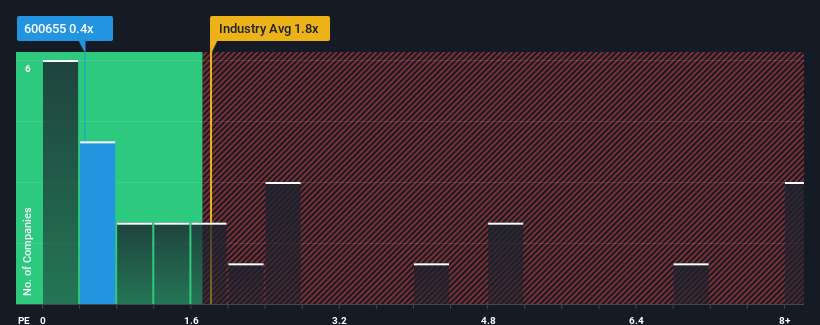

When close to half the companies operating in the Specialty Retail industry in China have price-to-sales ratios (or "P/S") above 1.8x, you may consider Shanghai Yuyuan Tourist Mart (Group) Co., Ltd. (SHSE:600655) as an attractive investment with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Shanghai Yuyuan Tourist Mart (Group)'s P/S Mean For Shareholders?

Shanghai Yuyuan Tourist Mart (Group) has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. You'd much rather the company continue improving its revenue if you still believe in the business. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Yuyuan Tourist Mart (Group) will help you uncover what's on the horizon.How Is Shanghai Yuyuan Tourist Mart (Group)'s Revenue Growth Trending?

In order to justify its P/S ratio, Shanghai Yuyuan Tourist Mart (Group) would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.5%. Regardless, revenue has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.5%. Regardless, revenue has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the four analysts following the company. That's shaping up to be materially lower than the 18% growth forecast for the broader industry.

With this information, we can see why Shanghai Yuyuan Tourist Mart (Group) is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Shanghai Yuyuan Tourist Mart (Group)'s P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Shanghai Yuyuan Tourist Mart (Group)'s analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Shanghai Yuyuan Tourist Mart (Group) (1 is a bit unpleasant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.