Currently, the popularity and activity of the dual-antibody circuit is rapidly rising, and it has become a new hot spot in the global innovative pharmaceutical industry. Multinational pharmaceutical companies are “sweeping the goods” one after another, actively seeking and investing in promising dual-antibody pipelines.

According to GLONGHUI statistics, in the first three quarters of 2024, global pharmaceutical companies were extremely active in trading activities in the field of dual-antibody drugs, reaching a total of 31 deals. This figure exceeds the annual trading volume for any of the past three years, which is enough to show that the position and influence of bipolar drugs in the global pharmaceutical market is rapidly rising.

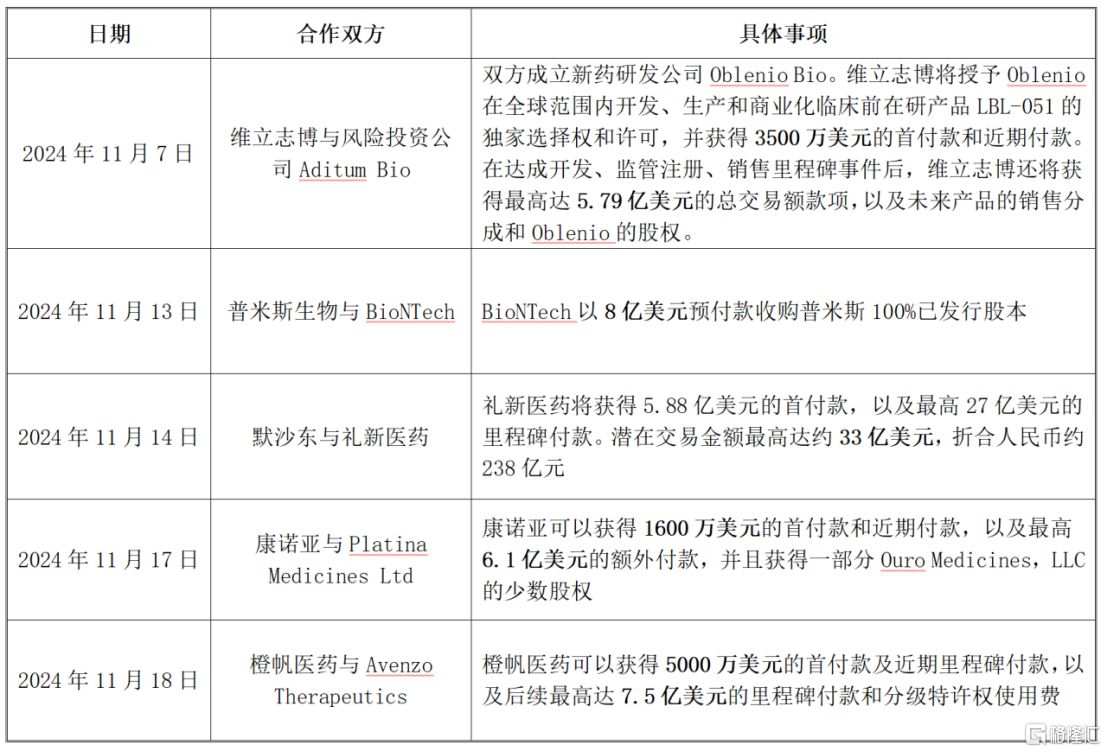

Among them, in November alone, there were 5 large-scale BD transactions involving dual antagonist/triple antibody drugs. The high amount of cooperation fully revealed the huge commercial value of the dual antibody circuit.

Source: Gelonghui compiled based on public information on the Internet

Source: Gelonghui compiled based on public information on the Internet

Why do capital and major global pharmaceutical companies favor dual-antibody drugs so much?

Judging from the development history of tumor immunotherapy, although the previous generation of tumor immunotherapy represented by PD-1 monoclonal antibodies was able to achieve an objective remission rate of about 20%, due to the complexity and variability of the tumor microenvironment, its curative effect was generally limited and unsustainable.

As a result, next-generation tumor immunotherapy represented by dual antibodies appeared, showing higher treatment potential. At this stage, immune checkpoint inhibitors began to be used in combination with chemotherapy or antiangiogenic drugs, which significantly increased the objective remission rate to 40% to 50%. Moreover, in order to achieve a higher objective remission rate, combination therapies with new targets and broad prospects, such as 4-1BB and PD-1 combination and LAG3 and PD-1 joint targeting, have emerged, which can systematically target various immune pathways and fully activate the immune system to achieve maximum anti-tumor effects, leading the future direction of tumor immunotherapy. According to Frost & Sullivan statistics, immunotherapy is expected to occupy nearly half of the global cancer treatment market by 2030.

Of course, this reflection of commercial value is also reflected in the growth in market size. According to data from PharmacIntelligence Network, the global dual-antibody drug market reached 8.8 billion US dollars in 2023, an increase of 50% over the previous year, further confirming the potential and vitality of the dual-antibody drug market.

In such a market environment, investors' attention to the dual resistance sector has also increased, and there is no shortage of investment opportunities worth paying attention to.

Recently, Weilizhibo submitted a listing to the Hong Kong Stock Exchange, which may be an example worth watching.

In the current context of the high popularity of the dual-antibody circuit, according to Frost & Sullivan's data, Verishibo's four core and main products (dual antibody LBL-024, LBL-034, LBL-033, and monoclonal antibody LBL-007) not only showed innovation in product design, but clinical research progress is also at the leading level in the world regardless of their respective drug categories or targets. The innovative and forward-looking nature of the pipeline layout has made it a leader in the development of next-generation tumor immunotherapy.

It can be said that the timing of Weilizhibo's submission to the Hong Kong Stock Exchange was also timely. While bringing capital market attention to the company itself, it also provided a window for investors to seize this high growth circuit.

Exploring differentiated targets, global FIC/BIC highlights the hard power of innovation

In the global field of innovative drug development, if a company wants to gain a foothold, the card in its hand must be excellent — it also needs to see the innovative nature of the product and the potential for clinical application.

Since its establishment, Weilizhibo has been committed to meeting the unmet medical needs of China and the world in terms of tumors, autoimmune diseases and other major diseases. With differentiated innovation and extensive treatment coverage, it has a layout in various drug fields such as dual antibodies, monoclonal antibodies, and ADC, and all have global commercial rights, paving a diversified growth path ahead of time.

At present, the company has established a product pipeline with 12 drug candidates, including 3 monoclonal antibodies, 4 double antibodies, 2 ADCs and 1 bispecific fusion protein for tumors, as well as 1 bispecific fusion protein and 1 tri-specific antibody for autoimmune diseases. Among them, 6 products have entered the clinical stage, including the core product LBL-024 and the main products LBL-034, LBL-033, and LBL-007, and R&D progress is at the leading level in the world, demonstrating its strong strength in the field of innovative drug research and development.

Source: Weilizhibo prospectus

For example, in the field of dual antibodies, Weilizhibo's core product LBL-024 is a novel PD-L1 and 4-1BB dual antibody at a critical clinical stage, which is expected to become the world's first immunotherapy targeting 4-1BB.

The world's first wave of tumor immunotherapy, represented by PD-1/PD-L1 immune checkpoint inhibitors, achieved an objective remission rate of only 20% with single drug treatment. LBL-024 uses the synergetic effects of these two pathways to achieve a balance between strong efficacy and controllable toxicity through a dual-targeting strategy, providing a safer and more effective treatment plan, and is an ideal complement to PD-1/L1 immunotherapy.

It is worth noting here that 4-1BB is a costimulatory agonist, and the path to monoclonal antibody development is fraught with major challenges, especially safety issues. Judging from clinical data, LBL-024 has shown good safety whether used as a single drug or in combination with chemotherapy. In the completed monotherapy I/II trial, 175 patients (111 patients in phase II) received high-dose administration of 0.2 mg/kg to 25 mg/kg every 3 weeks, and no dose-limiting toxicity was observed or achieved. The vast majority of adverse events are level 1 or 2 and can be controlled. However, in the phase IB/II trial in combination with chemotherapy, as of September 30, 2024, no dose-limiting toxicity was observed in 47 first-line extrapulmonary neuroendocrine cancer patients enrolled in doses of 6 mg/kg, 10 mg/kg, and 15 mg/kg, and the maximum tolerable dose was not reached when the dose reached 15 mg/kg.

In addition, the efficacy data observed with single drug treatment is equally encouraging. As of September 30, 2024, of the 45 evaluable patients with second-line/third-line neuroendocrine cancer, 15 had achieved partial remission, and 8 had achieved stable disease, that is, the objective remission rate was 33.3% and the disease control rate was 51.1%. The company has initiated key single-arm clinical trials for extrapulmonary neuroendocrine cancer.

At the same time, the broad expression of 4-1BB and PD-L1 has potential for drug development in multiple indications. It has a wide range of applications and can be extended to various solid tumors. Earlier, Frost & Sullivan data showed that the total number of cases with the main indications for 4-1BB antibodies showed an upward trend year by year, from 9.717 million cases in 2016 to 10.634 million cases in 2020.

Currently, Weilizhibo is conducting clinical research on the efficacy of LBL-024 in treating advanced extrapulmonary neuroendocrine cancer, small cell lung cancer, biliary tract cancer, non-small cell lung cancer, and other solid tumors, and plans to further expand it to more cancer indications such as esophageal squamous cell carcinoma, gastric cancer, and hepatocellular carcinoma.

In less than three years, LBL-024 went from the first human trial to a single-arm critical clinical trial for extrapulmonary neuroendocrine cancer, showing good efficacy and safety. It is the first 4-1BB targeted drug candidate in the world to reach the critical clinical trial stage, and is expected to be the first approved drug for this indication. According to reports, LBL-024 has been certified by the NMPA as a breakthrough treatment for later-line extrapulmonary neuroendocrine cancer, and has been certified as an orphan drug by the US FDA to treat neuroendocrine cancer.

Another major product, LBL-034, is a targeted GPRC5D and CD3 T-cell engager with the world's second-leading clinical progress.

Judging from the latest clinical developments, LBL-034 has obtained IND approval from the NMPA and the US FDA, and is undergoing phase I/II trials for the treatment of recurrent/refractory multiple myeloma in China.

According to the data, as of November 22, 2024, the objective remission rate (ORR) of LBL-034 reached 88.9%, achieved VGPR (high-quality remission) or better efficacy ratio of 66.7%, and the ORR reached 100.0% in the 800 μg/kg dose; compared with the only GPRC5D/CD3 dual antibody approved in the world - Johnson & Johnson's TALVEY (tacitumab) public clinical data showed that in patients with multiple myeloma doses of 800 μg/kg The proportion of VGPR (high-quality relief) or better efficacy was 52%. LBL-034 showed better efficacy. This result not only proved the potential of LBL-034, but also laid the foundation for future market competition. According to Johnson & Johnson's sales forecast, TALVEY's global annual sales peak will reach 5 billion dollars.

It is easy to judge from this that if LBL-034 is successfully clinically promoted and commercialized in the future, with better efficacy and clinical data, it is expected to quickly win the favor of the market and possibly surpass TALVEY's sales.

In addition, according to Frost & Sullivan's data, the company's other CD3 T-cell engager LBL-033 is one of only two MUC16/CD3 double antibodies in the world that have entered the clinical stage. It has shown strong anti-tumor activity and controllable safety in previous pre-clinical and early clinical studies. Currently, LBL-033 has obtained IND approval from NMPA and FDA, and phase I/II clinical studies are being carried out in China for single-agent treatment of advanced solid tumors.

In the field of monoclonal antibodies, according to Frost & Sullivan's data, Verishibo's LBL-007 is one of the top three monoclonal antibodies targeting LAG3 in the world, and it is also the first antibody of its kind to be proven to be effective against nasopharyngeal cancer. The number of clinical trial indications also ranks among similar products.

According to reports, LBL-007 is currently undergoing phase II clinical trials for various cancer indications in China and around the world. In addition to nasopharyngeal cancer, it also covers a wide range of non-small cell lung cancer, colorectal cancer, head and neck squamous cell carcinoma, and esophageal squamous cell carcinoma.

Overall, many leading titles such as “World's First” and “Global Top 3” are sufficient to reflect Weilizhibo's forward-looking and innovative ability in drug development.

Looking further, the good efficacy shown by these drug candidates in clinical trials not only reflects the company's deep understanding of patients' needs, but also verifies its ability to transform these needs into practical treatment plans.

It has real innovative research and development capabilities, and is favored and endorsed by the industry

Of course, the key factor that Weilizhibo's product pipeline can be so groundbreaking is that it has R&D capabilities that truly innovate at the source. We might as well discuss it from both internal and external perspectives.

Looking inward, Weilizhibo has a full-process R&D chain and fully integrated development capabilities, and has developed a number of proprietary innovative technology platforms, which enable the company to significantly improve the success rate in the drug development process.

These platforms include LeadsBodyTM (CD3 T-cell engager platform), X-bodyTM (4-1BB engager platform), and several other bispecific antibody and fusion protein platforms, which can continuously innovate drugs for different targets, mechanisms of action and drug types. They are suitable for various disease fields, and provide the company with a continuous growth engine.

For example, the advantages of the LeadsBodyTM platform can be simply summarized in three points: First, it can optimize the ratio and affinity of tumor-related antigens to the CD3 binding domain, direct T-cell engager effects to tumor sites, and reduce off-target toxicity. Second, the platform can induce T cells to effectively kill target cells and reduce cytokine secretion through structural optimization. Finally, in vitro and in vivo studies, the T-cell engager developed through the platform showed long-lasting anti-tumor effects and induced less T-cell depletion. Good clinical data from LBL-034 and LBL-033 fully validate the superiority of the LeadsBody platform in developing a powerful CD3 T-cell engager.

The X-bodyTM platform, on the other hand, uses advanced antibody engineering technology to balance the affinity between tumor-related antigens and 4-1bB, and only promotes cross-linking and activation of 4-1BB receptors when the tumor site binds to tumor-related antigens, thereby activating 4-1BB in the tumor microenvironment expressing tumor-related antigens. This unique molecular structure can enhance the immune response in the tumor microenvironment while reducing the risk of systemic toxicity. The company's core product, LBL-024, was developed based on the X-body platform.

In addition, the company's other technology platforms can also design candidate products based on various drug types of antibodies, such as common light chain bispecific antibodies, bifunctional fusion proteins, and ADCs for highly competitive targets on a global scale. These platforms use innovative molecular engineering technology to create dedicated drugs with dual functions, or reduce systemic side effects by accurately targeting tumor cells, and can further strengthen the company's leading position in the global innovative drug market.

Through strong internal innovation capabilities and technology platforms, Weilizhibo accurately focuses on treatment needs that have not been fully met in the market, and also plans to expand the scope of research and development to more major diseases, adding a new dimension to its core competitiveness in the global innovative drug field. At the same time, this also means that the company can better respond to market changes, grasp new trends in industry development, and maintain a leading position in the global field of innovative pharmaceuticals.

Looking outward, through its highly competitive product pipeline, Weilizhibo cooperates with well-known global pharmaceutical companies to expand the global value system and build a long-term sustainable business model. These collaborations not only proved that the company's innovative R&D capabilities were recognized and endorsed by the industry, but also paved the way for future promotion and commercialization in the global market.

For example, the collaboration between Verissimo and BeiGene is a typical example.

Verishibo granted BeiGene an exclusive license to develop, manufacture and commercialize LBL-007 outside of Greater China. The two parties jointly carried out clinical development and commercialization of LBL-007 for major cancer types. The cooperation amount was as high as 0.772 billion US dollars in advance payments and milestone payments, plus a tiered global sales share with a double digit percentage. This cooperation is expected to use BeiGene's rich experience and sales channels in drug development and commercialization to accelerate the global registration and marketing process of LBL-007, and lay a solid foundation for the promotion of Weilizhibo's innovative achievements on a global scale.

Furthermore, in an environment where TCE (T cell-engager) has recently gone overseas, Weilizhibo and Aditum Bio jointly established a new drug research and development company Oblenio Bio to cooperate on the global development and commercialization of LBL-051 (a CD19/BCMA/CD3 T cell engager), with a total amount of up to 0.614 billion US dollars. In addition, a potential medium single-digit percentage of global sales shares and shares in new companies is clearly visible.

It is undeniable that through its internal innovation capabilities and strategic global cooperation, Weilizhibo has continuously strengthened its innovative research and development capabilities. While enhancing the company's influence in the global innovative drug field, it has also brought more growth opportunities and market competitiveness.

epilogue

In today's fierce competition for innovative drug development, target homogenization has become a common challenge within the industry. Faced with this current situation, innovative pharmaceutical companies must seek differentiated strategies to ensure their long-term market competitiveness and sustainable development.

Weilizhibo holds differentiated drugs such as LBL-024, LBL-034, LBL-033, and LBL-007, and the leading edge in innovation is self-evident. The innovativeness of these drugs is reflected not only in their target selection, but also in their unique mechanism of action and therapeutic potential.

With the unique market positioning and growth potential brought about by these product advantages, I believe that the Hong Kong stock listing of Weilizhi is expected to receive more market attention and enter a new stage of development.

资料来源:格隆汇根据网络公开信息整理

资料来源:格隆汇根据网络公开信息整理