Huayi Brothers Media Corporation (SZSE:300027) shares have continued their recent momentum with a 29% gain in the last month alone. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

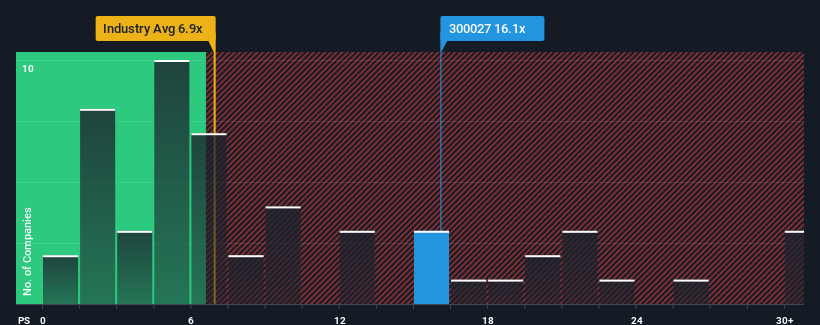

After such a large jump in price, you could be forgiven for thinking Huayi Brothers Media is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 16.1x, considering almost half the companies in China's Entertainment industry have P/S ratios below 7.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Huayi Brothers Media Performed Recently?

With revenue growth that's superior to most other companies of late, Huayi Brothers Media has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Huayi Brothers Media will help you uncover what's on the horizon.How Is Huayi Brothers Media's Revenue Growth Trending?

In order to justify its P/S ratio, Huayi Brothers Media would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Huayi Brothers Media would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. However, this wasn't enough as the latest three year period has seen an unpleasant 52% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 130% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 34% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Huayi Brothers Media's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Huayi Brothers Media's P/S Mean For Investors?

Huayi Brothers Media's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Huayi Brothers Media's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Huayi Brothers Media that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.