Decoding Iris Energy's Options Activity: What's the Big Picture?

Decoding Iris Energy's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Iris Energy. Our analysis of options history for Iris Energy (NASDAQ:IREN) revealed 35 unusual trades.

金融巨頭在Iris Energy上做出了引人注目的看好舉動。我們對Iris Energy(納斯達克:IREN)期權歷史的分析顯示,出現了35筆異常交易。

Delving into the details, we found 60% of traders were bullish, while 31% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $3,484,594, and 27 were calls, valued at $2,110,681.

深入細節,我們發現60%的交易員持有看好態度,而31%顯示出看淡傾向。在我們發現的所有交易中,有8筆看跌期權,價值3484594美元,以及27筆看漲期權,價值2110681美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.5 to $25.0 for Iris Energy over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,看來鯨魚們一直將Iris Energy的價格區間定在7.5美元到25.0美元之間,持續了過去3個月。

Insights into Volume & Open Interest

成交量和持倉量分析

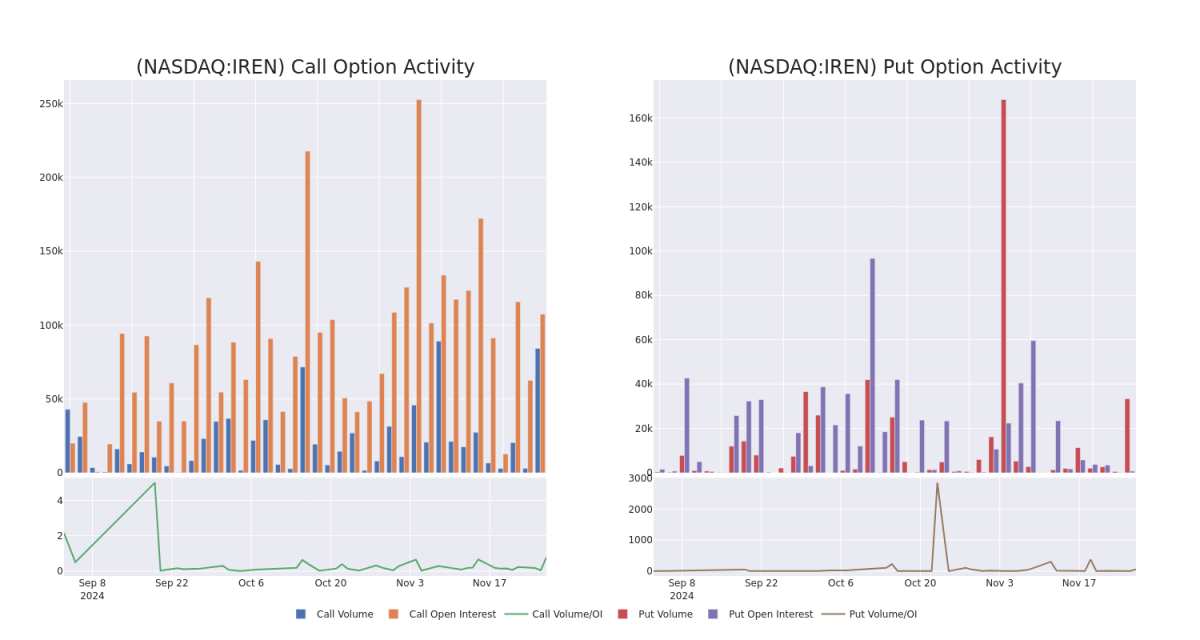

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Iris Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Iris Energy's significant trades, within a strike price range of $7.5 to $25.0, over the past month.

檢查成交量和未平倉合約提供了對股票研究的重要見解。這些信息對於衡量在特定執行價格下Iris Energy期權的流動性和利益水平至關重要。下面,我們呈現了過去一個月內Iris Energy重要交易中看漲和看跌期權在執行價格7.5美元至25.0美元區間內成交量和未平倉合約量趨勢的快照。

Iris Energy Call and Put Volume: 30-Day Overview

Iris Energy看漲和看跌期權成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IREN | PUT | SWEEP | BULLISH | 03/21/25 | $5.2 | $5.1 | $5.2 | $15.00 | $1.7M | 610 | 9.3K |

| IREN | PUT | SWEEP | BULLISH | 03/21/25 | $6.1 | $5.1 | $5.1 | $15.00 | $1.1M | 610 | 3.0K |

| IREN | CALL | SWEEP | BULLISH | 03/21/25 | $2.3 | $2.25 | $2.3 | $15.00 | $286.8K | 16.0K | 1.1K |

| IREN | CALL | SWEEP | BEARISH | 03/21/25 | $2.5 | $2.3 | $2.3 | $15.00 | $282.1K | 16.0K | 3.0K |

| IREN | CALL | SWEEP | BULLISH | 03/21/25 | $2.5 | $2.15 | $2.15 | $15.00 | $247.2K | 16.0K | 6.1K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IREN | 看跌 | SWEEP | BULLISH | 03/21/25 | $5.2 | $5.1 | $5.2 | $15.00 | $1.7M | 610 | 9.3K |

| IREN | 看跌 | SWEEP | BULLISH | 03/21/25 | $6.1 | $5.1 | $5.1 | $15.00 | 110萬美元 | 610 | 3.0K |

| IREN | 看漲 | SWEEP | BULLISH | 03/21/25 | $2.3 | $2.25 | $2.3 | $15.00 | $286.8K | 16.0K | 1.1K |

| IREN | 看漲 | SWEEP | 看淡 | 03/21/25 | $2.5 | $2.3 | $2.3 | $15.00 | $282.1K | 16.0K | 3.0K |

| IREN | 看漲 | SWEEP | BULLISH | 03/21/25 | $2.5 | $2.15 | $2.15 | $15.00 | $247.2K | 16.0K | 6.1K |

About Iris Energy

關於Iris Energy

Iris Energy Ltd is a Bitcoin mining company. It builds, owns, and operates data centers and electrical infrastructure for the mining of Bitcoin powered by renewable energy. The company's mining operations generate revenue by earning Bitcoin through a combination of block rewards and transaction fees from the operation of its specialized computers called Application-specific Integrated Circuits and exchanging these Bitcoin for currencies such as USD or CAD on a daily basis.

Iris Energy Ltd是一家比特幣採礦公司。它建造、擁有、運營比特幣的數據中心和電力基礎設施,使用可再生能源來採礦。該公司的礦業運營通過通過運營稱爲特定應用集成電路的專門計算機獲得比特幣的組合塊獎勵和交易手續費,並每天將這些比特幣兌換成美元或加元等貨幣來獲取收益。

Having examined the options trading patterns of Iris Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Iris Energy的期權交易模式後,我們的注意力現在直接轉向公司。這種轉變使我們能夠深入了解其當前的市場位置和表現

Present Market Standing of Iris Energy

Iris Energy的現市場地位

- Currently trading with a volume of 8,043,716, the IREN's price is up by 24.84%, now at $11.94.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 78 days.

- 目前成交量爲8,043,716,IREN的價格上漲了24.84%,現在爲$11.94。

- RSI讀數表明該股目前可能接近超買水平。

- 預期收益發布將在78天后進行。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Iris Energy options trades with real-time alerts from Benzinga Pro.

期權交易存在較高的風險和潛在回報。 精明的交易員通過不斷學習,調整策略,監控多個因子,並密切關注市場變化來管理這些風險。 通過來自Benzinga Pro的實時警報,了解最新的Iris Energy期權交易。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Iris Energy's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Iris Energy's options at certain strike prices. Below, we present a snapshot of the