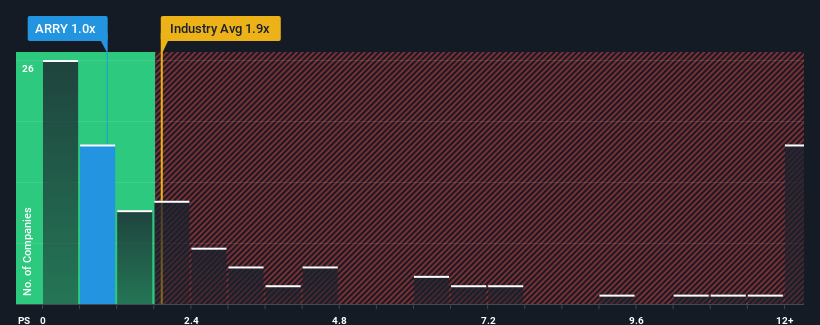

You may think that with a price-to-sales (or "P/S") ratio of 1x Array Technologies, Inc. (NASDAQ:ARRY) is a stock worth checking out, seeing as almost half of all the Electrical companies in the United States have P/S ratios greater than 2x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Array Technologies' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Array Technologies' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Array Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Array Technologies would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. Regardless, revenue has managed to lift by a handy 21% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. Regardless, revenue has managed to lift by a handy 21% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 12% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 27% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why Array Technologies' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Array Technologies' P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Array Technologies' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Array Technologies that we have uncovered.

If these risks are making you reconsider your opinion on Array Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.