The Commonwealth Bank of Australia said the New Zealand dollar could fall to 57 cents in the March quarter; economists expect the New Zealand Federal Reserve to announce a 50 basis point cut in interest rates in February.

The Zhitong Finance App learned that since more and more economists and investment institutions expect the New Zealand Federal Reserve to cut interest rates more rapidly than the Federal Reserve, hedge funds have switched to a net bearish New Zealand dollar for the first time in a year. The Commonwealth Bank of Australia said that the exchange rate between the New Zealand dollar and the US dollar may fall to 57 cents in the first quarter of next year. Economists and hedge fund traders generally expect the New Zealand Federal Reserve to announce a 50 basis point cut in interest rates at the February monetary policy meeting.

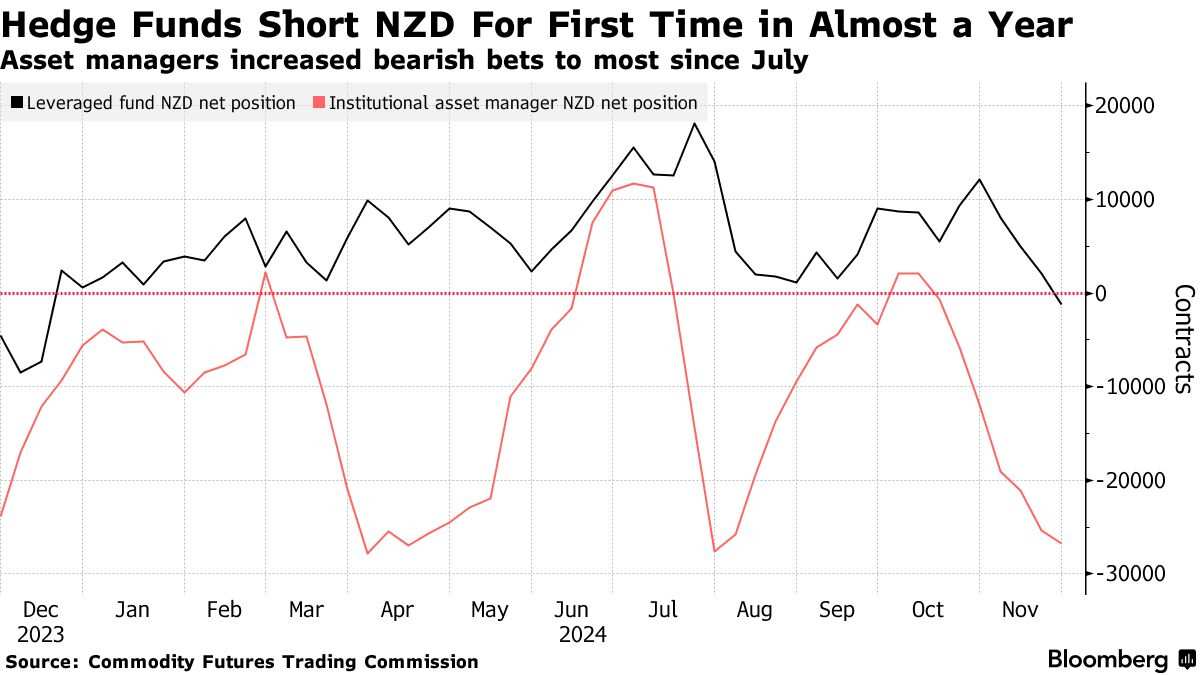

According to statistics from the US Commodity Futures Trading Commission (CFTC), since December 2023, leveraged hedge funds have held long positions in New Zealand dollars every week, but in the week ending November 26, leveraged hedge funds have switched to “net short positions.” Meanwhile, asset managers around the world have sharply increased their short bets on the New Zealand dollar, reaching the highest level since July.

As economists' expectations of the New Zealand Federal Reserve's policy easing heats up sharply, investment institutions' views on the New Zealand dollar have become more negative. According to Bloomberg survey data released on Tuesday, the economists interviewed expect the New Zealand Federal Reserve to announce three consecutive sharp interest rate cuts by 50 basis points at the February meeting next year, which is the next monetary policy meeting.

As economists' expectations of the New Zealand Federal Reserve's policy easing heats up sharply, investment institutions' views on the New Zealand dollar have become more negative. According to Bloomberg survey data released on Tuesday, the economists interviewed expect the New Zealand Federal Reserve to announce three consecutive sharp interest rate cuts by 50 basis points at the February meeting next year, which is the next monetary policy meeting.

New Zealand Federal Reserve Chairman Adrian Orr said in his speech last week that if the economic forecast data is accurate, interest rates may be cut for the third time at the beginning of next year. At the monetary policy meetings in October and November, the New Zealand Federal Reserve announced interest rate cuts of 50 basis points twice in a row, exceeding economists' general expectations.

The New Zealand dollar was the worst-performing Group-of-10 (Group-of-10) sovereign currency of the quarter, second only to the Swedish krona, and depreciated more than 7% against the US dollar. Compared to central banks such as the Federal Reserve, the New Zealand Federal Reserve is cutting interest rates drastically to help revive the troubled New Zealand economy. While the Federal Reserve of New Zealand is dealing with the weak domestic economy, the New Zealand dollar is facing tremendous exchange rate pressure due to strong US economic growth and US President-elect Donald Trump's MAGA fiscal policy, traders have reduced their bets on the pace of the Fed's interest rate cuts, and collectively turned bullish on the dollar and boosted US bond yields.

“The New Zealand dollar is likely to fall to 57 cents in the first quarter ending March, as Trump's potential increase or decrease in the size of tariffs will put tremendous pressure on the currency exchange rate. Even though New Zealand's exports to the US were not directly affected,” Joseph Capso, a foreign exchange strategist from Commonwealth Bank of Australia, wrote in a note to clients on Tuesday. “We expect that the difference in interest rates with the US will also continue to be a negative factor.” Currently, the exchange rate of the New Zealand dollar against the US dollar is hovering around 0.5869.

随着经济学家们对新西兰联储政策宽松的预期大幅升温,投资机构们对于新西兰元的看法变得更加负面。根据周二发布的彭博调查数据,受访经济学家们预计新西兰联储将在明年2月份的会议上,也就是下一次货币政策会议上,连续三次宣布大幅降息50个基点。

随着经济学家们对新西兰联储政策宽松的预期大幅升温,投资机构们对于新西兰元的看法变得更加负面。根据周二发布的彭博调查数据,受访经济学家们预计新西兰联储将在明年2月份的会议上,也就是下一次货币政策会议上,连续三次宣布大幅降息50个基点。