Spotlight on Citigroup: Analyzing the Surge in Options Activity

Spotlight on Citigroup: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Citigroup.

有很多資金要花費的大鯨魚對花旗集團採取了明顯的看淡立場。

Looking at options history for Citigroup (NYSE:C) we detected 15 trades.

通過查看花旗集團(紐交所:C)的期權歷史,我們檢測到了15筆交易。

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 60% with bearish.

如果考慮每筆交易的具體情況,可以準確地說40%的投資者以看好的預期開盤,而60%則是看淡。

From the overall spotted trades, 9 are puts, for a total amount of $443,285 and 6, calls, for a total amount of $254,927.

在所有發現的交易中,9筆爲看跌期權,總金額爲443,285美元,6筆爲看漲期權,總金額爲254,927美元。

Predicted Price Range

預測價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $47.5 to $77.5 for Citigroup during the past quarter.

分析這些合約的成交量和未平倉合約,似乎大玩家在過去一個季度一直關注花旗集團的價格區間在47.5美元到77.5美元之間。

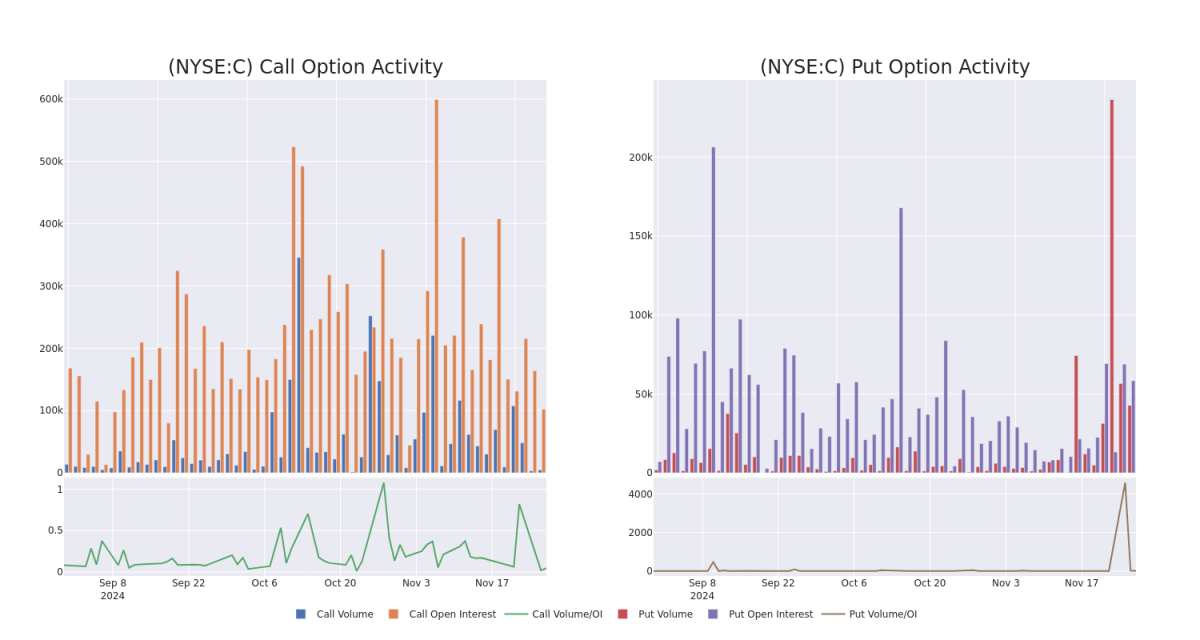

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

In today's trading context, the average open interest for options of Citigroup stands at 13369.42, with a total volume reaching 47,345.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Citigroup, situated within the strike price corridor from $47.5 to $77.5, throughout the last 30 days.

在今天的交易背景下,花旗集團期權的平均未平倉合約爲13369.42,總成交量達到47,345.00。附圖描繪了花旗集團在過去30天內高價值交易的看漲和看跌期權成交量及未平倉合約的變化,位於47.5美元到77.5美元的行權價區間內。

Citigroup 30-Day Option Volume & Interest Snapshot

花旗集團30天期權成交量和持倉量快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | PUT | SWEEP | BEARISH | 01/17/25 | $0.31 | $0.3 | $0.31 | $60.00 | $93.0K | 32.6K | 4.0K |

| C | PUT | SWEEP | BEARISH | 11/29/24 | $0.35 | $0.34 | $0.35 | $70.00 | $85.9K | 2.0K | 4.5K |

| C | CALL | TRADE | BULLISH | 06/20/25 | $5.8 | $5.75 | $5.8 | $70.00 | $58.0K | 24.0K | 104 |

| C | CALL | SWEEP | BEARISH | 11/29/24 | $0.62 | $0.59 | $0.62 | $70.00 | $51.9K | 5.3K | 1.8K |

| C | PUT | TRADE | BEARISH | 01/16/26 | $9.8 | $9.7 | $9.8 | $75.00 | $49.0K | 246 | 50 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | 看跌 | SWEEP | 看淡 | 01/17/25 | $0.31 | $0.3 | $0.31 | $60.00 | $93.0千 | 32.6千 | 4.0K |

| C | 看跌 | SWEEP | 看淡 | 11/29/24 | $0.35 | $0.34 | $0.35 | $70.00 | $85.9K | 2.0千 | 4.5K |

| C | 看漲 | 交易 | BULLISH | 06/20/25 | $5.8 | $5.75 | $5.8 | $70.00 | $58.0K | 24.0K | 104 |

| C | 看漲 | SWEEP | 看淡 | 11/29/24 | $0.62 | $0.59 | $0.62 | $70.00 | $51.9K | 5.3K | 1.8K |

| C | 看跌 | 交易 | 看淡 | 01/16/26 | $9.8 | 9.7 | $9.8 | $75.00 | $49.0千 | 246 | 50 |

About Citigroup

關於花旗集團

Citigroup is a global financial-services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank's primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

花旗集團是一家跨越100多個國家和地區的全球金融服務公司。花旗集團的業務分爲五個主要部門:服務、市場、銀行、美國個人銀行和财富管理。該銀行的主要服務包括爲跨國企業提供跨境銀行需求、投資銀行和交易以及在美國的信用卡服務。

After a thorough review of the options trading surrounding Citigroup, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對花旗集團周圍的期權交易進行了徹底審查之後,我們移步對該公司進行更詳細的檢查。這包括對其當前市場狀況和表現的評估。

Current Position of Citigroup

花旗集團當前位置

- Trading volume stands at 5,003,621, with C's price up by 0.05%, positioned at $69.78.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 49 days.

- 交易成交量爲5,003,621,C的價格上漲了0.05%,現價爲$69.78。

- RSI指標顯示該股票可能接近超買。

- 預計在49天內公佈收益。

Expert Opinions on Citigroup

花旗集團的專家意見

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $101.0.

在過去30天內,共有2位專業分析師對該股票發表了看法,設定了平均價格目標爲101.0美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Oppenheimer has decided to maintain their Outperform rating on Citigroup, which currently sits at a price target of $107. * Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Citigroup, targeting a price of $95.

Benzinga Edge的飛凡期權板塊在市場動向發生之前發現潛在的市場動量。看看大資金在你最喜歡的股票上採取了什麼倉位。點擊此處以獲取訪問權限。* Oppenheimer的一位分析師決定維持對花旗集團的跑贏大盤評級,目前目標價格爲107美元。* 繼續保持觀點,Wells Fargo的一位分析師繼續對花旗集團持有超配評級,目標價格爲95美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Citigroup options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在的回報。精明的交易者通過不斷學習、調整策略、監控多個因子並密切關注市場動態來管理這些風險。通過Benzinga Pro實時提醒及時了解最新的花旗集團期權交易。

From the overall spotted trades, 9 are puts, for a total amount of $443,285 and 6, calls, for a total amount of $254,927.

From the overall spotted trades, 9 are puts, for a total amount of $443,285 and 6, calls, for a total amount of $254,927.