Once again, a small essay stimulated the market, and the end of November passed smoothly. The Hang Seng Index rose slightly by 0.29% last week.

[Editor's View]

Another small article stimulated the market, and the end of November passed smoothly. Last week, the Hang Seng Index rose slightly by 0.29%.

No particularly bullish news over the weekend, however, the November PMI data is 50.3%, with PMI data for August to November at 49.1, 49.8, 50.1, and 50.3 respectively, achieving three consecutive increases, which is rare. It has been above the boom-bust line of 50 for two consecutive months. Leading the improvement in November PMI data are the new export order index and the new order index, stronger than the production index. Essentially, customers in the United States know that tariffs are going to increase significantly and are rushing to export and grab orders in advance. Therefore, the data still needs to be consistently monitored.

No particularly bullish news over the weekend, however, the November PMI data is 50.3%, with PMI data for August to November at 49.1, 49.8, 50.1, and 50.3 respectively, achieving three consecutive increases, which is rare. It has been above the boom-bust line of 50 for two consecutive months. Leading the improvement in November PMI data are the new export order index and the new order index, stronger than the production index. Essentially, customers in the United States know that tariffs are going to increase significantly and are rushing to export and grab orders in advance. Therefore, the data still needs to be consistently monitored.

The U.S. non-farm payroll data for November, to be released this Friday, will be a key factor in the Federal Reserve's December 17-18 Federal Open Market Committee (FOMC) meeting decision.

Tariffs are back. Over the weekend, the United States announced plans to impose tariffs of up to 271% on imported solar photovoltaics from four Southeast Asian countries. This news is bearish for capacity in Thailand and Vietnam, but it is bullish for the U.S. market as the scarcity of domestic production capacity and capacity outside of Southeast Asia will be further highlighted. Let's see if domestic industry conferences can offset this. From December 4-6, the China Photovoltaic Industry Association will hold the '2024 Photovoltaic Industry Annual Conference' in Yibin City, Sichuan Province.

From the above, the market still lacks a clear catalyst, and there is a need to keep a close watch on whether the heavyweight meetings will be held early. In terms of hot topics, on November 30 local time, the Vietnamese National Assembly approved a ten-year plan for the North-South high-speed rail investment. The plan will involve a total investment of $67 billion, with a total length of 1541 kilometers, and will connect 20 provinces and cities with the two ends set in the capital Hanoi and Ho Chi Minh City. The National Assembly of Vietnam has requested feasibility studies to begin in 2025, aiming for basic completion by 2035. It is expected to stimulate the high-speed rail sector.

On November 29, 2024, the Guangdong Capital Market Mergers and Acquisitions Alliance was officially established in Guangzhou. The alliance was jointly initiated by Guangdong Hengjian Holdings, Guangdong Listed Companies Association, and GF Securities. M&A concept stocks are expected to be active again.

[This week's hot stocks]

翰森制药(03692)

The company announced that the following four innovative drugs are renewed and included in the 'National Basic Medical Insurance, Work Injury Insurance, and Maternity Insurance Drug Catalog (2024)' released by the China National Healthcare Security Administration and Ministry of Human Resources and Social Security. The 2024 National Medical Insurance Catalog will be officially implemented on January 1, 2025. The total revenue from innovative drugs and cooperative products in the first half of 2024 amounted to 5.032 billion yuan, an increase of approximately 80.6% compared to the same period in 2023, with the proportion of total revenue rising to 77.40%.

Hansoh Pharma's innovative transformation has been effective. Since the listing of the first independently innovative Class 1.1 new drug Meilinda in 2014, the company has obtained approval for listing of 8 innovative drugs. The proportion of innovative drug revenue increased rapidly from 2020 to 2023, achieving stage leaps of 18%-42%-53%-67%. Anti-tumor drugs are the company's traditional advantage area. In 2023, the company's revenue from anti-tumor drugs reached 6.169 billion yuan, accounting for 59.7%. In the first half of 2024, the company's revenue from anti-tumor drugs reached 4.475 billion yuan, accounting for 68.8%. The company has formed a healthy product portfolio and rich R&D pipeline in the anti-tumor field. The market share of third-generation EGFRTKI Amezitin continues to rise, contributing significantly to revenue growth; second-generation Bcr-AblTKI Flumatinib has better efficacy than Imatinib, with a clear substitution trend. The subsequent tumor R&D pipeline is rich, covering multiple potential targets, especially two ADC products authorized by GSK, which are expected to bring continuous authorized income to the company. The layout extends to non-oncology fields. The company covers multiple disease areas including metabolism, immunity, central nervous system, and anti-infection, especially in the well-recognized indications with a large number of patients domestically. Bullish on the company's increased sales of listed products and the performance improvement brought by the R&D progress of pipeline products.

[Industry Observations]

New tobacco products are accelerating iteration, benefiting core suppliers.

Steady growth of NB, differentiated atomization structure. In 2023, the global market sizes of HNB cartridges/replacement sticks/disposables were 32.3/13.5/5.4 billion USD respectively, with year-on-year growth rates of +12.1%/8.2%/54.9%, and CAGRs from 2019 to 2023 were 21.3%/2.9%/83.7% respectively. Benefiting from global tobacco leaders such as PMI, BAT accelerating product updates and market expansion, HNB growth is more attractive. Japan/Hungary/Czech Republic/South Korea and other core regional heat-Not-Burn (HNB) penetration rates (share of cigarette sales) have reached 39%/24%/19%/18%, with a CAGR expected to reach 13.5% from 2023 to 2028 (Euromonitor data). Disposables account for 25% in the atomization segment. With stringent global regulations and a gradual slowdown in growth, the global control trend in 2023 is gradually declining. With bans being implemented in regions like the UK for 25 years, replacement sticks are expected to recover growth, with projected CAGRs from 2023 to 2028 for replacement sticks/disposables at 5.5%/-0.3% respectively.

Tobacco leaders accelerate HNB layout, products continuously iterated. In 2023, the global CR5 for HNB reached 97%, due to consumables involving regulated materials like tobacco leaves, high industry barriers, leading tobacco groups occupy the main shares, with FiMoo International, British American Tobacco, Japan Tobacco, South Korean Tobacco, and Imperial Tobacco holding market shares of 71.0%, 15.6%, 6.0%, 3.6%, and 0.7% respectively. FiMoo and BAT have early layouts, rich product categories, comprehensive technology paths, and ongoing innovations; Giant players like Japan Tobacco, Korean Tobacco, and Imperial Tobacco have also accelerated product launches and market expansions in recent years, helping to expand the market comprehensively.

The positive policy direction is expected to accelerate the global compliance process. From 2020 to 2024, the Biden administration has only approved 9 new harm reduction product applications (with a total of up to a million applications in the pool). Previously, Trump openly supported the effectiveness of e-cigarettes in smoking cessation and claimed to remove counterfeit products in the United States. It is expected that after taking office, there will be positive impacts on flavor restrictions (in 2019, there was a plan to ban all fruit flavors, but later changed the stance) and PMTA review toxicity reduction. In addition, regulatory scrutiny globally is significantly increasing, with stricter crackdowns on non-compliant e-cigarettes (recently South Korea is pushing for restrictions on synthetic nicotine e-cigarettes, Kyrgyzstan has signed a law banning e-cigarettes, and the UK has banned disposable e-cigarettes). It is expected that the compliant refill market will steadily recover. In this process, leading brands/suppliers are expected to continue to increase their market share due to their strong compliance awareness, social responsibility, and cost advantages over the years.

In the Hong Kong stock market, attention is focused on the deep cooperation partner of British American Tobacco, and the HNB-accumulated Smoore International (06969).

[Data Review]

The Hong Kong Exchanges and Clearing Limited (HKEX) announced that the total number of open contracts for Hang Seng Index Futures (December) was 106,382 contracts, with a net open interest of 37,878 contracts. The settlement date for Hang Seng Index Futures is December 30, 2024.

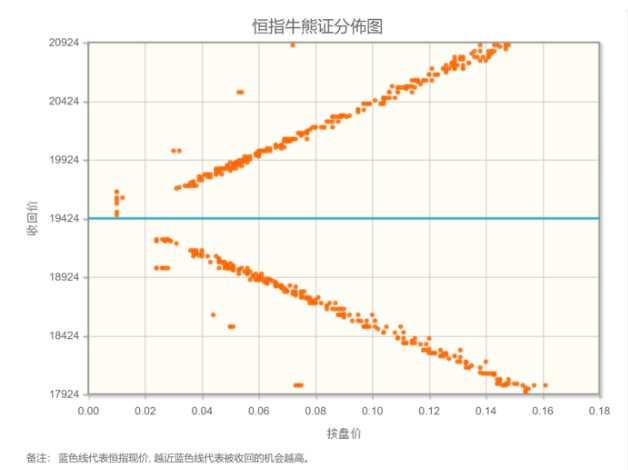

Looking at the distribution of market sentiments on the bull and bear streets of the Hang Seng Index, at the 19,424 point level, the bearish warrants are concentrated near the axis, indicating rebound space in the Hong Kong stock market. The market pricing is pointing to rate cuts once in the first half and once in the second half of next year. Institutions predict that the Fed will pause in the first half and have two rate cuts in the second half, each by 25 basis points. The Hang Seng Index is looking for support below the 0.02 million point level and is bullish this week.

Editor's Note:

Two interesting data points: first, last week's industry capital repurchase amount and number of repurchase cases were 7 billion Hong Kong dollars and 260 cases, respectively, close to the level in April this year. Second, the net inflow scale of southbound funds last week was 22.8 billion yuan, with southbound trades accounting for 36.3%, at a high level since 2014.

From a funding perspective, things are still stable. Based on past experience, nearing the end of December, fund managers will likely push for a wave, with the profit effect stronger than in November. At this point in time, it is advisable to observe the market cautiously and optimistically.

In terms of new stocks, the performance of Jiyuan Fund on its first day of listing last week was a typical case where the country's participation was cornerstone-dependent. New stock investors learn from their experiences. This week, Maoge Ping is worth looking forward to - let's see how the IPO situation unfolds.

周末没有看到特别利好,不过,11月PMI数据为50.3%,8-11月PMI数据分别为49.1、49.8、50.1、50.3,实现三连涨,比较罕见,并且已经连续两月处于荣枯线50上方。引领11月PMI数据向好的是新出口订单指数和新订单指数,并且强于生产指数,本质上美国那边客户知道接下来要大幅提升关税而提前抢出口、抢订单的行为。因此,数据仍需要持续观察。

周末没有看到特别利好,不过,11月PMI数据为50.3%,8-11月PMI数据分别为49.1、49.8、50.1、50.3,实现三连涨,比较罕见,并且已经连续两月处于荣枯线50上方。引领11月PMI数据向好的是新出口订单指数和新订单指数,并且强于生产指数,本质上美国那边客户知道接下来要大幅提升关税而提前抢出口、抢订单的行为。因此,数据仍需要持续观察。