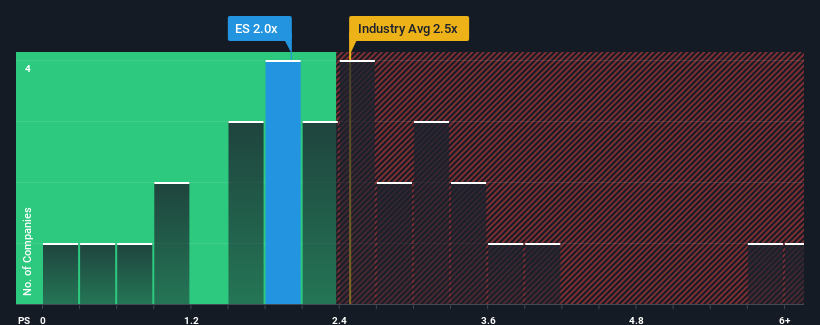

With a median price-to-sales (or "P/S") ratio of close to 2.4x in the Electric Utilities industry in the United States, you could be forgiven for feeling indifferent about Eversource Energy's (NYSE:ES) P/S ratio of 2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Eversource Energy Performed Recently?

Eversource Energy has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Eversource Energy.How Is Eversource Energy's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Eversource Energy's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 5.1% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 21% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Retrospectively, the last year delivered a frustrating 5.1% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 21% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 7.3% per annum during the coming three years according to the twelve analysts following the company. That's shaping up to be materially higher than the 5.0% each year growth forecast for the broader industry.

With this information, we find it interesting that Eversource Energy is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Eversource Energy's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Eversource Energy currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you take the next step, you should know about the 3 warning signs for Eversource Energy (2 can't be ignored!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.