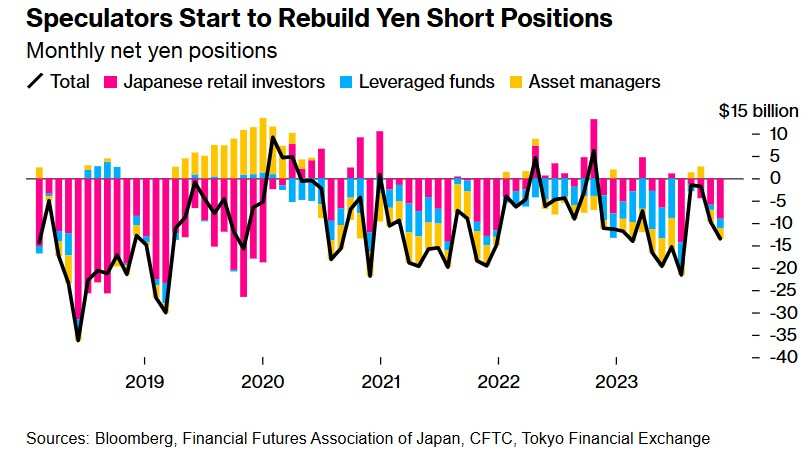

Arbitrage trading in yen, which disrupted the market, showed signs of recovery. Large yield gaps and low volatility are driving arbitrage trading; in November, the bearish bet on yen increased to $13.5 billion.

The Zhitong Finance App learned that the “Japanese yen arbitrage trading” that disrupted global financial markets in early August — an arbitrage investment strategy that exploded in an amazing way this year and hit the global stock market hard due to the cancellation of transactions, is once again being warmly welcomed by speculative forces and some leveraged hedge funds. The Japanese yen arbitrage trade, which destroyed the entire financial market on its own, showed signs of recovery, mainly due to the still huge yield gap between the Japanese and US treasury bond markets and the still low volatility driving this low-cost currency arbitrage transaction.

However, the recovery of “Japanese yen arbitrage” comes at a time when the Bank of Japan may announce an interest rate hike in December and may unleash an unexpected hawkish monetary policy path. Undoubtedly, the market is worried that the nightmarish financial incident of the “arbitrage settlement storm” came back to light after hitting the global stock market hard in early August.

According to the agency's forecast and analysis report on statistics from the Japan Financial Futures Association, the Tokyo Financial Exchange, and the US Commodity Futures Trading Commission, Japanese retail investors, leveraged hedge funds from abroad, and some foreign asset management companies may increase their bearish bet on yen from 9.74 billion US dollars in October to 13.5 billion US dollars in November.

According to the agency's forecast and analysis report on statistics from the Japan Financial Futures Association, the Tokyo Financial Exchange, and the US Commodity Futures Trading Commission, Japanese retail investors, leveraged hedge funds from abroad, and some foreign asset management companies may increase their bearish bet on yen from 9.74 billion US dollars in October to 13.5 billion US dollars in November.

Analysts expect these bearish bets to continue to increase next year, mainly due to the huge gap in benchmark interest rates and treasury yields between Japan and the US, increased US government borrowing, and relatively low volatility in the foreign exchange market. These conditions make it more attractive to borrow at a very low cost in Japan and then deploy capital to markets with higher global yields, such as the US stock market.

Speculators are starting to re-establish short positions in yen — net positions in yen per month

Alvin Tan, head of Asian foreign exchange strategy at Royal Bank of Canada in Singapore, said, “Compared to most currencies, the absolute interest rate spread of the yen is very large, which means that the yen will always be viewed by the market as a financing currency. If a sovereign currency is not used as a financing currency for arbitrage transactions, the main reason is its low volatility and interest spreads.”

Undercurrents in the financial market are surging, and a familiar sense of crisis hits!

Strategists at Mizuho Securities and Saxo Bank said that the scale of Japanese yen arbitrage trading may rise back to the level of late July to early August this year — but after that, the Bank of Japan suddenly announced interest rate hikes at the end of July and sent hawkish signals, compounding the weak non-agricultural data at the time to heat up expectations of the US recession. The yen rose sharply, and investors suddenly withdrew from the arbitrage trade, further damaging the global stock market.

Looking at the current financial market context, one phenomenon to be aware of is that Donald Trump's return to the White House may plunge the foreign exchange market into volatile currency transactions with sharp fluctuations.

The widespread adoption of this investment strategy is likely to affect global stock markets. The wave of global stock market sell-offs this summer was due to the “liquidation storm brought about by the cancellation of Japanese yen arbitrage transactions”. Under the heavy impact of this storm, the global stock market evaporated about 6.4 trillion dollars in just three weeks. The Nikkei 225 Index, the benchmark for Japanese blue chips, experienced the biggest decline since 1987.

It is worth noting that the Japanese yen exchange rate suddenly soared last week, and fluctuations in the foreign exchange market intensified after Trump won the election. Coupled with the fact that the Bank of Japan's latest monetary policy decision will be announced in two weeks — expectations of the Bank of Japan's December interest rate hike have recently heated up sharply. This macro environment and surging undercurrent trading atmosphere can be described as “familiar” on the eve of the global stock market sell-off in early August, comprehensively highlighting the continuing risks faced by investors who have restarted this arbitrage trade.

Bank of Japan Governor Kazuo Ueda recently stated that the timing of potential interest rate hikes is being considered, and emphasized that the Bank of Japan will focus on wage levels and other areas that affect prices when deciding whether to raise interest rates. According to economic data released recently, the inflation rate in Tokyo, the capital of Japan, accelerated last month, exceeding expectations. This data, combined with Japan's resilient GDP and Ueda and the hawks' comments, can be said to have boosted the Bank of Japan's interest rate hike expectations in December.

“Arbitrage trading” forced large-scale liquidation of positions was the culprit of “Black Monday” in global stock markets in early August. The rapid rise in the yen exchange rate prompted the rapid liquidation of arbitrage transactions, as well as investors' concerns that further interest rate hikes by the Bank of Japan might hurt Japan's weak economic recovery and that the appreciation of the yen would hit large exporters such as Toyota hard, leading to a “flash crash” in the Japanese stock market — the Japanese stock market plummeted several times at the time, causing the global stock market to collapse.

When the yen appreciates rapidly, the risk of arbitrage trading based on yen increases significantly. Since speculators are borrowing yen, if the yen appreciates, leveraged foreign exchange traders must buy back the yen at a higher price to repay the loan. This can result in a drastic reduction in their actual returns, and may even result in significant losses. When the Japanese yen exchange rate appreciates rapidly, traders usually choose to close positions quickly in order to make up for potential losses. This means selling a large number of risky assets such as global stocks with high liquidity in their hands to buy back yen, and since the yen is a safe haven currency in the traditional sense, some traders may sell stocks on a larger scale to buy yen to avoid risks in the face of turbulent global markets.

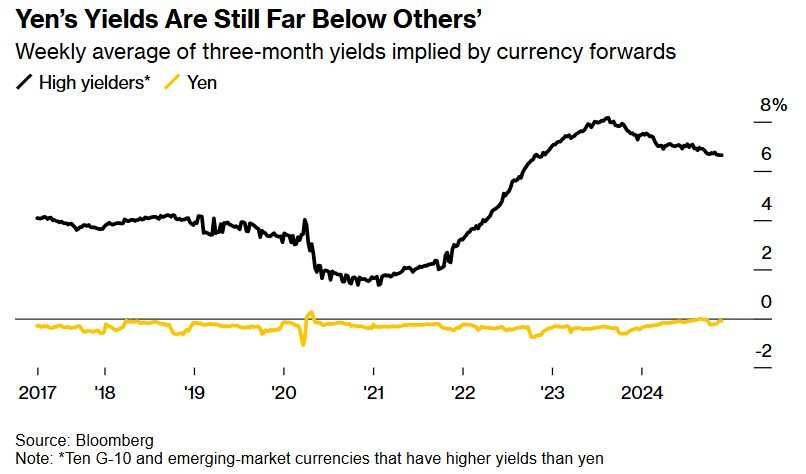

Interest rates and treasury bond yields are key factors driving arbitrage trading in yen. The average treasury yield of the top ten high-yield currencies and emerging market currencies is over 6%. In contrast, since the Bank of Japan's benchmark interest rate is currently only 0.25%, the yield on Japanese yen treasury bonds is almost zero, which is a core factor in why arbitrage trading chose yen.

Okay, the scar forgot the pain? Speculators are setting off another wave of “yen arbitrage trading”

Although the Bank of Japan is gradually raising interest rates to raise the benchmark interest rate, the yield gap between major economies such as Japan and the US is still large. The Federal Reserve cut the benchmark interest rate by 25 basis points in November to the 4.5% to 4.75% range, which is still far higher than Japan's benchmark interest rate. According to Australia & New Zealand Banking's Sydney-based foreign exchange analyst Felix Ryan, even if Japan raised the benchmark interest rate to around 1%, the logic of arbitrage trading based on yen still holds true.

This trading strategy has brought huge profits to leveraged hedge funds in recent years. Statistics show that since the end of 2021, yen financing arbitrage transactions targeting 10 major and emerging market currencies have achieved cumulative returns of up to 45%, compared to the return of the S&P 500 index, which takes into account reinvestment dividends, of about 32%. This has attracted more and more hedge funds and speculators, which is why short yen positions reached an astonishing 21.6 billion US dollars at the end of July, just before the wave of crazy liquidation in the foreign exchange market.

Charu Chana, chief investment strategist from Saxo Bank, said: “The Bank of Japan's rate hike is unlikely to be enough to close the yield gap between Japan and the US. Since US debt and fiscal conditions are clearly one of the key areas of concern for the incoming Trump administration, there may still be room for yen arbitrage transactions to maintain financial attractiveness even if they face occasional liquidation.”

The yield of yen is still far below that of other mainstream currencies - the weekly average of the three-month yield implied by the currency's forward

In recent months, US dollar and US Treasury yields have soared rapidly as the market speculates that Trump's tariffs and tax cuts will boost the US economy while boosting US inflation and may slow the pace of the Federal Reserve's interest rate cuts. However, after Trump nominated Scott Bessent, who had always been outspoken in demanding control of the deficit, as Secretary of the Treasury, this market concern eased somewhat.

Yoshiki Omori, chief Japanese strategist at Mizuho Securities in Tokyo, still said that Trump will ultimately decide the US fiscal policy. “Ultimately, it's all about Trump,” Omori said, stressing that arbitrage trading may reach a new climax as soon as January next year. “People are forgetting the risks of Trump's influence on Bezent. If Bezent wanted to stay in this position, I don't think he would be so stubborn about the budget.”

Trump's rise to power could trigger a new round of global trade wars, and could also put significant pressure on global assets, especially after the president-elect vowed to impose tariffs on China, Canada, and Mexico last week. Although the Mexican peso has long been the currency of choice for Japanese yen financing arbitrage transactions, as interest rates in the country are high in double digits, Trump's remarks may cause enough volatility to make this deal unattractive.

This is important because Japanese yen financing arbitrage trading benefits from reduced volatility in the foreign exchange market. Despite rising uncertainty in the new administration under Trump, the forex volatility index compiled by JPMorgan Chase & Co. (JPMorgan Chase & Co.) has retreated from post-pandemic highs.

Despite this, there are still some analysts who are not optimistic about the future of Japanese yen arbitrage trading. The narrowing interest rate gap may weaken the momentum of arbitrage trading next year, especially after Bank of Japan Governor Ueda Kazuo opened the door to interest rate hikes in December. Japanese officials are also cautious about the yen exchange rate. Japan's finance minister warned last month that the yen has fluctuated greatly in one direction since the end of September.

The yen is one of the worst performing sovereign currencies in the Group of Ten (Group-of-10) this year because structural issues such as massive capital outflows and yield gaps continue to put pressure on the yen exchange rate. Although the yen appreciated to 140 yen to $1 when the arbitrage trade closed a few months ago, it has now fallen back to around 150 yen per dollar.

Jane Welfare, head of foreign exchange strategy at Rabobank, said, “Japan's Ministry of Finance has re-engaged with speculators through verbal intervention, and Bank of Japan Governor Kazuo Ueda's recent tough remarks are continuing to heat up expectations that the Bank of Japan will raise interest rates in December.” “Although arbitrage trading received further support, this should ensure that arbitrage trading lacked the obvious confidence and momentum of this spring.”

Ahead of the monetary policy meeting between the Bank of Japan and the Federal Reserve in December, investors may have a clearer outlook on the future of Japanese yen arbitrage trading. If Kazuo Ueda's remarks were more moderate, or if Federal Reserve Chairman Jerome Powell's remarks were more hawkish, and key data points — such as US non-farm payrolls data and any level of suggestion given by the unemployment rate, it could prompt the yen arbitrage trading force to re-enter the market on a large scale.

“If the Bank of Japan reveals that interest rate hikes will slow down, and if Powell does not plan to cut interest rates quickly, then interest spreads will be significantly attractive to arbitrage trading.” Omori indicated. “Japan's Ministry of Finance isn't that aggressive. If they keep silent, investors may see no reason not to engage in these types of transactions and profit from a low-cost model.”

根据机构对日本金融期货协会、东京金融交易所以及美国商品期货交易委员会统计数据的预测与分析报告,日本散户投资者以及来自国外的杠杆型对冲基金以及一些国外资产管理公司,可能在11月将日元看跌押注从10月的97.4亿美元大幅增加至135亿美元。

根据机构对日本金融期货协会、东京金融交易所以及美国商品期货交易委员会统计数据的预测与分析报告,日本散户投资者以及来自国外的杠杆型对冲基金以及一些国外资产管理公司,可能在11月将日元看跌押注从10月的97.4亿美元大幅增加至135亿美元。