Alibaba's $71M Bet On Ably Corp Turns It Into South Korea's First Unicorn of 2024

Alibaba's $71M Bet On Ably Corp Turns It Into South Korea's First Unicorn of 2024

Chinese e-commerce company Alibaba Group Holding Ltd (NYSE:BABA) has invested $71.4 million or 100 billion Korean won in the South Korean apparel brand Ably Corp.

中国电子商务公司阿里巴巴(临时代码)已经向韩国服装品牌Ably corp投资了7140万美元或1000亿韩元。

What Happened: Ably is now South Korea's first unicorn of 2024, with the deal valuing the company at over $1 billion, as per a report by The Korean Economic Daily.

发生了什么: Ably现在是2024年韩国的第一个独角兽,根据《韩国经济日报》的报道,该交易对该公司的估值超过了10亿美元。

Following the investment, Ably's valuation has soared to around 3 trillion won (approx. $2.1 billion), a significant increase from its 900 billion won valuation during its 67 billion won pre-Series C fundraising round in January 2022.

在这笔投资之后,Ably的估值已经飙升至约3万亿韩元(约21亿美元),远远超过了2022年1月670亿韩元的C轮融资前估值9000亿韩元。

Why It Matters: This deal marks the first equity investment by China-based Alibaba in any Korean shopping app.

重要性: 这笔交易标志着总部位于中国的阿里巴巴首次在任何韩国购物应用上进行股权投资。

Ably is the first Korean startup to reach a valuation of over $1 billion this year, following Naver Corp.'s Kream Corp., which achieved a 1 trillion won valuation in December 2023 after completing a bridge round financing.

Ably是继Naver corp.'s Kream Corp之后,2023年12月完成一轮桥梁融资后,估值超过100亿美元的第一个韩国初创企业。

As per its 13F filings for the third quarter, Alibaba holds stakes in XPeng Inc. (NYSE:XPEV), Weibo Corp. (NASDAQ:WB), Perfect Corp. (NYSE:PERF), and Best Inc. (NYSE:BEST) in the U.S.

根据其2024年第三季度的13F报告,阿里巴巴在美国持有雪佛龙汽车 有限公司(纽交所:XPEV) 、微博 corp.(纳斯达克:WB)、完美 corp.(纽交所:PERF)和最佳 corp.(纽交所:BEST)的股份。

Alibaba increased its stake in XPeng by 371% in the September 2024 quarter compared to the June 2024 quarter. During the same period, it reduced its stake in Perfect by 2%, while its Weibo and Best stakes remained unchanged.

与2024年6月相比,阿里巴巴在2024年9月的一个季度里将其在雪佛龙汽车公司的持股比例增加了371%。在同一期间,它减少了在完美 corp 的持股比例2%,而其在微博和最佳公司的持股比例保持不变。

Alibaba Co-Founder Jack Ma Makes Rare Appearance At Company Campus

阿里巴巴联合创始人马云罕见地出现在公司校园。

Price Action: Shares of Alibaba Group Holdings' ADR closed 0.90% higher at $87.37 per share on Friday as compared to a 0.31% advance in the NYSE Composite Index.

价格走势:周五,阿里巴巴(临时代码)ADR的股价收涨0.90%,报87.37美元,相比纽约证券交易所综合指数0.31%的上涨。

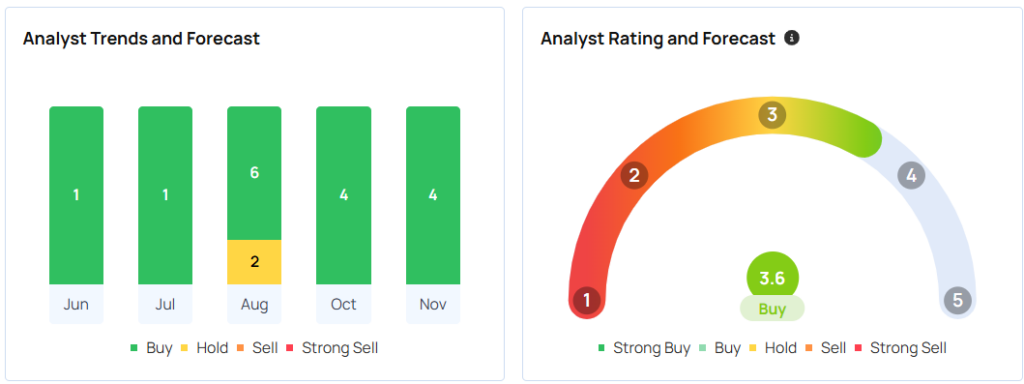

According to Benzinga Pro data, Alibaba has a consensus price target of $119.82 apiece based on the ratings of 23 analysts, but a consensus rating of "Buy." The highest price target among all the analysts tracked by Benzinga is $155 per share issued by Deutsche Bank on Jan. 13, 2023, whereas the lowest price target is $85 apiece issued by Bernstein on Aug. 16.

根据Benzinga Pro的数据,阿里巴巴(临时代码)得到23名分析师的一致性目标价为每股119.82美元,但一致评级为“买入”。Benzinga追踪的所有分析师中,德意志银行在2023年1月13日发布的每股155美元的最高目标价,而伯恩斯坦在8月16日发布的每股85美元是最低目标价。

The average price target of $122 per share between Barclays, Benchmark, and Mizuho implies a 39.64% upside for Alibaba.

巴克莱银行、Benchmark和瑞穗银行对阿里巴巴(临时代码)的每股平均目标价为122美元,暗示着39.64%的上涨空间。