Is There An Opportunity With Roku, Inc.'s (NASDAQ:ROKU) 48% Undervaluation?

Is There An Opportunity With Roku, Inc.'s (NASDAQ:ROKU) 48% Undervaluation?

Key Insights

主要见解

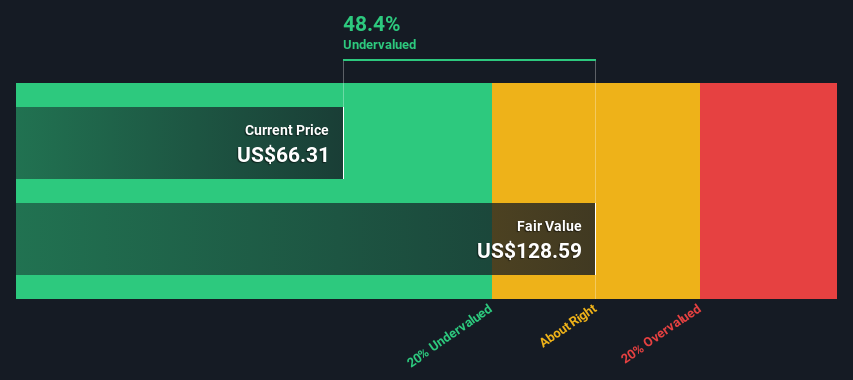

- The projected fair value for Roku is US$129 based on 2 Stage Free Cash Flow to Equity

- Roku is estimated to be 48% undervalued based on current share price of US$66.31

- Analyst price target for ROKU is US$77.70 which is 40% below our fair value estimate

- Roku的预计公允价值为129美元,基于2阶段自由现金流向股本模型

- 根据当前股价66.31美元,估计Roku被低估48%

- 分析师给出ROKU的目标价为77.70美元,比我们的公允价值估计低40%

Today we'll do a simple run through of a valuation method used to estimate the attractiveness of Roku, Inc. (NASDAQ:ROKU) as an investment opportunity by taking the expected future cash flows and discounting them to their present value. The Discounted Cash Flow (DCF) model is the tool we will apply to do this. It may sound complicated, but actually it is quite simple!

今天我们将简单运行一下估算Roku, Inc.(纳斯达克:ROKU)作为投资机会吸引力的估值方法,通过预期未来现金流量并将其贴现至其现值。贴现现金流量(DCF)模型是我们将应用的工具。听起来可能很复杂,但实际上很简单!

We generally believe that a company's value is the present value of all of the cash it will generate in the future. However, a DCF is just one valuation metric among many, and it is not without flaws. If you still have some burning questions about this type of valuation, take a look at the Simply Wall St analysis model.

我们通常认为,公司的价值是它未来所产生的所有现金的现值。然而,DCF只是众多估值指标之一,它也不是没有缺陷的。如果您对这种估值方法仍有疑问,请参阅Simply Wall St分析模型。

The Model

模型

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To start off with, we need to estimate the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

我们正在使用2阶段增长模型,这意味着我们考虑公司的两个增长阶段。在最初的阶段,公司可能具有更高的增长率,第二阶段通常假定具有稳定的增长率。首先,我们需要估计未来十年的现金流。如果有可能,我们使用分析师的估计,但当这些估计不可获得时,我们会利用上一个自由现金流(FCF)的估计或报告的价值进行推算。我们假设自由现金流不断萎缩的公司将会减缓萎缩速度,而流动自由现金不断增长的公司将会在此期间看到其增长率放缓。我们这样做是为了反映增长趋势在早期年份比后期年份更容易放缓。

Generally we assume that a dollar today is more valuable than a dollar in the future, so we discount the value of these future cash flows to their estimated value in today's dollars:

通常我们认为今天的一美元比未来的一美元更有价值,因此我们将这些未来的现金流折现为今天的估计价值:

10-year free cash flow (FCF) estimate

10年自由现金流 (FCF) 预估值

| 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Levered FCF ($, Millions) | US$340.6m | US$510.7m | US$646.3m | US$771.4m | US$882.0m | US$977.5m | US$1.06b | US$1.13b | US$1.19b | US$1.25b |

| Growth Rate Estimate Source | Analyst x9 | Analyst x6 | Est @ 26.54% | Est @ 19.36% | Est @ 14.34% | Est @ 10.82% | Est @ 8.36% | Est @ 6.64% | Est @ 5.43% | Est @ 4.59% |

| Present Value ($, Millions) Discounted @ 7.4% | US$317 | US$443 | US$521 | US$579 | US$617 | US$636 | US$642 | US$637 | US$626 | US$609 |

| 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| 杠杆自由现金流 ($, 百万) | 美元340.6百万 | 美元510.7百万 | 646.3百万美元 | 美元771.4百万 | 美元882.0百万 | 美元977.5百万 | 10.6亿美元 | 24年自由现金流为11.3亿美元。 | 11.9亿美元 | 12.5亿美元 |

| 增长率估计来源 | 分析师 x9 | 分析师 x6 | 目标价格 @ 26.54% | 以19.36%的估值增长率估算 | 以14.34%的速度增长 | 预计 @ 10.82% | 预计@ 8.36% | 预期 @ 6.64% | 以5.43%的速度估算 | Est @ 4.59% |

| 按7.4%折现,现值为(百万美元) | 317美元 | 4.43亿美元 | 521美元 | 579美元 | 617美元 | 6.36亿美元 | 642美元 | 637美元 | 626美元 | 美元609 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$5.6b

("Est" = Simply Wall St 估计的自由现金流增长率)

10年现金流的现值=56亿美元

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 2.6%. We discount the terminal cash flows to today's value at a cost of equity of 7.4%.

在计算完未来十年内现金流的现值之后,我们需要计算终端价值,这包括第一阶段以后的所有未来现金流。 戈登增长模型被用来计算以未来年增长率为10年政府债券收益率5年平均值2.6%的终端价值。我们将终端现金流以股权成本率7.4%贴现到今天的价值。

Terminal Value (TV)= FCF2034 × (1 + g) ÷ (r – g) = US$1.2b× (1 + 2.6%) ÷ (7.4%– 2.6%) = US$27b

终端价值(TV)= 自由现金流2034 × (1 + 2.6%) ÷ (7.4%– 2.6%) = 美元1.2亿 × (1 + 2.6%) ÷ (7.4%– 2.6%) = 美元27亿

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$27b÷ ( 1 + 7.4%)10= US$13b

终端价值的现值(PVTV)= TV / (1 + 7.4%)10= 美元27亿÷ ( 1 + 7.4%)10= 美元13亿

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is US$19b. In the final step we divide the equity value by the number of shares outstanding. Compared to the current share price of US$66.3, the company appears quite undervalued at a 48% discount to where the stock price trades currently. Remember though, that this is just an approximate valuation, and like any complex formula - garbage in, garbage out.

总价值,或股权价值,是未来现金流的现值之和,在本例中为美元190亿。最后一步是将股权价值除以流通股份数量。与当前股价66.3美元相比,该公司似乎被低估了48%,相对于目前股价的交易价格。请记住,这仅仅是一个近似的估值,就像任何复杂的公式一样-垃圾进,垃圾出。

Important Assumptions

重要假设

Now the most important inputs to a discounted cash flow are the discount rate, and of course, the actual cash flows. You don't have to agree with these inputs, I recommend redoing the calculations yourself and playing with them. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Roku as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 7.4%, which is based on a levered beta of 1.163. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

现在折现现金流的最重要输入是折现率,当然还有实际现金流。您不必同意这些输入,我建议重新计算自己并与之对比。DCF还没有考虑行业的可能周期性,或公司未来的资本需求,因此它不能全面反映公司的潜在绩效。鉴于我们正在考虑Roku作为潜在股东,所以使用的权益成本作为折现率,而不是资本成本(或加权平均资本成本,WACC)考虑了债务。在这个计算中,我们使用了7.4%,这是基于1.163的杠杆贝塔。贝塔是股票波动性的度量,与整个市场相比。我们得到我们的贝塔来自全球可比公司的行业平均贝塔,强加了0.8至2.0之间的限制,这是一个稳定业务的合理范围。

Looking Ahead:

展望未来:

Whilst important, the DCF calculation is only one of many factors that you need to assess for a company. The DCF model is not a perfect stock valuation tool. Rather it should be seen as a guide to "what assumptions need to be true for this stock to be under/overvalued?" For instance, if the terminal value growth rate is adjusted slightly, it can dramatically alter the overall result. Can we work out why the company is trading at a discount to intrinsic value? For Roku, there are three further elements you should explore:

虽然重要,DCF 计算只是需要评估一家公司的众多因素之一。DCF 模型并非完美的股票估值工具,而应被视为“为了使该股票被低估/高估,哪些假设需要成立的指南?”例如,如果终端价值增长率略有调整,可能会极大地改变整体结果。我们能否找出这家公司为何以低于内在价值的折价交易?对于 Roku,您应该进一步探讨三个因素:

- Financial Health: Does ROKU have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Future Earnings: How does ROKU's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

- 财务健康:ROKU是否拥有健康的资产负债表?通过对关键因素(如杠杆和风险)进行六项简单检查,查看我们的免费资产负债表分析。

- 未来收益:ROKU的增长率与同行及更广泛市场相比如何?通过与我们的免费分析师增长预期图表交互,深入了解未来几年的分析师一致预期数字。

- 其他高质量选择:你喜欢一个好的多面手吗?浏览我们的高质量股票交互列表,了解还有哪些你可能错过的好东西!

PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock just search here.

PS. Simply Wall St每天都会更新其对每只美国股票的折现现金流计算,因此,如果你想找到其他股票的内在价值,只需在此搜索即可。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

Generally we assume that a dollar today is more valuable than a dollar in the future, so we discount the value of these future cash flows to their estimated value in today's dollars:

Generally we assume that a dollar today is more valuable than a dollar in the future, so we discount the value of these future cash flows to their estimated value in today's dollars: