Check Out What Whales Are Doing With GME

Check Out What Whales Are Doing With GME

Whales with a lot of money to spend have taken a noticeably bearish stance on GameStop.

擁有大量資金的鯨魚對遊戲驛站採取了明顯的看淡立場。

Looking at options history for GameStop (NYSE:GME) we detected 54 trades.

查看GameStop (紐交所:GME) 的期權交易記錄,我們發現了54筆交易。

If we consider the specifics of each trade, it is accurate to state that 29% of the investors opened trades with bullish expectations and 51% with bearish.

如果我們考慮每筆交易的具體情況,準確地說,29%的投資者持有看好的期權,51%持有看淡的期權。

From the overall spotted trades, 34 are puts, for a total amount of $1,322,200 and 20, calls, for a total amount of $1,069,919.

在所有發現的交易中,有34筆看跌期權,總金額爲$1,322,200,以及20筆看漲期權,總金額爲$1,069,919。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $125.0 for GameStop during the past quarter.

分析這些合同中的成交量和未平倉合約,似乎大戶們一直將GameStop 在過去一個季度內的價格區間定在$25.0 到 $125.0之間。

Insights into Volume & Open Interest

成交量和持倉量分析

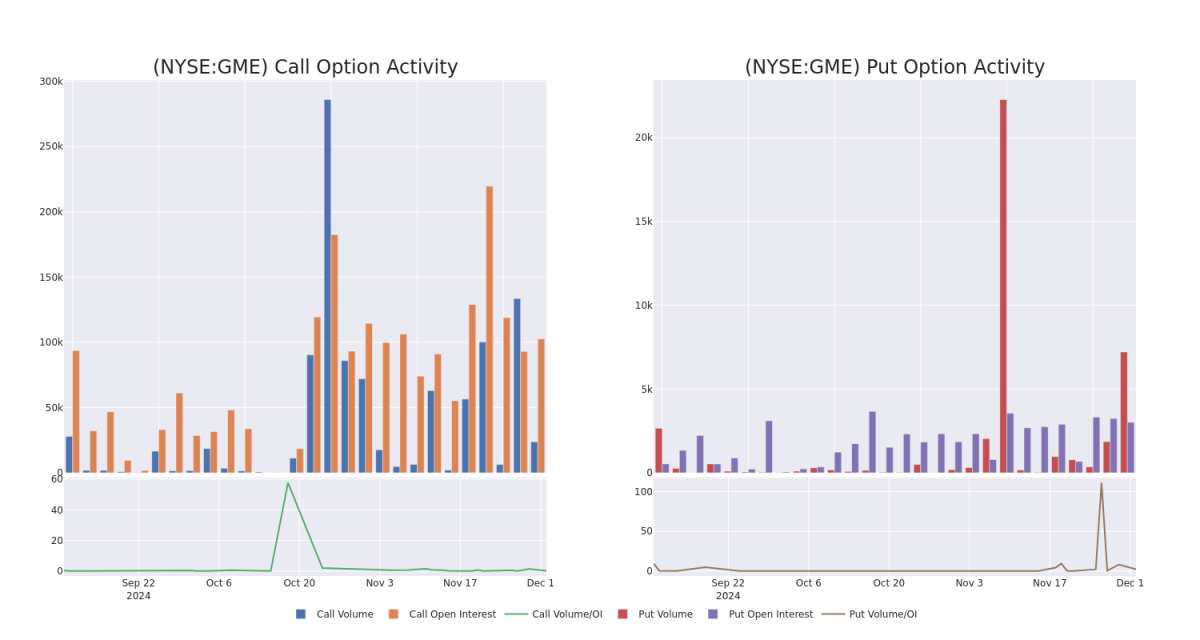

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for GameStop's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across GameStop's significant trades, within a strike price range of $25.0 to $125.0, over the past month.

檢查成交量和未平倉合約爲股票研究提供了關鍵見解。這些信息在評估GameStop特定行權價的期權的流動性和興趣水平方面至關重要。以下是在過去一個月內針對GameStop主要交易的看漲和看跌期權的成交量和未平倉合約趨勢快照,行權價區間爲$25.0到$125.0。

GameStop Call and Put Volume: 30-Day Overview

GameStop看漲和看跌期權成交量:30天綜合概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | TRADE | BEARISH | 01/17/25 | $4.8 | $4.65 | $4.65 | $25.00 | $182.2K | 27.8K | 3.0K |

| GME | CALL | SWEEP | BULLISH | 01/15/27 | $11.8 | $7.1 | $11.8 | $55.00 | $88.6K | 94 | 69 |

| GME | CALL | SWEEP | BEARISH | 04/17/25 | $4.05 | $3.8 | $3.8 | $50.00 | $76.0K | 2.8K | 615 |

| GME | CALL | TRADE | BEARISH | 04/17/25 | $6.75 | $6.4 | $6.52 | $30.00 | $65.2K | 3.6K | 461 |

| GME | CALL | SWEEP | BULLISH | 12/06/24 | $1.0 | $0.97 | $1.0 | $30.00 | $63.0K | 14.7K | 6.3K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 遊戲驛站 | 看漲 | 交易 | 看淡 | 01/17/25 | $4.8 | $4.65 | $4.65 | $25.00 | $182.2K | 27.8千 | 3.0K |

| 遊戲驛站 | 看漲 | SWEEP | BULLISH | 01/15/27 | $11.8 | $7.1 | $11.8 | $55.00 | $88.6K | 94 | 69 |

| 遊戲驛站 | 看漲 | SWEEP | 看淡 | 04/17/25 | $4.05 | $3.8 | $3.8 | $50.00 | $76.0K | 2.8K | 615 |

| 遊戲驛站 | 看漲 | 交易 | 看淡 | 04/17/25 | $6.75 | 6.4美元 | $6.52 | $30.00 | $65.2K | 3.6千 | 461 |

| 遊戲驛站 | 看漲 | SWEEP | BULLISH | 12/06/24 | $1.0 | $0.97 | $1.0 | $30.00 | $63.0K | 14.7K | 6.3K |

About GameStop

關於遊戲驛站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp是美國的一家多渠道視頻遊戲、消費電子和服務零售商。該公司在歐洲、加拿大、澳洲和美國等地區運營。GameStop主要通過GameStop、Eb Games和Micromania商店以及國際電子商務網站銷售新和二手視頻遊戲硬件、實體和數字視頻遊戲軟件和視頻遊戲配件。銷售收入的大部分來自美國。

In light of the recent options history for GameStop, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於遊戲驛站最近的期權歷史,現在應該專注於公司本身。我們的目標是探索其當前的表現。

GameStop's Current Market Status

GameStop的當前市場狀態

- Currently trading with a volume of 11,210,969, the GME's price is down by -5.03%, now at $27.59.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 8 days.

- 目前交易量爲11,210,969股,GME的價格下跌了-5.03%,目前價格爲27.59美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預計將在8天內發佈收益報告。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多種指標和密切關注市場動態來管理這些風險。通過Benzinga Pro獲取GameStop期權交易的實時提醒,保持最新動態。

From the overall spotted trades, 34 are puts, for a total amount of $1,322,200 and 20, calls, for a total amount of $1,069,919.

From the overall spotted trades, 34 are puts, for a total amount of $1,322,200 and 20, calls, for a total amount of $1,069,919.