In early Asian trading on Monday (December 2), spot gold fluctuated and fell slightly. Currently trading at $2646.95 per ounce. Gold prices rose slightly last Friday, boosted by the fall in the US dollar and ongoing geopolitical tension, but November still recorded the biggest monthly decline since September last year, mainly due to the post-election sell-off caused by Trump's victory.

Spot gold climbed 0.5% to $260.26 an ounce last Friday, but the decline will be more than 2% last week, as the price of gold plummeted by more than 3% last Monday. Although the price of gold tried to rebound in the following trading days, it failed to reverse last Monday's decline. Investors need to watch out for further downside risks in gold prices.

In November, spot gold fell 3.4%, the biggest monthly decline since September 2023. The reason was that “Trump's excitement” boosted the dollar in early November, blocking the rise in gold and triggering a post-election sell-off.

The US dollar index fell to a new low of more than two weeks last Friday, but rose 1.8% in November, as Trump's victory on November 5 fueled expectations of large fiscal spending, higher tariffs, and tighter border controls.

The US dollar index fell to a new low of more than two weeks last Friday, but rose 1.8% in November, as Trump's victory on November 5 fueled expectations of large fiscal spending, higher tariffs, and tighter border controls.

Gold is now under pressure as higher tariffs may stimulate inflation and cause the Federal Reserve to be wary of further interest rate cuts.

Jim Wyckoff, senior market analyst at Kitco Metals, said it is currently uncertain how the tariffs pledged by Trump will be implemented. However, “the uncertainty of this matter, that is, tariffs that may slow economic growth, is actually beneficial to the gold market from a safe-haven perspective”.

Analysts said policies promising to crack down on illegal immigration could also lead to a rekindling of inflation. The better-than-expected economic data also raised bets that the Federal Reserve will slow down the pace of interest rate cuts as it approaches neutral interest rates.

According to the CME FedWatch Tool, traders believe that the probability that the Federal Reserve will cut interest rates by 25 basis points at the December 17-18 meeting is 66%, but the probability of cutting interest rates again in January is only 17%.

Ole Hansen, head of commodity strategy at Saxo Bank (Saxo Bank) in Denmark, said in a report: “Continued global uncertainty continues to drive demand for gold as a safe haven asset.”

The next important US economic data will be released on Friday, the November jobs report. Investors will have a fresh perspective on the health of the US economy, and the report may help determine the trajectory of interest rates over the next few months.

A series of strong economic data (including the strong employment report in September) raised concerns that if the Federal Reserve cuts interest rates too much, inflation may rebound, thus putting in vain the progress made in suppressing prices over the past two years.

Investors said that although they mostly welcome the evidence that the economy is strengthening, if the non-farm payrolls data released on December 6 shows strong again, it may further weaken expectations of the Federal Reserve's interest rate cut and heighten their vigilance about inflation.

Angelo Kourkafas, senior investment strategist at Edward Jones, said the non-farm payrolls data “will provide a clearer picture of potential trends, which is very important because there is a lot of controversy and uncertainty surrounding the Federal Reserve's interest rate path.”

Federal Reserve Chairman Powell said in early November that the Federal Reserve does not need to rush to lower interest rates because the job market is stable and the inflation rate is still above the 2% target. Sameer Samana, a senior global market strategist at Wells Fargo Investment Research Institute, said that the Federal Reserve “is beginning to loudly question how much easing policies the economy, particularly the labor market, still needs.”

Anthony Saglimbene, chief market strategist at Ameriprise Financial, said that economists surveyed by Reuters expect an increase of 183,000 non-farm payrolls in November. If the report far exceeds expectations, it may shake people's confidence in the December action and weigh down the stock market. “If the employment report is stronger than expected, there may be a slight sell-off in the US stock market”.

In addition to the non-farm payrolls report, this week will also bring in economic data such as US ISM manufacturing PMI data for November, US JoLTS job vacancies in October, US ADP employment changes in November, US ISM non-manufacturing PMI for November, and US trade accounts for October. In addition, many Federal Reserve officials, including Federal Reserve Chairman Powell, will deliver speeches this week, and investors also need to pay attention.

Among them, the US ISM manufacturing PMI data for November will be released on Monday. This trading day will also welcome speeches by Federal Reserve Governor Waller and New York Federal Reserve Chairman Williams. Investors need to pay attention. Also, investors need to continue to pay attention to news related to the geographical situation.

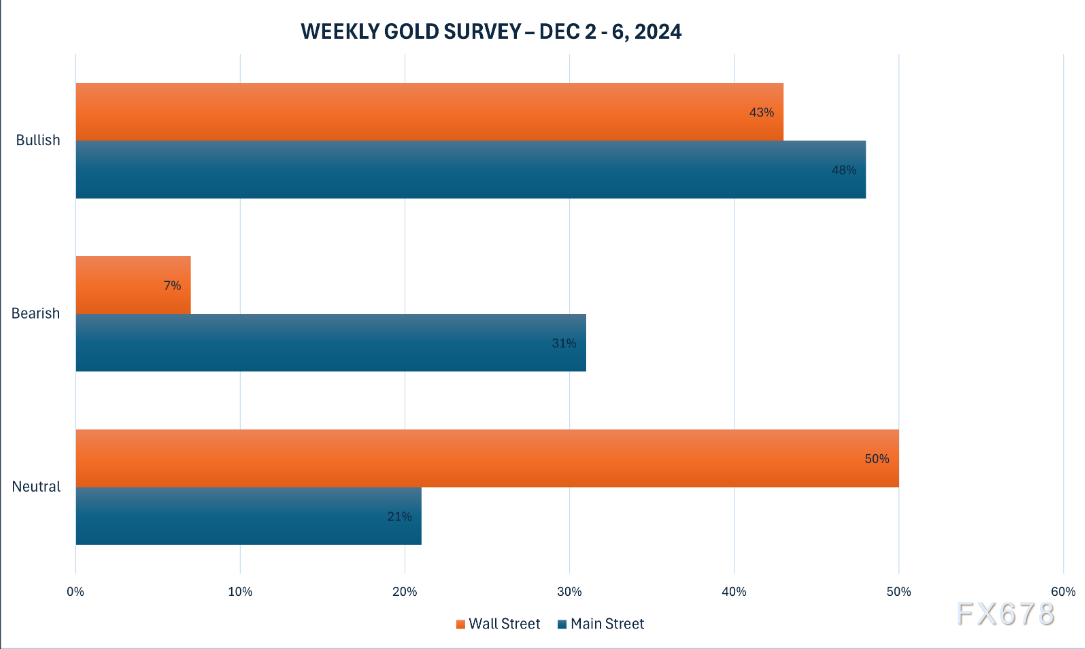

According to the latest KITCO, Wall Street analysts' desire to be bearish has declined. Most analysts tend to be neutral or bullish on future market trends, while most retail investors tend to be bullish on the future market.

A total of 14 analysts participated in the survey. Of these, 6 (43%) expected the price of gold to rise in the coming week, 7 (50%) predicted that gold would consolidate further, and only 1 (7%) predicted that the price of gold would fall. Of the 199 participants in the online survey, 96 (48%) expected the price of gold to rise, 61 (31%) expected to fall, and the remaining 42 (21%) expected gold to trade sideways.

From a technical point of view, the trend of gold prices last week is somewhat similar to a bearish “flag”. Investors need to be wary of the possibility that the price of gold will fall back to the 100-day EMA. Currently, the support is around 2575. If this support is broken, they may look further towards the 200-day EMA around 2435.

Above, watch for resistance near the 55-day EMA at 2662.46. If it stands above this position, it will weaken the bearish signal for the future market.

(Spot gold daily chart, source: daily chart)

At 07:22 Beijing time, the current price of spot gold is 2646.92 US dollars/ounce.

美元指数上周五跌至逾两周新低,但11月仍上涨1.8%,因特朗普11月5日的胜选助长了对大额财政支出、提高关税和收紧边境控制的预期。

美元指数上周五跌至逾两周新低,但11月仍上涨1.8%,因特朗普11月5日的胜选助长了对大额财政支出、提高关税和收紧边境控制的预期。