Shandong Mining Machinery Group Co., Ltd. (SZSE:002526) shares have continued their recent momentum with a 33% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 32% in the last year.

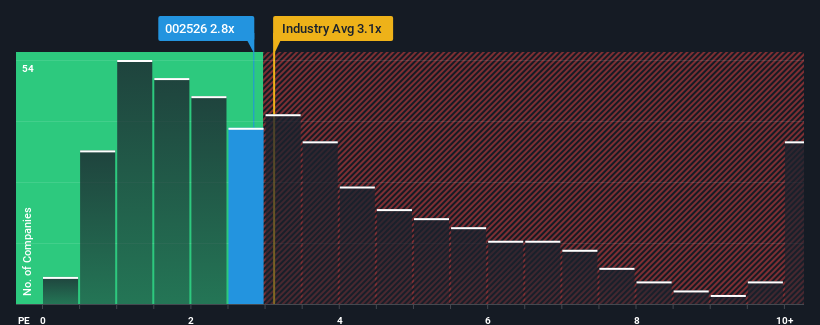

In spite of the firm bounce in price, there still wouldn't be many who think Shandong Mining Machinery Group's price-to-sales (or "P/S") ratio of 2.8x is worth a mention when the median P/S in China's Machinery industry is similar at about 3.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Shandong Mining Machinery Group Has Been Performing

As an illustration, revenue has deteriorated at Shandong Mining Machinery Group over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shandong Mining Machinery Group will help you shine a light on its historical performance.How Is Shandong Mining Machinery Group's Revenue Growth Trending?

Shandong Mining Machinery Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Shandong Mining Machinery Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 24% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Shandong Mining Machinery Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Shandong Mining Machinery Group's P/S?

Its shares have lifted substantially and now Shandong Mining Machinery Group's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shandong Mining Machinery Group's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Shandong Mining Machinery Group (1 is significant) you should be aware of.

If these risks are making you reconsider your opinion on Shandong Mining Machinery Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.