Despite an already strong run, Gansu Guofang Industry & Trade (Group) Co., Ltd. (SHSE:601086) shares have been powering on, with a gain of 35% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 4.8% isn't as attractive.

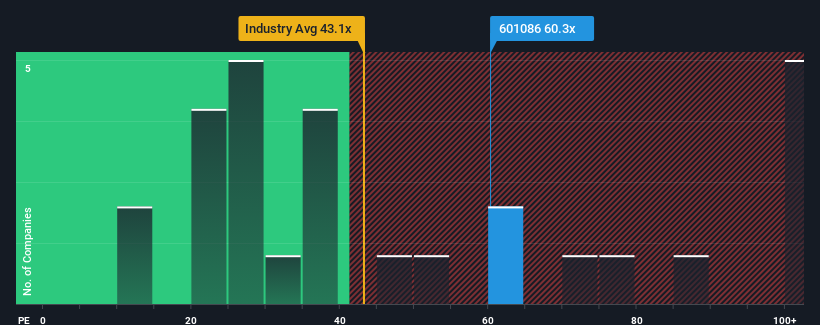

After such a large jump in price, Gansu Guofang Industry & Trade (Group) may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 60.3x, since almost half of all companies in China have P/E ratios under 36x and even P/E's lower than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For instance, Gansu Guofang Industry & Trade (Group)'s receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Gansu Guofang Industry & Trade (Group)'s is when the company's growth is on track to outshine the market decidedly.

The only time you'd be truly comfortable seeing a P/E as steep as Gansu Guofang Industry & Trade (Group)'s is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 69% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 52% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 39% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Gansu Guofang Industry & Trade (Group) is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Gansu Guofang Industry & Trade (Group)'s P/E?

Shares in Gansu Guofang Industry & Trade (Group) have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Gansu Guofang Industry & Trade (Group) revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Gansu Guofang Industry & Trade (Group) has 3 warning signs (and 1 which can't be ignored) we think you should know about.

You might be able to find a better investment than Gansu Guofang Industry & Trade (Group). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.