Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. For example, the Shanghai Huace Navigation Technology Ltd (SZSE:300627) share price is up a whopping 324% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. Also pleasing for shareholders was the 37% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 26% in 90 days).

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

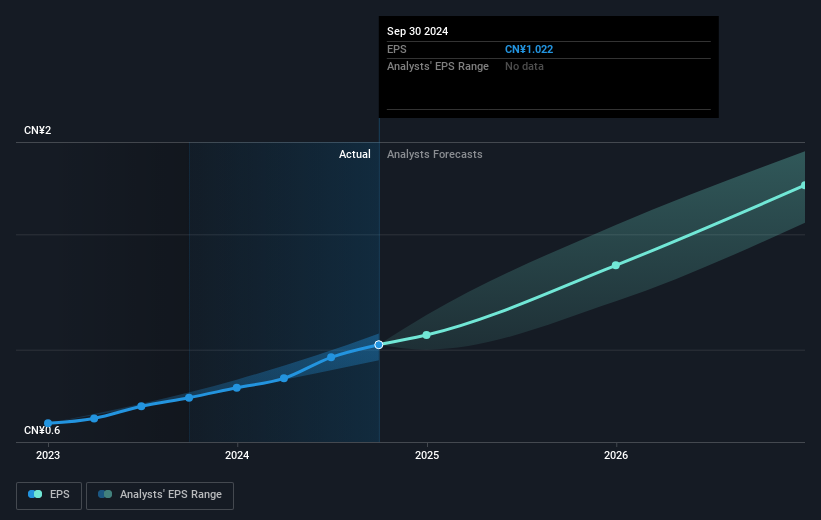

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Shanghai Huace Navigation Technology achieved compound earnings per share (EPS) growth of 34% per year. That makes the EPS growth particularly close to the yearly share price growth of 34%. That suggests that the market sentiment around the company hasn't changed much over that time. In fact, the share price seems to largely reflect the EPS growth.

During five years of share price growth, Shanghai Huace Navigation Technology achieved compound earnings per share (EPS) growth of 34% per year. That makes the EPS growth particularly close to the yearly share price growth of 34%. That suggests that the market sentiment around the company hasn't changed much over that time. In fact, the share price seems to largely reflect the EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Shanghai Huace Navigation Technology's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Shanghai Huace Navigation Technology, it has a TSR of 346% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Shanghai Huace Navigation Technology shareholders have received a total shareholder return of 27% over the last year. Of course, that includes the dividend. However, the TSR over five years, coming in at 35% per year, is even more impressive. Is Shanghai Huace Navigation Technology cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.