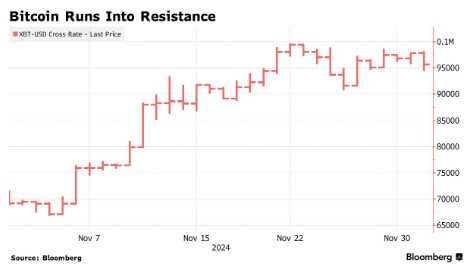

As Bitcoin's momentum towards $0.1 million gradually waned, bulls began to doubt its gains.

The Zhitong Finance App learned that as Bitcoin's move towards 0.1 million dollars gradually waned, bulls began to doubt its rise.

Chris Newhouse, head of research at Cumberland Labs, said: “While we are seeing strong institutional buying pressure, particularly continued accumulation strategies from entities such as MicroStrategy (MSTR.US), the broader cryptocurrency ecosystem is experiencing diversification of capital flows from institutional and non-institutional players.”

As the price of Bitcoin stabilized, interest in other digital assets began to rise, such as the second-largest cryptocurrency, Ether and Ripple. Following the victory of President-designate Trump, these two cryptocurrencies have been lagging behind during Bitcoin's record price rise. The former president has become a cryptocurrency advocate, raising expectations that the US will more amicably regulate this often contentious asset class.

As the price of Bitcoin stabilized, interest in other digital assets began to rise, such as the second-largest cryptocurrency, Ether and Ripple. Following the victory of President-designate Trump, these two cryptocurrencies have been lagging behind during Bitcoin's record price rise. The former president has become a cryptocurrency advocate, raising expectations that the US will more amicably regulate this often contentious asset class.

According to compiled data, Bitcoin and Ether ETFs set monthly net inflows of $6.5 billion and $1.1 billion respectively in November. The daily subscription volume for Ether ETFs also reached an all-time high last Friday.

Fadi Aboulfa, head of research at Copper Technologies Ltd., said in a message on Monday: “After six weeks of positive capital inflows, we have seen a week of sell-off, and derivatives traders are using ETF demand as a macro indicator. Early Bitcoin ETF investors may be keen to rebalance their portfolios, and their capital has more than doubled.”

options market

Meanwhile, according to Coinglass data, in the cryptocurrency options market, options that expire later this month show that Bitcoin has shown more downside protection, while the leverage ratio of Bitcoin futures is moderate, remaining sluggish even after the digital asset broke through $0.099 million.

Vetle Lunde, head of research at digital asset research firm K33, quoted data from The Bitcoin Lab: “On-chain data shows that traders (who bought in the 0.055-0.07 million price range) are actively cashing out their profits, and the trend of profit settlement is particularly strong when the price of Bitcoin exceeds 90,000.”

According to Lunde, the indicator is an estimate that tracks Bitcoin's movement on the chain at the time of the last price change. However, he said that it is rare to see such a high concentration within a price range, so this indicates that within the current price range, this range is particularly active.

Open positions on Bitcoin options and futures contracts have remained at moderate levels after large-scale liquidation during Bitcoin's rise in recent weeks.

Jake Ostrovski, an OTC trader at Wintermute, said: “Over the past 10 days, the market has come to a standstill as the price of Bitcoin is just under 0.1 million dollars. The volume has been reduced slightly to the 64th percentile, while the volume of Ether is significantly higher, at the 81st percentile.”

Market tension was heightened on Monday with a post on X by blockchain analytics firm Arkham, which stated that approximately $2 billion worth of bitcoin seized from the former Silk Road website had been transferred from US government wallets to the CoinBase (COIN.US) exchange. Prices tend to plummet when traders speculate that large amounts of Bitcoin might enter the market at the same time.

As of press time, the price of Bitcoin has stabilized at $95,734. On November 22, the digital currency once hit a record high of 99,728 US dollars.

随着比特币的价格趋于平稳,人们对其他数字资产的兴趣开始上升,例如第二大加密货币以太币和瑞波币,在候任总统特朗普获胜后,这两种加密货币在比特币创纪录的价格上涨期间一直处于落后状态。这位前总统已成为加密货币的倡导者,这提高了人们对美国对这一经常引起争议的资产类别进行更友好监管的期望。

随着比特币的价格趋于平稳,人们对其他数字资产的兴趣开始上升,例如第二大加密货币以太币和瑞波币,在候任总统特朗普获胜后,这两种加密货币在比特币创纪录的价格上涨期间一直处于落后状态。这位前总统已成为加密货币的倡导者,这提高了人们对美国对这一经常引起争议的资产类别进行更友好监管的期望。