GLP-1减重药物的竞争已进入白热化。国内Biotech来凯医药(02105),有望率先分享减脂增肌这一庞大全球市场的蛋糕。

GLP-1减重药物的竞争已进入白热化。

如今,过去巨头们以卷减重幅度来做出Me better以强化竞争优势,但这一方向能带来的边际效应正在递减,11月Viking Therapeutics公布的VK-2735减重幅度数据展现出“同类最佳”的潜质,股价却创下了今年三月份以来的最大单日下跌。

当“更大幅度的减重”策略式微,GLP-1巨头们如何打出差异化?“更健康的减重”成为了巨头们当下更核心的迭代策略选择,减脂增肌无疑是这个策略中的“种子选手”。肌肉流失是目前GLP-1药物最常见的副作用之一,临床研究表明:接受GLP-1药物治疗的患者,其肌肉流失速度远快于通过饮食或运动减肥的人群,这导致潜在的骨折风险、心血管风险增加等各种健康问题。

当“更大幅度的减重”策略式微,GLP-1巨头们如何打出差异化?“更健康的减重”成为了巨头们当下更核心的迭代策略选择,减脂增肌无疑是这个策略中的“种子选手”。肌肉流失是目前GLP-1药物最常见的副作用之一,临床研究表明:接受GLP-1药物治疗的患者,其肌肉流失速度远快于通过饮食或运动减肥的人群,这导致潜在的骨折风险、心血管风险增加等各种健康问题。

随着巨头们调转枪头和减脂增肌路线被临床初步验证,推动了近两年来减脂增肌靶点管线的水涨船高,包括Scholar Rock在公布其MSTN抗体Apitegromab脊髓性肌萎缩症三期数据后股价暴涨361.99%、礼来以19.25亿美元收购核心管线为Bimagrumab(ActRIIA/ActRIIB抗体)的Versanis公司等。不过,这个赛道的“主升浪”远远未到来。2025年上半年之前,全球减脂增肌管线将井喷数个催化,礼来的Bimagrumab(以下简称:Bima)联用司美格鲁肽的二期临床完成,再生元的Trevogrumab(MSTN)和Garetosmab(Activin A抗体)两款药物读出二期数据,而Scholar Rock公司Apitegromab联用GLP-1治疗肥胖患者二期临床也将公布数据,一旦出现超预期数据,板块分子资产价值将出现极大攀升。

国内Biotech来凯医药(02105),有望率先分享减脂增肌这一庞大全球市场的蛋糕。

11月20日,来凯医药与礼来签订一项临床合作协议,在来凯医药保留LAE102的全球权利背景下,LAE102在美国的一期研究将由礼来负责并承担相关费用。精明的MNC可不会有什么无缘无故的爱,礼来和来凯医药这一临床合作有望为首个国产减脂增肌药物出海夯实稳固的基础。

01为什么LAE102能获得礼来青睐?

礼来作为已经收购Bima入局减脂增肌赛道并取得全球领先位置的MNC,不可能坐视来凯医药这款潜在同类最佳的LAE102落入其他减肥药物巨头的手中。

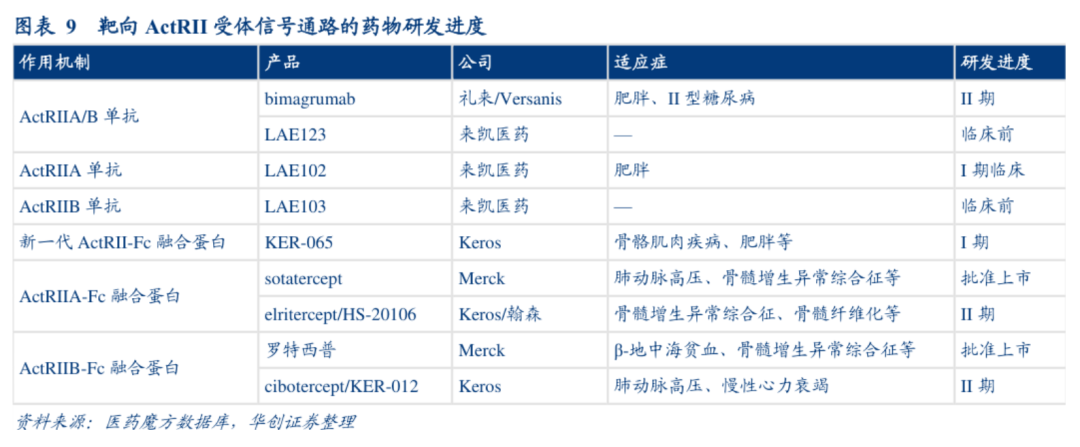

目前,全球进入临床阶段靶向ActRII受体的药物仅有礼来的Bima和来凯医药的LAE102,其余在研临床管线均靶向ActRII配体。研究表明,阻断ActRII通路能抑制肌肉的萎缩,而ActRII的多个配体包括都被证明是骨骼肌负调控因子,阻断受体的策略比只阻断单类配体的策略在机理逻辑更加通顺,疗效大概率更加有效。

针对阻断ActRII受体的策略,来凯医药采取“多线出击”的策略,除了备受瞩目进入临床阶段LAE102(ActRIIB抗体)之外,针对ActRIIA/IIB双靶点抗体LAE123在近日达到PCC要求,并正式进入IND支持性研究阶段,加上此前已启动的LAE103(ActRIIB选择性抗体)的IND支持性研究,这样公司在确保了领先优势和留出试错空间的同时,能够对ActRII通路潜在适应症实现全面覆盖。

不仅因为机理上的逻辑通顺,靶向ActRII受体药物的成药性层面同样不存在太大问题。据礼来早前公布Bima的48周二期临床针对75名2型糖尿病的超重或肥胖患者数据显示:相比安慰剂,尽管Bima治疗组的体重只下降了6.5%,但可促成患者约20.5%脂肪含量的丢失(媲美礼来Mounjaro的疗效),并且增加3.6%的瘦体重。更重要的是,相比一般的GLP-1药物,Bima治疗组患者停止治疗12周内并未观察到体重的增加。

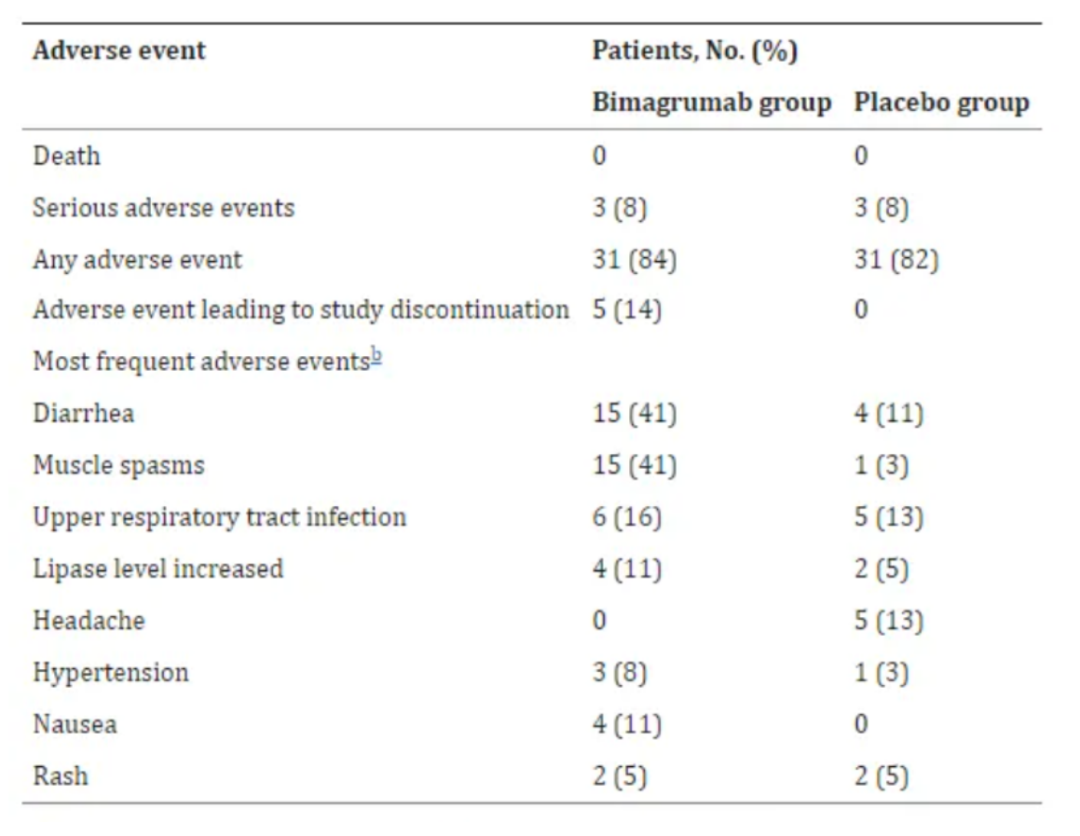

尽管拥有强大的减重和增肌效果,Bima并非没有缺点,这也给后来者指引出更多优化或迭代的机会。诺华2021年在JAMA发表的Bima临床数据显示:其核心不良事件是轻度腹泻(41% vs 11%)和肌肉痉挛(41% vs 3%),尤其是首次给药后腹泻频率最高,后逐渐减少;另外,上述提到的2型糖尿病合并肥胖患者的二期临床试验中有5名患者因为不良反应事件导致研究中止,这也为后续Bima大样本临床增加了更多的不确定性。

为什么来凯医药LAE102是潜在同类最佳的分子?

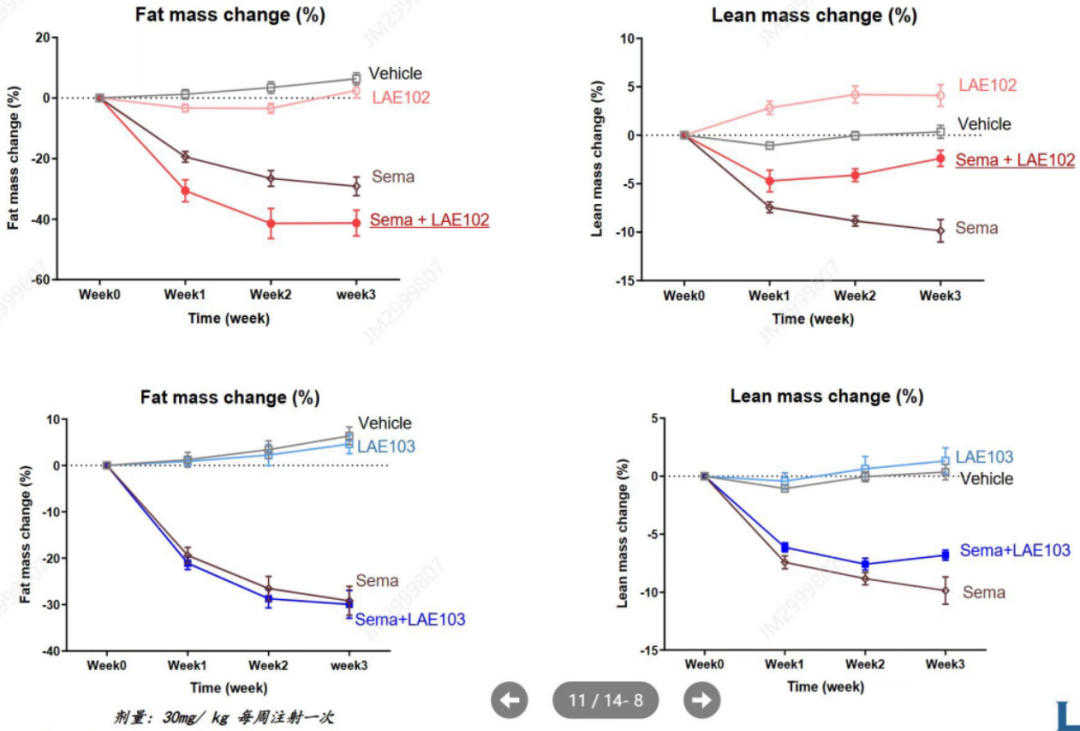

1)临床前和早期临床指标支持:LAE102在临床前就已经展现出增加肌肉并减少脂肪的潜力,同时其与GLP-1受体激动剂可以进一步减少脂肪并显著降低GLP-1受体激动剂带来的肌肉损失。来凯医药此前公告披露,LAE102在临床低剂量下就可以观察到靶点结合的早期迹象和预期的PD生物标志物变化,这极大增加了LAE102读出优良早期临床数据的可能性。

2)ActRIIA与ActRIIB路线之争不明确(强A或强B):众所周知Bima虽是同时靶向ActRIIA和ActRIIB的抗体,但其与ActRIIB受体的结合活性远高于ActRIIA。尽管已有研究文献中,myostatin在年轻肌肉中高表达并被认为在肌肉生长调控中的关键作用,而myostatin对ActRIIB的亲和力高于ActRIIA,不过阻断受体A还是阻断受体B谁在减脂增肌中更有效,尚无定论。

来凯医药公布的临床前DIO模型(饮食诱导肥胖模型)数据显示,LAE102对瘦体重(Lean mass)增加呈现出了明显的效果,而公司另一款ActRIIB选择性抗体LAE103亦展出瘦体重增加的疗效,且LAE102疗效更强;在联用司美格鲁肽的DIO模型中,LAE102展现出了强劲的效果。这些数据结果都在扎实的支撑LAE102一跃成为赛道潜在同类最佳分子。

3)皮下注射的便捷性:目前畅销的GLP-1均为预充针皮下注射,皮下注射制剂的减重伴侣更便于减重患者联合GLP-1使用。LAE02在一期临床开启了皮下注册队列,在全球临床进度方面也是FIC的。

另外,LAE102的潜力也可通过其他层面进行印证和初探,一方面来凯医药创始人吕向阳博士是Bima共同发明人,在ActRII研究领域超过20年经验,有更大概率做出Bima的Better。另一方面,从来凯医药全力推进LAE102进度、临床执行迅速等动作可看出,公司团队对于LAE102有着充分的信心和把握。

02礼来,大Deal的创造者

对于来凯医药而言,礼来是全球“唯二、最佳适配”的合作伙伴。

纵观礼来2023-2024年收购布局,以买“早”、买“新”、高溢价收购为主要特点。尤其在代谢领域,2023年7月礼来以19亿美元收购VersanisBio,当时核心管线Bima处于2a期临床完成/2b期入组的阶段;2023年6月礼来以3.096亿美元的总对价收购糖尿病细胞疗法公司Sigilon,溢价超过400%,并且收购时Sigilon的核心管线刚刚进入临床;而礼来最新与KeyBioscience达成总包14亿美元的扩大合作,其治疗肥胖和骨关节炎的核心管线双淀粉降钙素受体激动剂(DACRA)也刚刚完成临床一期。如今来凯医药的LAE102所处的临床早期阶段,正好在礼来收购战略的射程之内。

礼来与来凯医药关于LAE102的海外临床合作,很难不让投资者合理遐想:临床合作只是“引子”,为了打下基础,后续双方有着进一步的潜在合作甚至达成M&A。

这样的猜测并非没有依据,而是在全球MNC、Biopharma与Biotech合作中屡见不鲜。以礼来为例,其在早在2018年与Sigilon达成1型糖尿病治疗的封装细胞疗法SIG-002管线开发合作(6300万美元首付款+4.1亿美元里程碑付款),5年之后用约3亿美元将其收入囊中;再以Biontech与国内Biotech普米斯合作为例,2023年11月首次达成关于PD-L1/VEGF双抗PM8002的全球权益合作,一年之后普米斯被Biontech全资收购。

不排除来凯医药和礼来的合作重走上述发展路径,或许一切需要等待LAE102的临床数据兑现。

其次,不少投资者对礼来既收购Versanis又与来凯医药LAE102感到疑惑。实则两项交易对于礼来而言并不冲突,MNC们不会“将鸡蛋放在一个篮子里”,目前非常明显的趋势是礼来和诺和诺德都在围绕GLP-1进行迭代和组合布局,旨在加强自身竞争优势,而“减脂增肌”这个迭代方向及ActRII通路成药可行性得到验证,所以礼来的双布局一是“占位”思维,二是不放过这个通路主要研发路径,成药的分子或者FIC分子“一定要在我的体系内”。

同理,这种策略也在默沙东全力押注“IO+ADC”的布局中出现,其同时与第一三共、科伦博泰的ADC管线展开合作,力求网罗市面不同的靶点ADC。

从另一个角度看,对于来凯医药而言,礼来是LAE102全球最好的合作伙伴之一,主要基于三个层面:1)礼来作为拥有多款GLP-1药物上市和在研的MNC,不仅在海外减重代谢类药物临床设计、临床资源层面拥有丰富的经验和储备。更重要的是,未来LAE102可以通过联用礼来已上市GLP-1加速海外临床开发,实现加速上市;2)礼来在减重领域的商业化能力无可置疑,LAE102作为“减重伴侣”的角色,与礼来体系内GLP-1管线并非竞争而是协同关系,有望借GLP-1东风快速放量;3)礼来作为实力雄厚的MNC,后续大额引进LAE102又或是全资收购来凯,都具备可能性。

作为投资者和观察者,我们或许只需要等待LAE102即将出炉的国内临床数据,和来凯医药与礼来更进一步的后续合作。

03主动权握在来凯手里

值得注意的是,尽管与巨头礼来展开合作,但来凯医药是把“话事权”牢牢把握在自己手里。

保留全球权益的海外临床合作紧接着2.3亿港元配售再融资,这一记组合拳,凸显来凯医药的“做大做强”这单BD的决心。

据国盛医药统计的2018年后国内创新药出海数据显示,临床前项目占比34-43%,一期临床项目占比19-26%,上市后项目占比22%-23%,2/3期临床和申请上市阶段占比均小于10%。一般临床推进到越后期阶段,交易首付款金额更大,交易总额也更大。

目前,来凯医药LAE102在国内处于临床一期(数据尚未读出),在美国亦处于刚进入临床的阶段。

而选择临床合作的方式等同于“借船加速发展”,一方面来凯医药借助礼来的资源实现LAE102在海外的临床加速,并让MNC自己做临床验证管线核心质地,另一方面来凯医药能够通过临床合作这种方式以“时间换空间”,最大限度的平衡授权价值风险的配比,力求将管线卖出一个最优的价格。

不少投资者对此次配售的时机有所质疑,实质上这是最佳再融资的时间窗口之一。尽管来凯医药在再融资之前至少有2年现金流管道,但继续增加现金储备一来能够给予公司更大的临床战略选择余地(License Out或者继续选择推进国内临床),更重要的是现金储备不足将不再成为潜在海外大买家压价公司要价的核心理由,这也为来凯医药日后成交大额交易增添了更多的谈判筹码。

同时,投资者可以发散的LAE102潜在交易对象不应局限于礼来,诺和诺德、罗氏、阿斯利康等MNC体内均有GLP-1产品管线,这些巨头对减重伴侣、减脂增肌创新分子的兴趣同样不弱。

曾有外媒消息爆料,去年最先和Versanis(Bima)谈判深入的买家并不是礼来,而是另有其人,随后被礼来高价截胡。

所以,未来LAE102将以什么样的价格BD、选择授权给哪家MNC的主动权,还牢牢把握在来凯医药的手里,这为公司未来的长远发展,增添了更多不同的可能性。

从潜在交易类型可能性分析,除了BD管线之外,来凯医药像被Versanis一样整体收购并非无可能,MNC酷爱收购平台型Biotech,来凯医药围绕ActRII受体阻断策略,布局了包括LAE102、LAE103和LAE123一系列的“管线纵队”,随着未来LAE102早期数据兑现和LAE123的临床前数据公布,来凯医药在Activin信号通路的平台属性或将被强验证,这无疑彰显公司的“平台性”和巨大的收购价值。

结语:随着GLP-1药物愈加广泛的使用,可以预见患者减脂增肌的需求长线增长趋势几乎是确定的。来凯医药与礼来的临床合作,相信只是中国Biotech分享全球减肥市场蛋糕的一个典型合作的缩影,不过其蕴含的远期可能性,亦可能变成一个未来巨额的BD交易案例,又或是首个港股18A Biotech被收购的里程碑事件。

本文转载自“瞪羚社”公众号,智通财经编辑:蒋远华。