreement, several investors and the seller (i.e. Tai Meng Investment Group) signed a separate transaction agreement to establish a new special purpose vehicle company (SPV) (referred to as "Buyer SPV2" in the announcement) to acquire 100% equity of the target assets (i.e. Gas Power Technology industrial gas business). This also led to the termination of the original transaction plan.

It is worth noting that the new transaction agreement was signed on November 21, 2024.

△ Screenshot from the announcement of Hangzhou Oxygen Plant Group

In the new agreement, Hangzhou Oxygen Plant Group's indirect controlling shareholder Hangzhou Capital will contribute to the establishment of Hangzhou Hangmeng Management Consulting Partnership Enterprise (Limited Partnership) as a limited partner (LP). Hangzhou Hangmeng will hold 19.55% of SPV2, will not be the largest shareholder of SPV2, Hangzhou Capital will not have a director seat in SPV2, and will no longer have decision-making and management rights over the acquired company. Consequently, the original asset integration plan will face significant uncertainty.

There are market rumors that the newly established special purpose company (SPV2) as per the agreement is Hangzhou Yingde. However, this news has not been officially confirmed.

Hangzhou Yingde has just completed a capital increase of over 18.6 billion yuan, with participation from Ping An Life.

Tianyancha business information shows that Hangzhou Yingde was registered and established on May 30 this year, located in Hangzhou, Zhejiang Province. It is an enterprise mainly engaged in the manufacturing of instruments and meters, with the initial shareholder being TIGER ROCK PTE.LTD.; the registered capital is 100 million RMB. TIGER ROCK PTE. LTD is a foreign-funded enterprise, and more information is not available for inquiry.

On November 22, Hangzhou Yingde welcomed its first capital increase, increasing its registered capital from 100 million RMB to 18750 million RMB. The market entity type also changed from 'limited liability company wholly foreign-owned' to 'limited liability company (foreign investment, non-wholly-owned).'

Of note, Ping An Life Insurance as a new shareholder participated in the capital increase. In addition, there are 7 new shareholders including Hangzhou Hangmeng Management Consulting Partnership Enterprise (Limited Partnership) (i.e., Hangzhou Hangmeng), Suzhou Yibin Equity Investment Partnership Enterprise (Limited Partnership), Fortune Venture L.P., Yichang Zhiyao Enterprise Management Partnership Enterprise (Limited Partnership), TIGER ROCK II LIMITED, Hangzhou Reform Leading Management Consulting Partnership Enterprise (Limited Partnership), and Sunshine Life Insurance Co., Ltd. Among them, Yichang Zhiyao Enterprise Management Partnership Enterprise (Limited Partnership) is a member of China International Capital Corporation.

Tianyancha business information shows that currently, apart from disclosing that TIGER ROCK PTE.LTD. holds a 0.5333% shareholding and a subscribed capital of 100 million RMB, the contribution amounts and shareholding ratios of the other 8 new shareholders have not been disclosed.

△ Screenshot from Tianyancha

11月27日,财联社记者向平安人寿相关人士咨询后获悉,上述投资事项尚处于签署协议阶段,目前没有更多信息可以披露,后续交割完毕后,将会披露完整的标的和股权占比信息。

11月27日,财联社记者向平安人寿相关人士咨询后获悉,上述投资事项尚处于签署协议阶段,目前没有更多信息可以披露,后续交割完毕后,将会披露完整的标的和股权占比信息。