Disney is increasing its investment in cruise ships.

Disney (DIS.US) is increasing its investment in cruise ships. The company's sixth ship, “Disney Treasure (Disney Treasure),” will launch its maiden voyage on December 21, and seven more ships are expected to be launched by 2031. These boats are part of Disney's experience business, which also includes the theme park business, which is a key growth area that has rapidly expanded in recent years.

Prior to “Treasure,” Disney launched its sister ship “Disney Wish” in 2022, and had not released a new ship for 10 years before. But with the launch of two ships at the end of 2025 — “Disney's Fate” and “Disney Adventure” — and five more to be launched over the next six years, Wall Street analysts say it's time to start focusing on the business.

Morgan Stanley analyst Ben Swinburne said, “We believe that the return on investment capital of these businesses is higher than the average non-Disney cruise business.” He pointed out that since most of the guests on the cruise are families, these businesses have high occupancy rates and revenue per room.

Morgan Stanley analyst Ben Swinburne said, “We believe that the return on investment capital of these businesses is higher than the average non-Disney cruise business.” He pointed out that since most of the guests on the cruise are families, these businesses have high occupancy rates and revenue per room.

The “Disney Treasure” can carry 4,000 passengers and 1,555 crew members. The first flight price starts at $8511 per person, and all rooms are currently sold out online. Swinburne continued: “It's clearly a very profitable investment. We think their investment in growing this business is a positive thing for the company.”

In an interview last week, Disney CEO Bob Iger pointed out that “Treasure” recreates the rides, characters, and storylines of Disney theme parks as more consumers choose an almost all-inclusive cruise vacation rather than the usual more expensive theme park accommodations.

Damo: The cruise business is very important to stocks

Investors have recently been increasingly concerned that the Disney theme park business may slow down as prices rise and demand weakens. However, Disney's chief financial officer Hugh Johnston said earlier this month that the operating profit of the experience sector (including parks, cruises, and consumer products) is expected to rebound next year, with an increase of between 6% and 8%. In particular, he pointed out that the launch of “Treasure” was a catalyst for this growth.

In another report to customers last month, Swinburne estimated that by 2026, cruise cabin capacity will increase from the current 5,500 to more than 0.01 million rooms, and “Disney cruise revenue will more than double” from the end of this year to the end of 2027. Although Swinburne and his team recently disclosed some information about Magical Cruise Company, a UK-based Disney subsidiary, Disney did not release financial metrics for its cruises.

“Although it is still relatively small compared to the overall park business in the US, and even smaller than the experiential business, this business is not insignificant in terms of its contribution to growth and profit margins,” the analyst said.

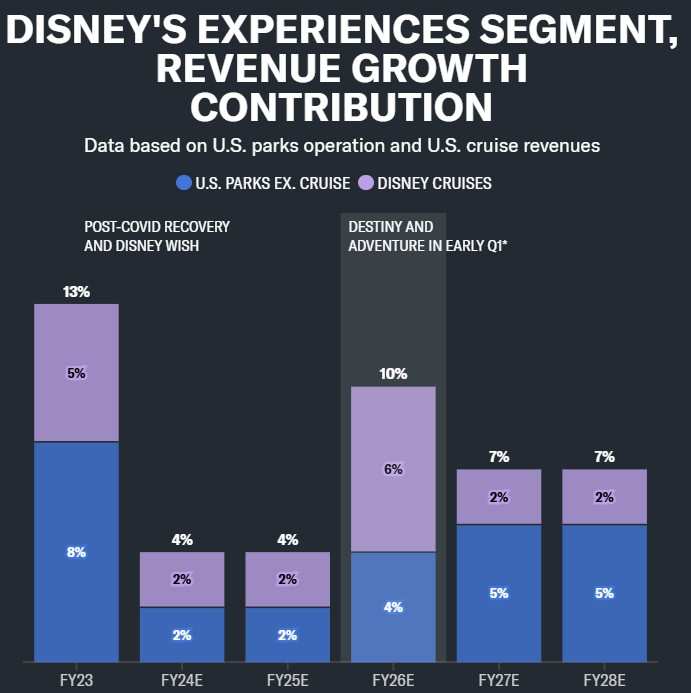

As shown in the chart below, according to Morgan Stanley's estimates, the share of cruise revenue in the US experience market is expected to increase. The company anticipates that by 2026, cruise ships will drive most of the revenue growth in this US segment, and two cruise ships will be launched by the end of 2025.

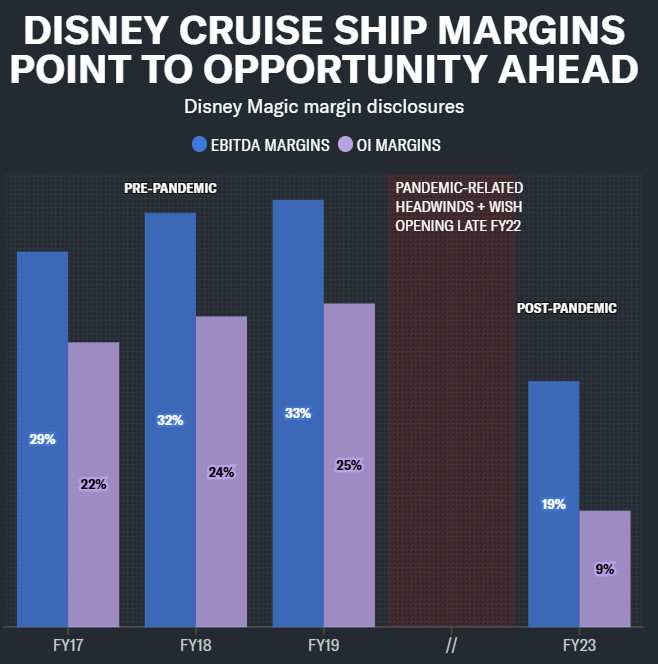

In addition to revenue growth, operating margin, a key measure of profitability, is also expected to increase. According to the Morgan Stanley team, information disclosed by Magical Cruise Company shows that before the outbreak of the epidemic, the operating profit margin of the cruise business reached 20% to 25%.

Although profit margins have yet to return to those high levels, probably due to start-up costs associated with fleet expansion and the continued recovery of the cruise industry as a whole, the analyst team pointed out, “Disney's historical cruise profit margins and public cruise companies all indicate opportunities to achieve meaningful revenue contributions in the future.”

Finally, Swinburne pointed out that investors are increasingly curious about the development trajectory of cruise ships last year, especially since it relates to Disney's future profit potential. The analyst compared the cruise business to Disney's other growth areas: by 2032, the year cruise construction is expected to be completed, Morgan Stanley estimates that the cruise business will bring in about 9 billion US dollars in revenue and generate about 2.3 billion US dollars in operating profit. Meanwhile, for the full year ending September 28, the Disney Sports business, including the flagship ESPN network, had revenue of $17.6 billion and operating profit of $2.4 billion.

In other words, the revenue from the cruise business is about half of Disney's sports business, and it is expected to eventually generate revenue equivalent to the revenue reported by the sports business this year. “Cruise ships play a very important role,” Swinburne said. For those of us who are focused on growth and the company's ability to deliver or exceed expectations, it's actually important to understand the timing of cruise launches and the revenue contributions of the launch. It's very important for Disney stock.”

摩根士丹利分析师Ben Swinburne表示:“我们认为,这些业务的投资资本回报率高于一般的非迪士尼邮轮业务。”他指出,由于邮轮上的大多数客人都是家庭,这些业务的入住率和每间客房的收入都很高。

摩根士丹利分析师Ben Swinburne表示:“我们认为,这些业务的投资资本回报率高于一般的非迪士尼邮轮业务。”他指出,由于邮轮上的大多数客人都是家庭,这些业务的入住率和每间客房的收入都很高。