The ApicHope Pharmaceutical Co., Ltd (SZSE:300723) share price has done very well over the last month, posting an excellent gain of 26%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

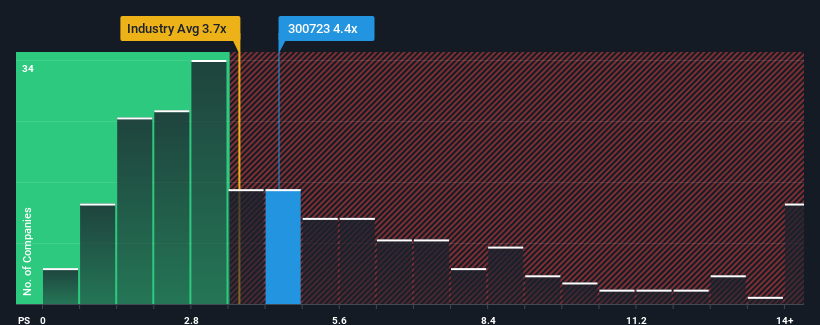

After such a large jump in price, you could be forgiven for thinking ApicHope Pharmaceutical is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.4x, considering almost half the companies in China's Pharmaceuticals industry have P/S ratios below 3.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has ApicHope Pharmaceutical Performed Recently?

While the industry has experienced revenue growth lately, ApicHope Pharmaceutical's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think ApicHope Pharmaceutical's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For ApicHope Pharmaceutical?

There's an inherent assumption that a company should outperform the industry for P/S ratios like ApicHope Pharmaceutical's to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like ApicHope Pharmaceutical's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 25%. The last three years don't look nice either as the company has shrunk revenue by 11% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 41% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 212%, which is noticeably more attractive.

In light of this, it's alarming that ApicHope Pharmaceutical's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

The large bounce in ApicHope Pharmaceutical's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that ApicHope Pharmaceutical currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 3 warning signs for ApicHope Pharmaceutical (2 are potentially serious!) that we have uncovered.

If these risks are making you reconsider your opinion on ApicHope Pharmaceutical, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.