Hanwang Technology Co.,Ltd (SZSE:002362) shares have continued their recent momentum with a 26% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 4.1% isn't as impressive.

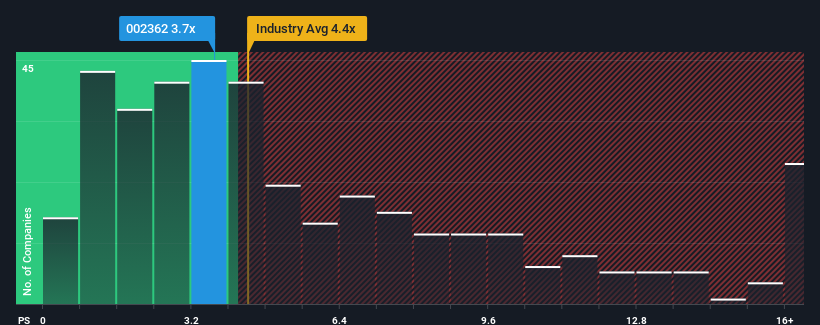

Although its price has surged higher, it's still not a stretch to say that Hanwang TechnologyLtd's price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" compared to the Electronic industry in China, where the median P/S ratio is around 4.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Hanwang TechnologyLtd's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Hanwang TechnologyLtd has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Hanwang TechnologyLtd will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Hanwang TechnologyLtd?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hanwang TechnologyLtd's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hanwang TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 3.3% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 32% over the next year. With the industry only predicted to deliver 27%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Hanwang TechnologyLtd's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Hanwang TechnologyLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Hanwang TechnologyLtd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Hanwang TechnologyLtd with six simple checks.

If these risks are making you reconsider your opinion on Hanwang TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.