Block orders want to escape?

In the A-share market, if it is said that the huawei concept is the strongest concept that can completely traverse bull and bear markets, absolutely no one would have any doubts.

Over the years, this concept has produced a large number of super stocks that have remarkably traversed bull and bear markets, and has also revealed countless stocks with exaggerated price increases.

According to hithink royalflush information network data, there are currently as many as 937 listed companies related to the huawei concept, and the number is still soaring.

According to hithink royalflush information network data, there are currently as many as 937 listed companies related to the huawei concept, and the number is still soaring.

Just in the second half of this year, with the "924" big market event combined with ongoing speculation, there have been already hundreds of stocks in this concept that have doubled in price, and even super stocks like airon software, shenzhen ysstech info-tech, shenzhen infogem technologies, solareast holdings, and shijiazhuang changshan beiming technology with price increases of several times.

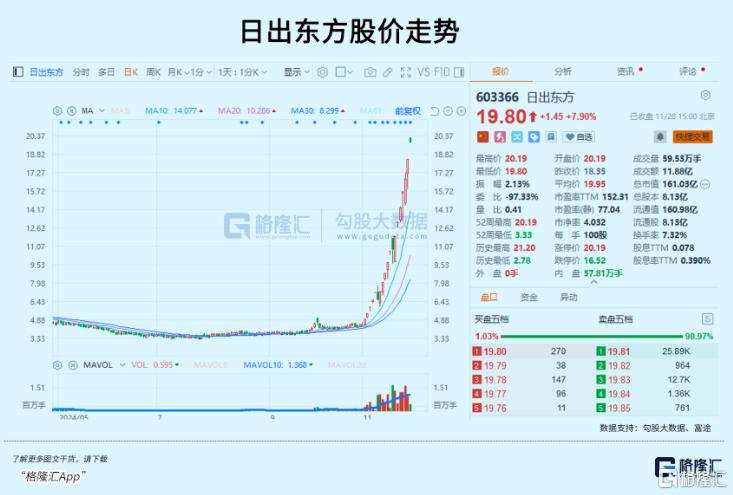

Among them is also the recently hyped "eastern system" name mystique of solareast holdings, which created a strong momentum of a 360% increase in 20 days, but just at the last trading moment, suddenly a huge sell order of 0.744 billion was thrown out, breaking the price limit and ultimately closing up by 7.9%.

This last transaction volume accounted for a large part of the daily trading volume, indicating how significant the impact would be.

This small company, which was experiencing continuous performance declines and facing pressure for business growth, has suddenly transformed into a hot super speculative stock, and it is finally about to start swinging its scythe to change the trend.

01

Unexplainable explosive speculation.

After today's market close, solareast holdings once again issued a stock price abnormal movement warning announcement, stating that the company's stock price is subject to irrational speculation risks. It has fully indicated that the previously established supercharging station business has not generated operational income and profits, and there are no plans for large-scale promotion.

This is also the same warning it has issued several times this month, reflecting that the stock price has risen to the point where even the company is fearful.

The intensity of this round of speculation by solareast holdings has exceeded the expectations of most people.

On November 1, several official media outlets disclosed that the "Huawei Super Charging - Lianyungang Station" launch ceremony for solareast holdings' fully liquid-cooled supercharging station was grandly held at solareast holdings' Lianyungang headquarters base. This demonstration charging station, which inherits Huawei's fully liquid-cooled supercharging technology and solareast holdings' "light storage charging" integrated solution, has officially been put into operation. This is also the first light storage supercharging demonstration power station in the northern Jiangsu region.

Since then, solareast holdings has quickly caught the attention of speculative funds, beginning a crazy upward trajectory in its stock price.

In fact, the construction and operation of the supercharging stations in cooperation with huawei has already been initiated nationwide, and such cooperation is not unusual, while the actual significance is not particularly high.

The so-called "supercharging station" refers to a charging station where a single supercharging pile using huawei's advanced liquid cooling technology and smart charging technology can reach a maximum power of 600KW during use. Last December, huawei announced plans to provide over 100,000 fully liquid-cooled supercharging devices by the end of 2024, covering 340 cities nationwide, and constructing over 4,500 high-speed supercharging stations.

On November 21 of this year, at the 2024 China Automotive Charging and Swapping Ecology Conference, Liu Dawei, president of huawei's digital energy smart charging network business, stated that huawei has currently achieved supercharging deployment in over 200 cities and 21 major provincial-level expressways nationwide.

In other words, the fully liquid-cooled supercharging station at jiangsu lianyungang port in cooperation with huawei is just one of the 340 cities planned by huawei, and it's not particularly noteworthy.

Moreover, several listed companies have already reached cooperation with huawei in the fully liquid-cooled supercharging station business, such as gcl energy technology, zhejiang yonggui electric equipment, and jiangsu boamax technologies group, but their stock prices have reacted mildly and have not seen the same kind of hype as dongfeng nissan.

SolarEast Holdings has also repeatedly issued alerts stating, "It is still in the internal trial phase, has not generated relevant business income and profits," "will not have a significant impact on the company's operation performance," and "there are no plans for large-scale promotion."

Stepping back further, even if there are more cooperations, when this project can start contributing to profits remains a challenging issue. Some institutions estimate that the investment recovery period for ordinary charging station operators will be 4.9 years, but liquid cooling supercharging means greater electrical demand and excess capacity on site, resulting in larger hardware investments and a longer payback period compared to ordinary charging stations. This will be even longer in non-core cities and areas with average traffic.

In this regard, with no plans for large-scale promotion, SolarEast Holdings finding Fortune through this project is almost impossible.

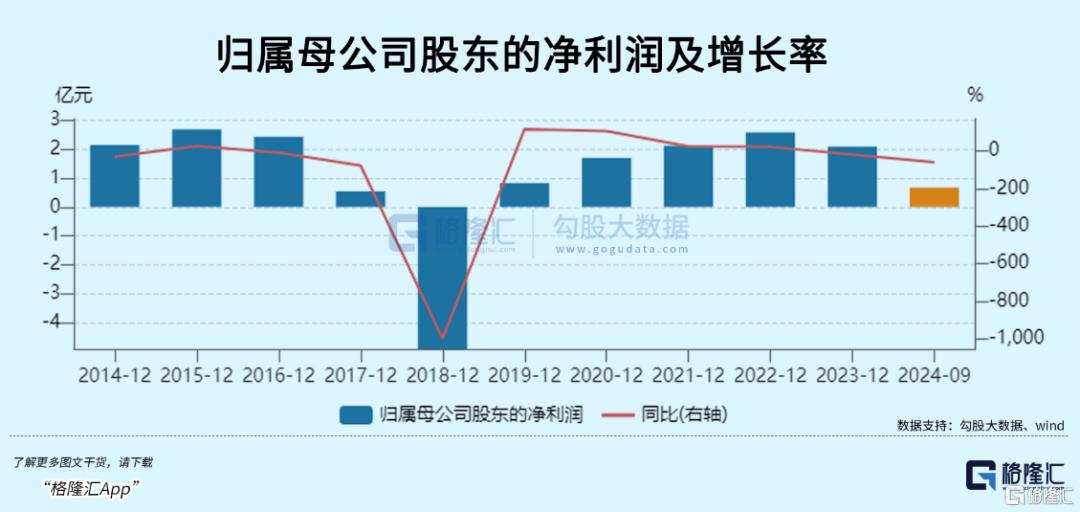

Meanwhile, on the other side, Solareast Holdings' main business has been continuously declining in recent years. Currently, Solareast's main business areas include the clean energy thermal application sector (such as air energy heating and solar heating), the clean energy electrical application sector (which includes distributed photovoltaics and energy storage business), and the kitchen appliances sector.

In the first three quarters of this year, Solareast Holdings achieved revenue of 3.269 billion yuan, a year-on-year decrease of 6.28%, and the net income attributable to the parent company was 0.067 billion yuan, a year-on-year decrease of 60.40%, while the non-recurring net income was 0.012 billion yuan, a year-on-year decrease of 90.22%.

In addition to the significant decline in performance, Solareast Holdings is also facing inventory turnover issues. As of the end of the third quarter this year, Solareast's inventory turnover days in the first three quarters exceeded 100 for the first time, reaching 111.44 days, and the inventory turnover rate dropped to 2.4, setting the lowest level for the same period since its listing.

Despite the company's poor performance, it is fortunate that the company is also a relatively pure new energy enterprise, with popular concepts such as photovoltaics, charging stations, and light storage charging, which laid the foundation for later cooperation with Huawei to be further speculated by the market.

Under the rampant speculation from funds, whether the company has performance expectations has become unimportant.

02

Crazy speculators

The reason why solareast holdings has become a hot stock right now is due to its connection with the recently hyped concept of 'Eastern Mysticism' in the market.

Recently, in addition to solareast holdings, other stocks with the name 'Eastern' such as funeng oriental equipment technology, hengxin shambala culture, eastern carbon, wuxi commercial mansion grand orient, guangdong dongfang precision science & technology, and guangxi oriental intelligent manufacturing technology have also been continuously hyped, with many of them having doubled in stock price since the '924' major market rally, and today nearly ten related stocks hit the daily limit up.

Looking at the top trading data of these popular stocks, the most obvious feature is that the top five buy and sell transactions are mainly dominated by the Lhasa branch of east money information securities, sometimes fully occupied by these branches.

There is a saying circulating online describing the Lhasa team:

If you ask me what the Lhasa team is, I’ll tell you: the highs that you speculators dare not chase, we chase; the profits you speculators dare not cut, we cut; the pitfalls you speculators dare not step on, we step on. In short, you speculators can handle the trades we can take; and even the trades you speculators can’t handle, we also want to take. We eat noodles in the dark and never regret it, that is the Lhasa team!

In reality, there are indeed many speculative stocks that exhibit a perplexing situation: when they rise significantly and gain market attention, the eastern money information network's Lhasa operations do not appear, and only when the stock price reaches high peaks do they show up in large numbers.

Data statistics indicate that the winning rate of stocks after these operations are listed is astonishingly low, regardless of whether buying occurs the next day, the second day, or within a week or a month, the average price fluctuation is negative, and the winning rate for thousands of buying attempts is even less than 30%.

Therefore, they are also referred to as 'scattered wealth teams,' and the nightmare for retail investors, and some even describe it online as 'Lhasa setting out, nothing grows.'

For example, the speculative stock Guangxi yuegui guangye holdings, which started to soar since early November and once achieved several consecutive limit-ups, did not have the eastern money information network's Lhasa operations appearing when the stock price rose from 6 yuan at the beginning of the month to 18 yuan on November 22, and only on November 25 did these operations suddenly show up in the top five for net purchases, followed by consecutive price limit downs on the 26th and 27th, with heavy appearances in the top five for trading.

Many investors simply believe this is because these operations are concentrated retail accounts of the eastern money information network, and due to their large numbers, they tend to appear prominently on the dragon and tiger list.

But in reality, what secrets lie within the identities of these operations, no one can clarify.

The most counterintuitive is:

Why do many speculative stocks not take action when they significantly rise, but instead buy in only after the rise reaches an exaggerated level?

Are they too foolish?

Or do many of them act as 'fake retail investors' helping speculators and institutions take over?

Unfortunately, Solareast Holdings did not enter the stock leaderboards today, making it impossible to know whether East Money's 'Lhasa Team' has begun to 'expedition', while Funeng Oriental (+17%), Wuxi Commercial Mansion Grand Orient (+10%), Zhejiang Orient Financial Holdings Group (+10%), Hengxin Shambala Culture (+10%), and Eastern Communications (-5%) have made the list. Among them, aside from Eastern Communications' top five net purchases having these trading offices, others did not appear.

Additionally, the stock price performance of Eastern Communications seems to again validate the pattern mentioned above.

Regardless of the situation, Solareast Holdings broke through the limit with heavy volume at the end of the day, clearly indicating that block orders have begun to cash out and exit, which likely means that a price change is about to begin.

03

Epilogue

Speculative concepts have always been a prominent feature in the A-shares market; whenever the market lacks a main theme, various inexplicable concepts are often traded wildly.

Speculating on positions, zodiac animals, numbers, and puns, even reversing the names can lead to explosive trading, such as five instances of "20CM" in six days being wildly speculated, with someone on the stock forum revealing the secret - because the company's name read backwards means "it can reach ten times."

Source: Stock Forum

Source: Stock ForumThen there's the previous phenomenon of "the more broken the entrance, the more demonized the stock nature"; typical representatives such as dongguan chitwing technology, aai precision, ningbo shenglong automotive powertrain system, shenzhen silver basis technology, sichuan golden summit, and other companies with rather ordinary fundamentals have had their stock prices double in a very short time, which can be considered a norm in the A-share market.

Whether these phenomena are healthy and should be regulated varies from person to person.

However, the vast majority of these hot stocks ultimately cannot escape the outcome of many investors being heavily trapped after the peak. For example,

Dongguan chitwing technology, from trading up to a peak of 52 yuan, fell all the way down to below 17 yuan, a decline of 70%; chengdu hi-tech development, which experienced three rounds of speculative trading, both of the previous two waves had retracements of over 50%, and the third wave is currently ongoing; shenzhen silver basis technology, after the bubble burst, saw a decline of 70% from the peak to the lowest point; sanbaisuo, after the bubble burst, also dropped 70% from the peak to the lowest point, and so on.

Therefore, for ordinary investors, when faced with such abnormally large increases in stock prices, the most important thing to do might be to take a cautious view and control risks, rather than taking unnecessary risks. (End of article)

同花顺数据显示,目前华为概念的上市公司多达937家,并且数量还在飙升。

同花顺数据显示,目前华为概念的上市公司多达937家,并且数量还在飙升。