According to J.P. Morgan traders, the S&P 500 index still has room to rise further before the end of the year, even after breaking out of the strongest market wave since the beginning of the internet bubble.

The bank's derivatives analyst said that the most sought after options trading is betting that the US stock benchmark hit 6,200 to 6,300 points this month. Based on the closing level of around 6032 points last Friday, this means it is expected to rise another 3%-4% before the end of the year.

“The positive macro environment, growth in performance, and the fact that the Federal Reserve still supports the market are factors that keep us focused on maintaining tactics until the end of the year,” Andrew Tyler of Global Market Research wrote in a report to clients on Monday. “We think it is wise to use market momentum, and the possibility of a pullback before mid-January is low.”

Tyler's team suggests favoring value stocks and cyclical sectors such as banks, car manufacturers, transportation companies (excluding airlines), and the small-cap Russell 2000 Index. In terms of technology and telecommunications, they said they will continue to invest in the so-called seven major technology stocks, data centers, and semiconductors.

Tyler's team suggests favoring value stocks and cyclical sectors such as banks, car manufacturers, transportation companies (excluding airlines), and the small-cap Russell 2000 Index. In terms of technology and telecommunications, they said they will continue to invest in the so-called seven major technology stocks, data centers, and semiconductors.

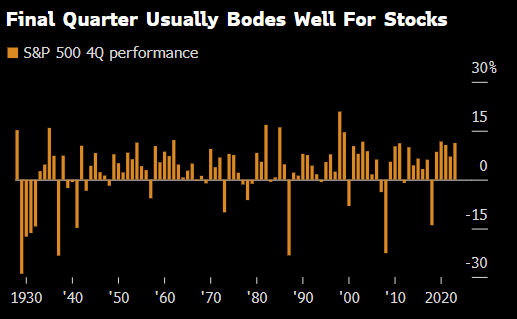

Wall Street strategists are generally optimistic about the rest of the year, and the stock market usually performs strongly during this period.

Goldman Sachs's trading department also expected the S&P 500 index to rise to 6270 points before the end of the year.

Scott Rubner, the bank's managing director of global markets and tactical expert, predicts that the US stock benchmark index may end well above 6,000 points this year. He calculated data dating back to 1928 and found that the median historical return for the S&P 500 index for the period from October 15 to December 31 was 5.17%. The median annual yield for the general election is even slightly above 7%, which means that the year-end level can reach 6270 points.

Tyler的团队建议更偏向价值股和周期性板块,例如银行、汽车制造商、运输企业(不含括航空公司)以及小盘股 罗素2000指数。在科技和电信方面,他们表示继续投资所谓的七大科技股、数据中心和半导体。

Tyler的团队建议更偏向价值股和周期性板块,例如银行、汽车制造商、运输企业(不含括航空公司)以及小盘股 罗素2000指数。在科技和电信方面,他们表示继续投资所谓的七大科技股、数据中心和半导体。