存在客户集中风险

智能汽车领域又跑出一个IPO。

格隆汇获悉,近日,广东弘景光电科技股份有限公司(简称“弘景光电”)提交了首次公开发行股票并在创业板上市招股说明书注册稿,距离上市仅一步之遥。

弘景光电的主要产品包括智能汽车光学镜头及摄像模组、新兴消费光学镜头及摄像模组,产品应用于智能座舱、智能驾驶、智能家居、相机等领域。

弘景光电的主要产品包括智能汽车光学镜头及摄像模组、新兴消费光学镜头及摄像模组,产品应用于智能座舱、智能驾驶、智能家居、相机等领域。

公司已与众多Tier 1及EMS厂商建立合作关系,产品进入了戴姆勒-奔驰、日产、本田、奇瑞、比亚迪、吉利、长城、埃安、蔚来、小鹏、小米等国内外知名品牌。

这家公司质地如何?今天就来一探究竟。

01

德赛西威、全志科技入股

弘景光电前身“中山市弘景光电科技有限公司”成立于2012年,位于广东省中山市,由曾伟、饶龙军共同出资成立,其中曾伟的出资比例为90%,曾伟所持股权为替赵治平代持。

在发展过程中,弘景光电获得了多轮融资,投资方包括昆石财富、勤合创投、德赛西威等机构。

本次发行前,弘景光电的控股股东、实际控制人为赵治平,他直接持有公司28.0971%股份,并通过担任员工持股平台弘云投资、弘宽投资、弘大投资的执行事务合伙人,以及与周东签署《一致行动协议》的方式直接和间接控制公司57.0052%的表决权。同时,德赛西威、勤合创投、立湾投资、全志科技均为公司股东。

赵治平出生于1969年,硕士研究生学历,曾历任东莞信泰光学有限公司制造部课长、品保部部长兼管理者代表,还当过凤凰光学(广东)有限公司总经理、舜宇光学(中山)有限公 司总经理、舜科光学(天津)有限公司董事长。2016年5月至今,赵治平任弘景光电董事长兼总经理。

周东1974年出生,本科学历,他曾任东莞信泰光学有限公司品质主管,还陆续担任上海劳达斯洁具有限公司制造副总经理、舜宇光学(中山)有限公司销售副总经理等职务。2016年5月至今,周东任弘景光电董事、常务副总经理。

02

预计2024年营收超10亿元

弘景光电的主要产品为光学镜头及摄像模组,包括智能汽车光学镜头及摄像模组、新兴消费光学镜头及摄像模组两大产品线。

其中,公司生产的智能座舱类产品包括车载视频行驶记录系统(DVR)镜头及摄像模组、驾驶员监测系统(DMS)镜头及摄像模组、乘客监测系统(OMS)镜头及摄像模组。

公司生产的智能座舱类产品,图片来源:招股书

公司生产的智能座舱类产品,图片来源:招股书智能驾驶类产品包括高级驾驶辅助系统(ADAS)镜头及摄像模组、全景式监控影像系统 (AVM)镜头及摄像模组、电子后视镜(CMS)镜头及摄像模组。

新兴消费类产品包括智能家居光学镜头及摄像模组、全景/运动相机光学镜头及摄像模组。

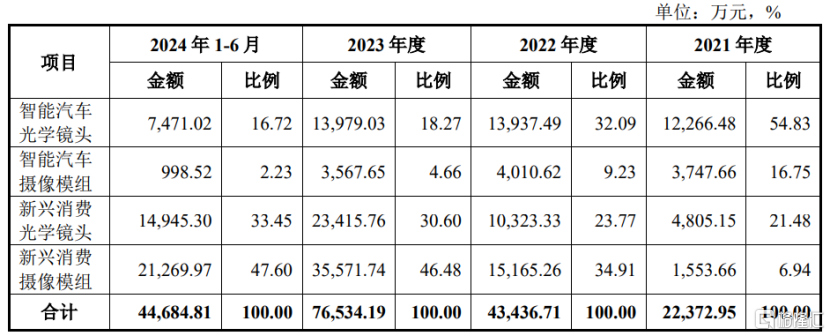

具体来看,2021年至2024年上半年,公司来自智能汽车光学镜头、智能汽车摄像模组的营收占比均呈下滑趋势,而新兴消费光学镜头、新兴消费摄像模组的营收占比有所上升。

其中,2024年上半年,新兴消费光学镜头、新兴消费摄像模组的营收占比分别为33.45%、47.60%,占比较大。

公司主营业务收入分产品构成情况,图片来源:招股书

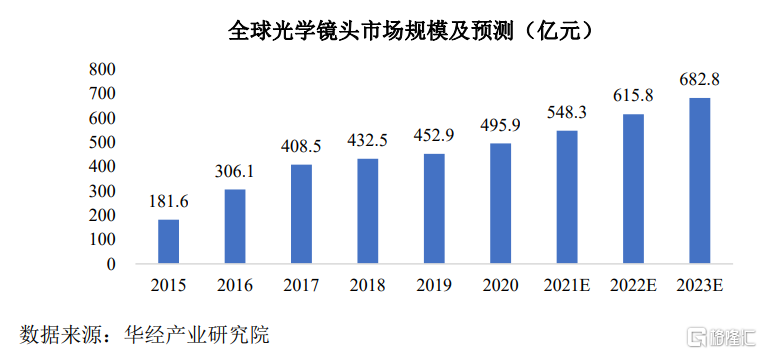

公司主营业务收入分产品构成情况,图片来源:招股书得益于相机、手机、显微镜等传统设备的高端化趋势,以及智能汽车、智能家居、智能安防等新兴应用场景的快速发展,近年来光学镜头市场规模增长很快。

据华经产业研究院的数据,2023年全球光学镜头市场规模达到682.8亿元,2021年中国光学镜头市场规模为140.36亿元,2017年至2021年复合增长率为10.85%。

图片来源:招股书

图片来源:招股书在光学镜头市场规模不断扩大的背景下,作为光学镜头及摄像模组制造商,弘景光电的业绩也呈增长趋势。

招股书显示,2021年、2022年、2023年、2024年1-6月,弘景光电的营业收入分别约2.52亿元、4.46亿元、7.73亿元和4.5亿元,同期净利润分别为1525.81万元、5645.37万元、1.16亿元、6852.44万元。

公司预计2024年实现营业收入约10.78亿元,同比增长39.46%;预计2024年归属于母公司所有者的净利润约1.65亿元,同比增长41.88%。

03

2022年为全球第六大车载光学镜头厂商,市场占有率3.7%

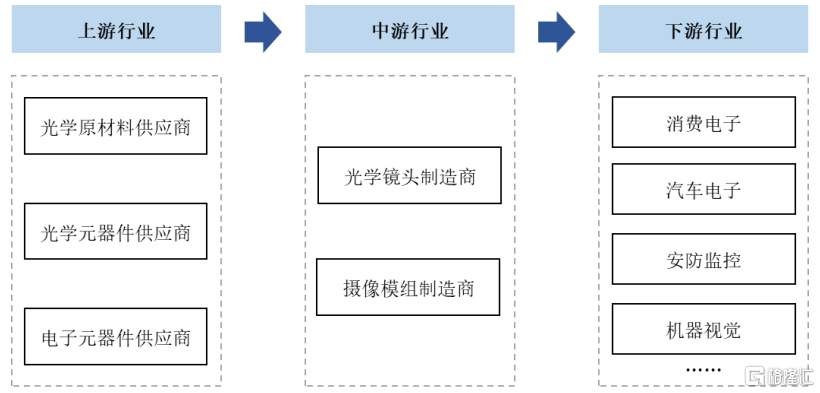

弘景光电的主要产品为光学镜头及摄像模组,处于光学产业链中游。行业下游主要包括消费电子、汽车电子、安防监控、机器视觉等行业。

光学镜头及摄像模组产业链,图片来源:招股书

光学镜头及摄像模组产业链,图片来源:招股书公司的下游客户主要为知名消费电子品牌厂商、Tier 1、EMS厂商,前五大客户包括影石创新、AZTECH、华勤技术、海康威视、工业富联、胜达电子等。

报告期内,弘景光电向前五大客户的销售收入合计占营业收入的比例分别为48.79%、59.46%、77.65%和78.43%,且公司在2023年及2024年上半年来自影石创新的销售收入占比超过45%,占比较大,存在客户集中风险。

公司下游新兴消费的全景/运动相机领域市场集中度较高。

据Frost&Sullivan的数据,全球消费级的全景相机领域领先企业包括中国的影石创新、日本的理光以及美国的GoPro,2022年这三家公司的市场占有率分别为50.7%、19.7%和17.8%。而这些品牌通常同款型号的产品通常仅选择一家镜头模组供应商,该领域光学镜头及摄像模组的竞争厂商主要包括弘景光电、联创电子、舜宇光学科技等。

近年来,随着光学镜头的应用领域不断拓宽,光学镜头及摄像模组市场快速增长,同时行业良好的前景吸引了更多新进入企业,市场竞争不断加剧。

在智能家居领域,据艾瑞咨询数据推算,2023年弘景光电在全球家用摄像机(含可视门铃)光学镜头领域的市场占有率为9.95%;在全景/运动相机领域,据Frost&Sullivan数据推算,2023年弘景光电在全球全景相机镜头模组市场的占有率达25%以上。

在智能汽车领域,由于汽车行业对零部件的可靠性要求较高,认证周期较长,通过认证后,车厂一般不会轻易更换供应商。

据TSR报告,2022年在车载镜头市场,舜宇光学科技的镜头出货量居全球第一,市场占有率为36.2%;日本Maxell、日本电产集团(Nidec Sankyo)、韩国Sekonix等境外厂商紧随其后。弘景光电2022年在全球车载光学镜头市场占有率为3.70%,排名全球第六,可见公司在细分领域拥有一定市场地位。

2021年至2024年上半年,弘景光电的主营业务毛利率分别为28.12%、27.03%、30.75%和30.81%。其中,公司主营业务毛利率低于力鼎光电、茂莱光学、中润光学,高于舜宇光学科技、宇瞳光学、联创电子。

公司与同行业可比公司主营业务毛利率比较情况,图片来源:招股书

公司与同行业可比公司主营业务毛利率比较情况,图片来源:招股书04

尾声

近几年,在光学镜头市场规模扩大的背景下,弘景光电的业绩也呈增长趋势,且公司在全球车载光学镜头、全景相机镜头模组等细分领域占据一定市场地位。如果成功登陆创业板,有利于获得一笔长期资金支撑公司发展,提升公司知名度。但同时弘景光电所处的光学镜头及摄像模组行业市场竞争激烈,未来想要提高市场占有率也并非易事。