Perfect Corp. (NYSE:PERF) shareholders would be excited to see that the share price has had a great month, posting a 40% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

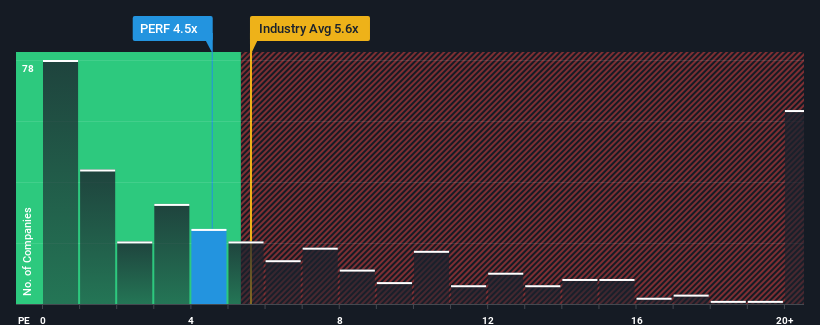

In spite of the firm bounce in price, there still wouldn't be many who think Perfect's price-to-sales (or "P/S") ratio of 4.5x is worth a mention when the median P/S in the United States' Software industry is similar at about 5.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Perfect Performed Recently?

Recent revenue growth for Perfect has been in line with the industry. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on Perfect will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Perfect.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Perfect would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Perfect would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 56% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 21% per annum growth forecast for the broader industry.

With this in mind, we find it intriguing that Perfect's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Perfect's P/S?

Perfect's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given that Perfect's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Perfect you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.