Top 3 Consumer Stocks That Are Set To Fly In Q4

Top 3 Consumer Stocks That Are Set To Fly In Q4

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

非必需消費品領域超賣次數最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,RSI接近或低於30。

Kohls Corp (NYSE:KSS)

科爾斯公司(紐約證券交易所代碼:KSS)

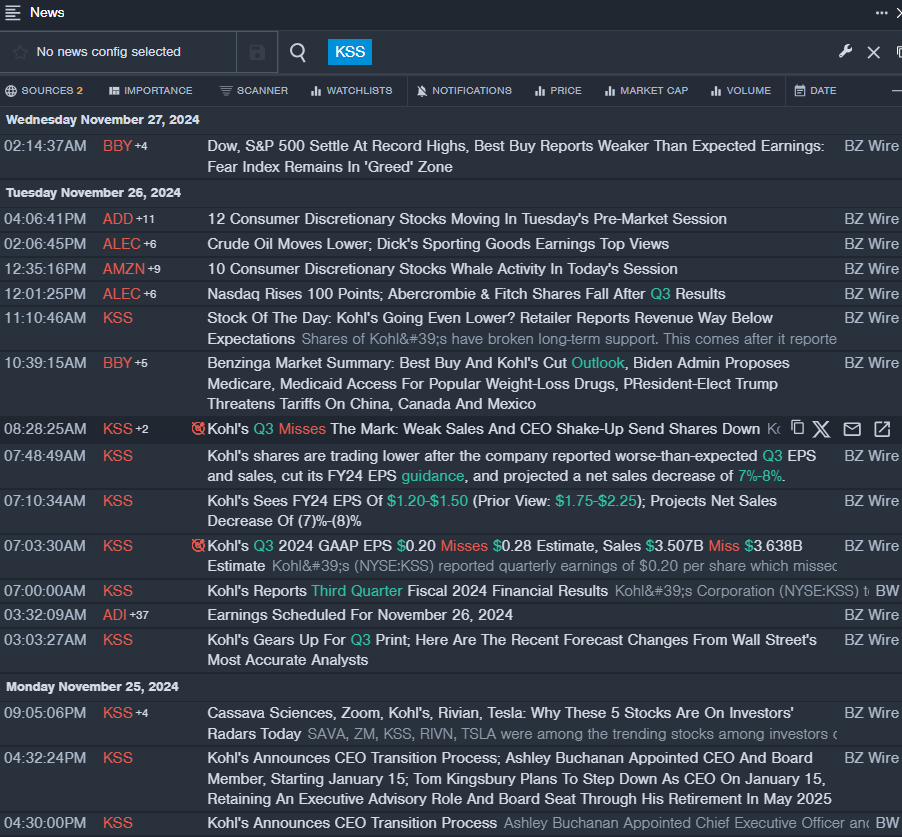

- On Nov. 26, Kohl's shares are trading lower after the company reported worse-than-expected third-quarter results, cut its FY24 EPS guidance, and projected a net sales decrease of 7%-8%. Tom Kingsbury, Kohl's chief executive officer, said, "Our third quarter results did not meet our expectations as sales remained soft in our apparel and footwear businesses. Although we had a strong collective performance across our key growth areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies "R" Us shops in 200 of our stores, these were unable to offset the declines in our core business." The company's stock fell around 20% over the past month and has a 52-week low of $14.22.

- RSI Value: 26.35

- KSS Price Action: Shares of Kohls fell 17% to close at $15.22 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest KSS news.

- 11月26日,科爾的股價走低,此前該公司公佈的第三季度業績低於預期,下調了24財年的每股收益預期,並預計淨銷售額將下降7%-8%。科爾首席執行官湯姆·金斯伯裏表示:「由於服裝和鞋類業務的銷售仍然疲軟,我們第三季度的業績沒有達到我們的預期。儘管我們在包括絲芙蘭、家居裝飾、禮物和衝動在內的關鍵增長領域取得了強勁的集體業績,而且還受益於我們在200家門店開設的Babies 「R」 Us門店,但這些都無法抵消我們核心業務的下降。」該公司的股票在過去一個月中下跌了約20%,爲52周低點14.22美元。

- RSI 值:26.35

- KSS價格走勢:週二,科爾斯股價下跌17%,收於15.22美元。

- Benzinga Pro 的實時新聞提醒注意最新的 KSS 新聞。

Honda Motor Co Ltd (NYSE:HMC)

本田汽車有限公司(紐約證券交易所代碼:HMC)

- On Nov. 6, Honda Motor reported a decline in the first-half profit and lowered its annual profit forecast. The company reported the first half of FY24 revenue growth of 12.4% year over year 10.798 trillion yen ($69.9 billion), while profits declined 19.7% to 494.6 billion Yen ($3.20 billion). The company's stock fell around 17% over the past month and has a 52-week low of $25.57.

- RSI Value: 25.03

- HMC Price Action: Shares of Honda fell 3% to close at $25.87 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in HMC stock.

- 11月6日,本田汽車報告上半年利潤下降,並下調了年度利潤預期。該公司報告稱,24財年上半年收入同比增長12.4%,同比增長10.798萬億日元(合699億美元),而利潤下降19.7%,至4946日元(合32.0億美元)。該公司的股票在過去一個月中下跌了約17%,跌至52周低點25.57美元。

- RSI 值:25.03

- HMC價格走勢:本田股價週二下跌3%,收於25.87美元。

- Benzinga Pro的圖表工具幫助確定了HMC股票的走勢。

PDD Holdings Inc – ADR (NASDAQ:PDD)

PDD Holdings Inc — ADR(納斯達克股票代碼:PDD)

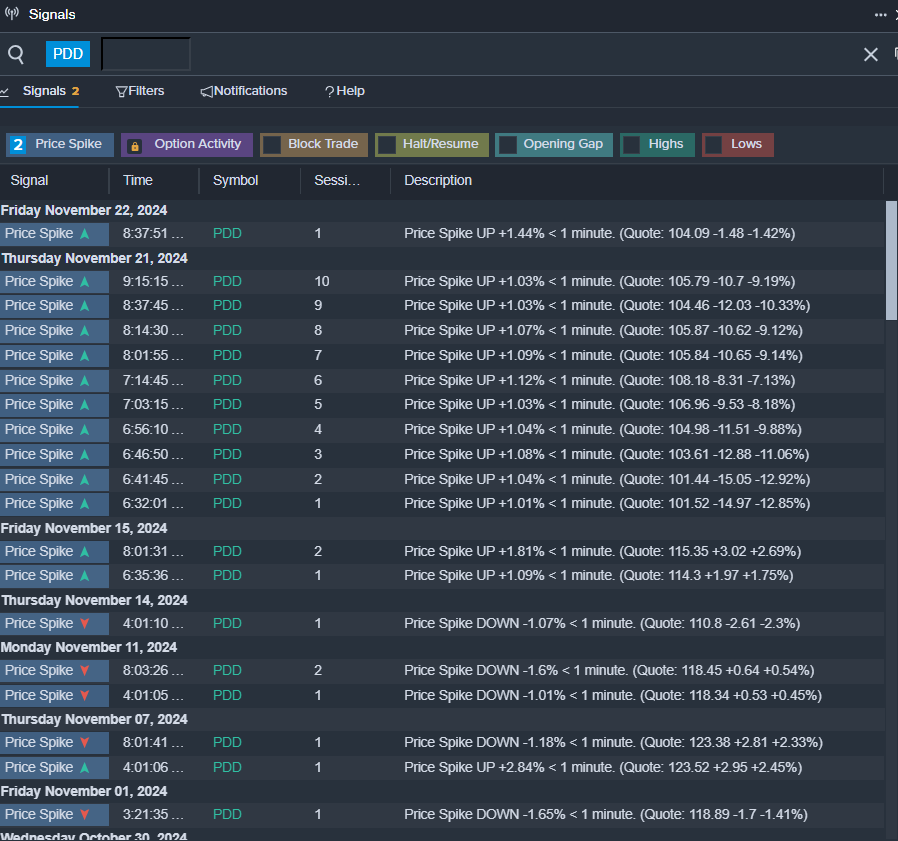

- On Nov. 21, PDD Holdings reported worse-than-expected third-quarter financial results. PDD reported fiscal third-quarter 2024 revenue growth of 44% year-on-year to $14.16 billion (68.84 billion Chinese yuan), missing the analyst consensus estimate of $14.47 billion. The company's stock fell around 21% over the past month and has a 52-week low of $88.01.

- RSI Value: 29.89

- PDD Price Action: Shares of PDD fell 1.4% to close at $99.31 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in PDD shares.

- 11月21日,PDD Holdings公佈的第三季度財務業績低於預期。PDD報告稱,2024財年第三季度收入同比增長44%,達到141.6億美元(人民幣688.4元),未達到分析師共識估計的144.7億美元。該公司的股票在過去一個月中下跌了約21%,跌至52周低點88.01美元。

- RSI 值:29.89

- PDD價格走勢:週二,PDD股價下跌1.4%,收於99.31美元。

- Benzinga Pro的信號顯示PDD股票可能出現突破。

Read More:

閱讀更多:

- Jim Cramer: Linde Is A 'Terrific' Company, Sees Another Stock Up 75% As 'Not Done'

- 吉姆·克萊默:林德是一家 「了不起」 的公司,認爲另一隻股票上漲了75%,原因是 「未完成」