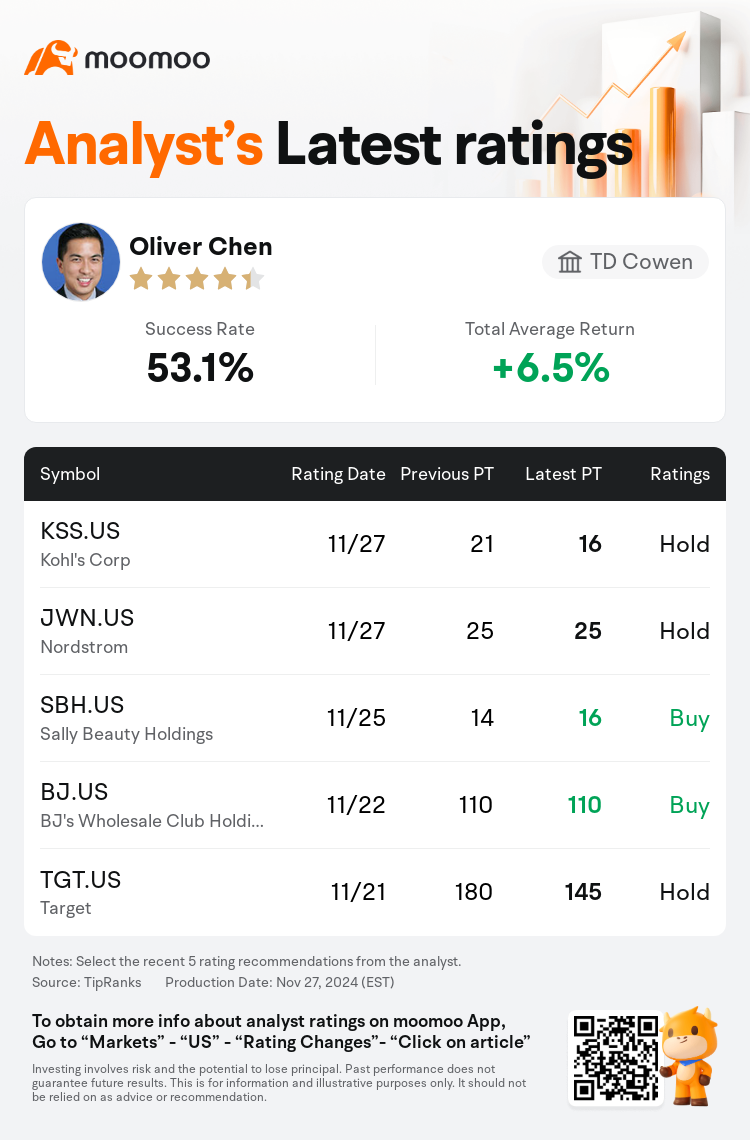

TD Cowen analyst Oliver Chen maintains $Kohl's Corp (KSS.US)$ with a hold rating, and adjusts the target price from $21 to $16.

According to TipRanks data, the analyst has a success rate of 53.1% and a total average return of 6.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Kohl's Corp (KSS.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Kohl's Corp (KSS.US)$'s main analysts recently are as follows:

After the management at Kohl's revised its FY24 forecasts downwards for sales, comparable store sales, operating margins, and earnings per share, reflecting ongoing difficulties in the core business and anticipation of a competitive holiday season, challenges are still seen as prevalent in the core business. Additionally, despite the appointment of a new CEO with customer-facing expertise from a significant retail background, it is anticipated that many of the fundamental issues at Kohl's will persist.

Sales have consistently been a challenge for Kohl's over several years, with a noticeable deterioration in trends in Q3. The company's initiatives appear to be underperforming, exacerbating its competitive difficulties.

The company reported a Q3 miss and lowered outlook. Analysts note a 9.3% decline in same-store sales which further decelerated on a two-year stacked basis to 14.8%, marking the 11th consecutive quarter of negative performance in this metric. Observations indicate a sequential slowdown during September and October, attributed to unfavorably warm weather, hurricanes, and emerging headwinds as the U.S. election approached.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

TD Cowen分析师Oliver Chen维持$柯尔百货 (KSS.US)$持有评级,并将目标价从21美元下调至16美元。

根据TipRanks数据显示,该分析师近一年总胜率为53.1%,总平均回报率为6.5%。

此外,综合报道,$柯尔百货 (KSS.US)$近期主要分析师观点如下:

此外,综合报道,$柯尔百货 (KSS.US)$近期主要分析师观点如下:

在Kohl's管理层下调了FY24销售、同店销售、运营利润率和每股收益的预测后,反映出核心业务面临的持续困难以及对竞争激烈的假日季节的预期,核心业务仍然面临普遍挑战。此外,尽管新任CEO的客户服务经验来自于重要的零售背景,但预计Kohl's的许多根本问题仍将持续。

多年来,Kohl's的销售一直是一个挑战,第三季度的趋势显著恶化。公司的举措似乎表现不佳,进一步加剧了其竞争困难。

公司报告第三季度业绩不佳,并降低了前景。分析师注意到同店销售额下降了9.3%,在两年叠加基准上进一步回落至14.8%,这是该指标连续第11个季度的负面表现。观察表明,九月和十月期间出现了逐步放缓,原因归结为不利的温暖天气、飓风,以及随着美国大选临近而出现的逆风。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$柯尔百货 (KSS.US)$近期主要分析师观点如下:

此外,综合报道,$柯尔百货 (KSS.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of