The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For instance the Trip.com Group Limited (NASDAQ:TCOM) share price is 156% higher than it was three years ago. Most would be happy with that. On top of that, the share price is up 37% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

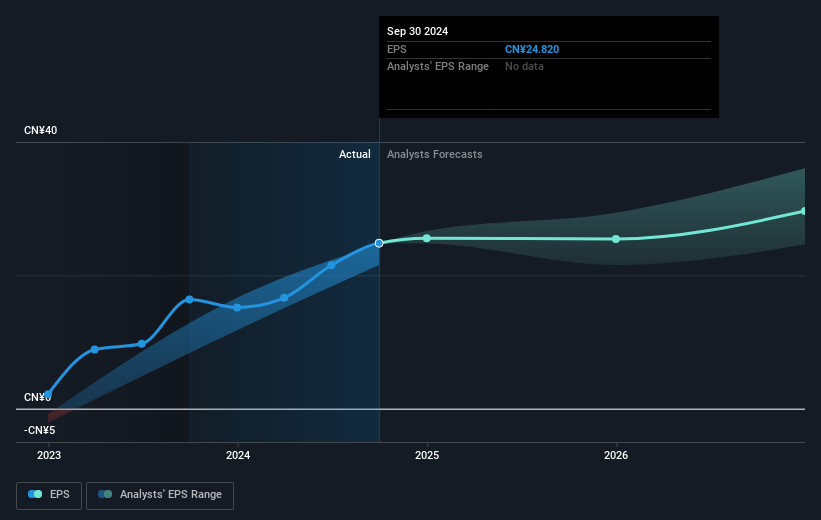

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Trip.com Group was able to grow its EPS at 131% per year over three years, sending the share price higher. This EPS growth is higher than the 37% average annual increase in the share price. So one could reasonably conclude that the market has cooled on the stock.

Trip.com Group was able to grow its EPS at 131% per year over three years, sending the share price higher. This EPS growth is higher than the 37% average annual increase in the share price. So one could reasonably conclude that the market has cooled on the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Trip.com Group has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Trip.com Group shareholders have received a total shareholder return of 89% over the last year. That's better than the annualised return of 14% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before deciding if you like the current share price, check how Trip.com Group scores on these 3 valuation metrics.

But note: Trip.com Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.