金曜日に発表されたデータによると、ユーロ圏の11月のインフレ率が加速し、最も注目されているインフレ率のサブ指標は依然として高いレベルにあり、これは来月の欧州中央銀行がより慎重に利下げをする理由を増やした。

智通財経アプリによると、金曜日に発表されたデータによると、ユーロ圏の11月のインフレ率が加速し、最も注目されているインフレ率のサブ指標は依然として高いレベルにあり、これは来月の欧州中央銀行がより慎重に利下げをする理由を増やした。

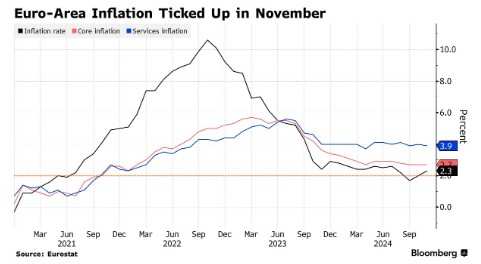

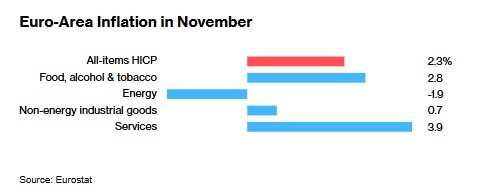

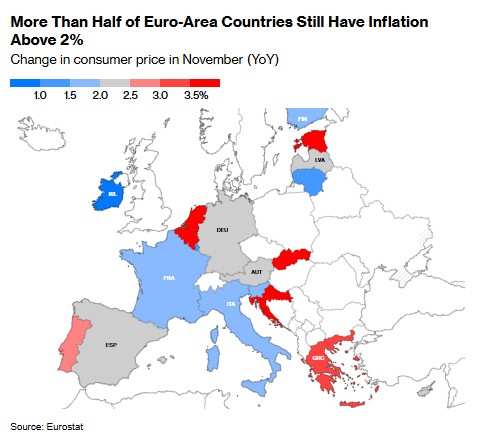

欧州統計局のデータによると、11月、ユーロ圏20カ国の消費者物価インフレ率は2.3%でした。前月の2.0%および欧州中央銀行の2%の目標を上回っていますが、予想通りです。

一方、欧州中央銀行は金利設定時に主に焦点を当てる潜在的インフレ率が2.7%で安定していることに注目しています。サービスコストのわずかな低下が商品インフレの上昇で相殺されています。

一方、欧州中央銀行は金利設定時に主に焦点を当てる潜在的インフレ率が2.7%で安定していることに注目しています。サービスコストのわずかな低下が商品インフレの上昇で相殺されています。

消費者物価バスケットの中で最大の項目であるサービス価格の上昇は、過去1年間4%前後で推移し、今月は4.0%から3.9%に減速しました。

サービス料金は通常、全体的な平均水準よりも高いですが、エネルギーや輸入商品の影響が時間とともに薄れ、約3%の数字は望ましいと考えられています。

ただし、金曜日のデータは全体的な状況を変えておらず、来年のインフレ率はより持続可能な基盤に基づいてユーロ央行の目標にゆっくりと下がるという見方がされています。したがって、預金金利をさらに3.25%引き下げる必要性は依然としてあります。

現在の重要な問題は、12月12日に25ベーシスポイントの利下げが適切かどうか、それともより大きな50ベーシスポイントの利下げを選択すべきかということです。

25ベーシスポイントの利下げを支持する人々は、サービス料金が依然として高く、安心できない状況であると考えています。また、過去最低の失業率の支持を受け、賃金は依然として急速に上昇しています。成長率は低くても、それはヨーロッパ中央銀行が常に目指してきた「ソフトランディング」の考えに合致しています。

Joachim Nagelなどのハト派の支持者は慎重を要すると述べ、サービス業のインフレ、賃金の上昇、および巨大な地政学的不確実性により、利下げを急ぐべきでないと警告しています。

理事会メンバーであるIsabel Schnabelは今週、貸出コストが中立水準に近づいているとさえ述べ、現時点では経済刺激のために金利を引き下げるのは適切でないようです。

一方、大幅な利下げを支持する人々は、経済がまだ不況に陥っていないため、雇用を保護するためにより大規模な刺激策が必要であると主張しています。裁量の増加は、既に脆弱な需要を抑制し、さらに裁量をもたらすことで、自己強化的なサイクルが形成される可能性があります。

欧州中央銀行のハト派な政策立案者であるYannis StournarasやMario Centenoなどは、欧州経済の弱さが2%の目標を下回る低インフレをもたらす可能性に懸念を抱いています。彼らは現在の3.25%の預金金利を2%に迅速に引き下げることを強く訴え、それが中立水準であり、経済成長を制限せず、促進せずに済むと考えています。

フランス中央銀行総裁Francois Villeroy de Galhauは木曜日に述べた、欧州中央銀行は成長を促進するために貸出コストを拡張的水準まで引き下げる必要があるかもしれないと、最近のイタリア中銀総裁Fabio Panettaの発言と一致しています。

投資家たちも同様の懸念を抱いているようで、中期インフレ予想を測定する重要な市場指標が今週2%を下回り、これは2022年以来の初めてのことです。

ただし、12月12日の会議の前に欧州中央銀行からの新経済予測を受け取るまで、この論争は解決される可能性は低いですが、最近、ハト派の役員でさえも利下げを段階的に行う理由を示唆し、25ベーシスポイントの利下げに同意する可能性があると述べられています。

欧州中央銀行の12月の新しい経済成長と物価の予測が、緩和政策の程度を決定する鍵となります。一部の役員は2025年初に2%のインフレ率に達するだろうと考えていますが、最近の欧州委員会の予測では、これにはより長い時間がかかるとしています。

米国の新政権が発足し政策の考え方が実際の政策になる前に、グローバル経済に重大な影響を及ぼす可能性のある措置があるため、一定の政策空間を確保する必要があります。

トランプ氏の復帰は不確実性を増大させました。ほとんどの欧州中央銀行の政策決定者たちは貿易関税が欧州の経済成長を弱めると考えていますが、物価への影響はまだ明確ではありません。ラガルド総裁は今週、「貿易戦争は短期的にはわずかな正味インフレをもたらす可能性がある」と述べました。

現時点では、市場はわずかな利下げが予想され、さらなる50ベーシスポイントの利下げの可能性は10%未満だと考えられています。しかし市場の期待は常に不安定であり、先週の特に弱いビジネス調査の後、この確率は一時的に50%に近づきました。

12月12日の結果に関係なく、投資家はヨーロッパ中央銀行が着実に利下げを行うことに賭けており、政策は少なくとも来年6月の会議ごとに緩和されると予想されています。2025年末までに、預金金利は1.75%に低下し、この水準は経済成長を再び刺激するに十分低い水準です。

与此同时,欧洲央行在设定利率时主要关注的潜在通胀稳定在2.7%,因为服务成本的小幅放缓被商品通胀的上升所抵消。

与此同时,欧洲央行在设定利率时主要关注的潜在通胀稳定在2.7%,因为服务成本的小幅放缓被商品通胀的上升所抵消。