Check Out What Whales Are Doing With PLTR

Check Out What Whales Are Doing With PLTR

Deep-pocketed investors have adopted a bullish approach towards Palantir Technologies (NASDAQ:PLTR), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PLTR usually suggests something big is about to happen.

资金雄厚的投资者对palantir科技(纳斯达克:PLTR)采取了看好的态度,这一点市场参与者不应忽视。我们在Benzinga跟踪公共期权记录揭示了今日这一重要动向。这些投资者的身份仍然不为人知,但在PLTR上的这种重大举动通常意味着一些大事件即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 27 extraordinary options activities for Palantir Technologies. This level of activity is out of the ordinary.

我们今天从观察中得知这一信息,当Benzinga的期权扫描仪突显出27个飞凡的期权活动为palantir科技时。这一活动水平非同寻常。

The general mood among these heavyweight investors is divided, with 55% leaning bullish and 33% bearish. Among these notable options, 6 are puts, totaling $394,321, and 21 are calls, amounting to $1,134,569.

这些重量级投资者的一般情绪比较分化,55%看好,33%看淡。在这些显著的期权中,6个是看跌期权,总计394,321美元,21个是看涨期权,总计1,134,569美元。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $75.0 for Palantir Technologies over the last 3 months.

考虑到这些合约的成交量和未平仓合约,鲸鱼们在过去三个月里似乎将价格区间目标锁定在25.0美元到75.0美元之间。

Insights into Volume & Open Interest

成交量和持仓量分析

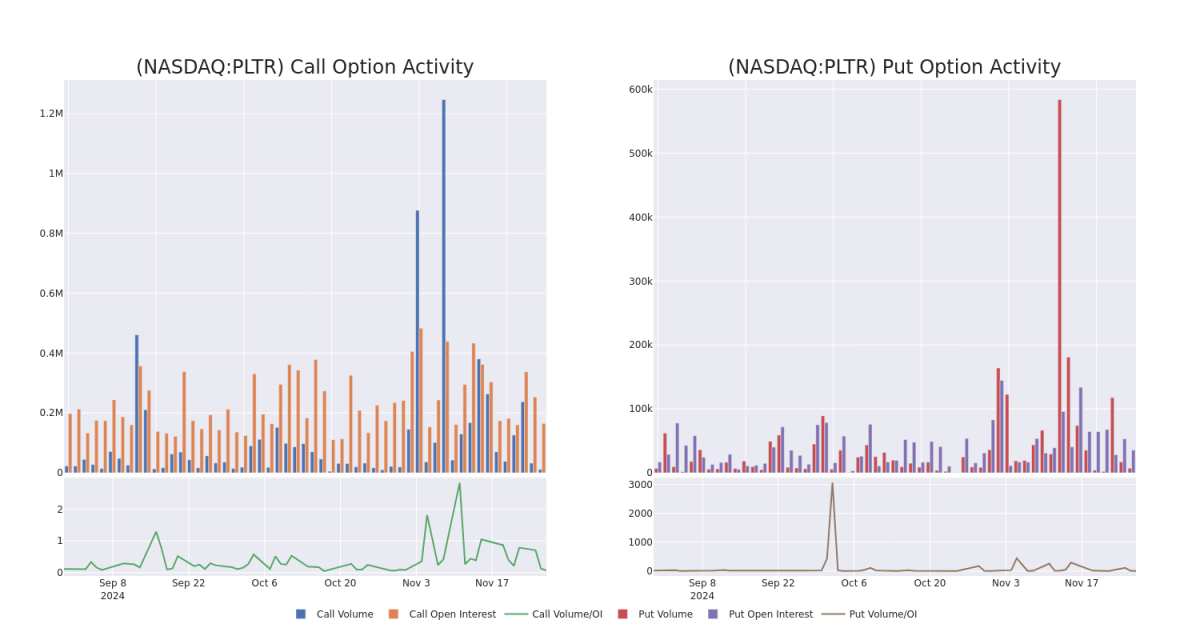

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Palantir Technologies's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Palantir Technologies's significant trades, within a strike price range of $25.0 to $75.0, over the past month.

分析成交量和未平仓合约提供了对股票研究的重要见解。这些信息对于评估palantir科技在特定行权价格下的流动性和兴趣水平至关重要。以下,我们展示了过去一个月内palantir科技的重要交易中看涨和看跌期权的成交量和未平仓合约趋势快照,行权价格区间为25.0美元到75.0美元。

Palantir Technologies 30-Day Option Volume & Interest Snapshot

Palantir Technologies 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLTR | CALL | SWEEP | BULLISH | 09/19/25 | $12.3 | $12.15 | $12.3 | $75.00 | $269.3K | 4.3K | 18 |

| PLTR | PUT | TRADE | BEARISH | 02/21/25 | $10.15 | $10.05 | $10.11 | $70.00 | $101.1K | 1.1K | 176 |

| PLTR | PUT | TRADE | BEARISH | 01/17/25 | $2.77 | $2.77 | $2.77 | $60.00 | $76.1K | 12.3K | 919 |

| PLTR | CALL | SWEEP | BULLISH | 12/20/24 | $7.65 | $7.6 | $7.65 | $60.00 | $74.9K | 19.4K | 313 |

| PLTR | PUT | TRADE | BULLISH | 05/16/25 | $16.5 | $16.3 | $16.3 | $75.00 | $73.3K | 249 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| palantir | 看涨 | SWEEP | BULLISH | 09/19/25 | $12.3 | $12.15 | $12.3 | $75.00 | 269.3K美元 | 4.3千 | 18 |

| palantir | 看跌 | 交易 | 看淡 | 02/21/25 | $10.15 | $10.05 | $10.11 | $70.00 | $101.1K | 1.1K | 176 |

| palantir | 看跌 | 交易 | 看淡 | 01/17/25 | $2.77 | $2.77 | $2.77 | $60.00 | $76.1K | 12.3K | 919 |

| palantir | 看涨 | SWEEP | BULLISH | 12/20/24 | $7.65 | $7.6 | $7.65 | $60.00 | $74.9K | 19.4K | 313 |

| palantir | 看跌 | 交易 | BULLISH | 05/16/25 | $16.5 | $16.3 | $16.3 | $75.00 | $73.3千美元 | 249 | 0 |

About Palantir Technologies

关于Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

Palantir是一家专注于利用数据创造客户组织效率的分析软件公司,该公司通过其Foundry和Gotham平台为商业和政府客户提供服务。总部位于丹佛的该公司成立于2003年,并于2020年上市。

Having examined the options trading patterns of Palantir Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Palantir Technologies的期权交易模式之后,我们现在的注意力直接转向了这家公司。这种转变让我们能够深入了解其当前的市场位置和表现

Where Is Palantir Technologies Standing Right Now?

Palantir Technologies目前处于什么位置?

- With a volume of 43,863,013, the price of PLTR is up 0.11% at $65.81.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 68 days.

- PLTR成交量为43,863,013,价格上涨0.11%,现为$65.81。

- RSI因子暗示底层股票可能被超买。

- 下次盈利预计在68天后公布。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $75.0 for Palantir Technologies over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $75.0 for Palantir Technologies over the last 3 months.