① The scale of Japanese yen arbitrage trading has gradually returned to its original “heyday”; ② The “guillotine” of the Bank of Japan's interest rate hike is also likely to fall later this month!

Financial Services Association, December 3 (Editor: Xiaoxiang) This summer, the closing of Japanese yen arbitrage trades erased the market value of about 6.4 trillion dollars from global stock markets in just three weeks, and the Nikkei 225 Index also experienced its biggest one-day decline since 1987. The global market turmoil at the time made it still hard for many market traders to forget...

Now, as we approach the end of the year, one very disturbing phenomenon is that the general environmental background that initially triggered a series of summer market earthquakes seems to be being repeated again and again in a “remake”:

The scale of Japanese yen arbitrage trading has gradually returned to its original “heyday,” and the “knife” of the Bank of Japan's interest rate hike is likely to fall later this month!

This makes many market participants think: once the hidden driver of the August US-Japan stock crash “reappears,” where will the global market go this time around?

A financing arbitrage transaction means that investors borrow money from countries with lower interest rates, such as yen, and then use this capital to invest in the currencies or related assets of countries with higher interest rates, such as the United States and Mexico. In recent years, the yen has been the most popular financing currency due to ultra-low interest rates in Japan. However, once the arbitrage transaction is forced to close the position, investors may sell off a range of previously purchased risky assets while buying back yen.

Japanese yen arbitrage trading “chives are booming”

There are signs that Japanese yen arbitrage trading is gaining popularity again recently.

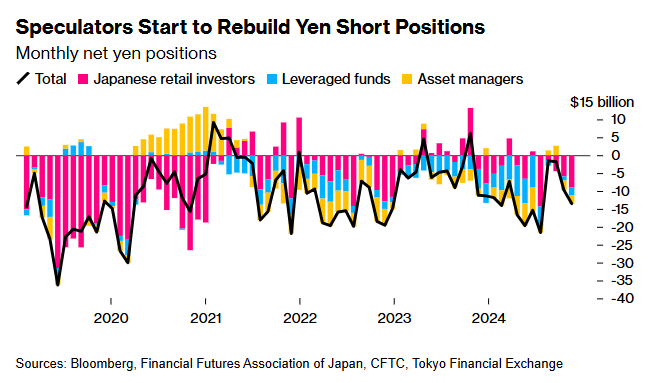

According to industry analysis of data from the Japan Financial Futures Association, the Tokyo Financial Exchange, and the US Commodity Futures Trading Commission (CFTC), net short positions in yen held by Japanese retail investors and overseas leveraged funds and asset management companies have increased from $9.74 billion in October to $13.5 billion in November.

Many analysts pointed out that due to factors such as widening interest spreads, increased US government borrowing, and low volatility in the money market, yen arbitrage trading bets are still very popular in the market. These conditions make it very attractive to borrow money in Japan (borrow in yen) and then invest the capital in the global high-yield market.

Strategists at Mizuho Securities and Saxo Bank said arbitrage trading could return to levels earlier this year.

Interest rate differences have long been a major driver of Japanese yen arbitrage trading. The average interest rate for G10 currencies and the ten high-yield emerging market currencies is over 6%. In contrast, the Bank of Japan's benchmark interest rate is still only 0.25%, and the local bank loan interest rate is around 1.7%, which indicates that the cost required to borrow yen is still quite low.

Although the Bank of Japan is gradually raising interest rates, the yield gap with major economies such as the US is still very large. As a result, the current Japanese yen arbitrage trading strategy is actually still very profitable. Since the end of 2021, the return on Japanese yen arbitrage transactions targeting 10 major currencies and emerging market currencies has reached 45%. In contrast, when dividend reinvestment is added, the S&P 500 index also has a return of only 32%.

This lucrative profit has attracted more and more investors. At one point, the net short position in yen reached $21.6 billion at the end of July — that is, before the Japanese yen arbitrage deal was drastically closed. Alvin Tan, head of Asian foreign exchange strategy at Royal Bank of Canada in Singapore, said that the absolute interest rate spread of other currencies compared to the yen is very large, which means it will always be treated as a financing currency.

In terms of the yen exchange rate, due to structural issues such as massive capital outflows that continue to put pressure on the yen, the yen also still performs the worst among G10 currencies this year. Although the exchange rate of yen rose to 140 against the US dollar against the backdrop of interest spread trading closed a few months ago, it is still relatively weak at around 150.

Bank of Japan moves towards a “rate hiker”

Obviously, while the Japanese yen arbitrage trading has begun to “revive”, there is always a hidden danger: once the Bank of Japan raises interest rates at the end of the year, will the Japanese arbitrage liquidation storm similar to this summer be repeated?

The sudden short-term surge in the yen last week actually highlights the continuing risks faced by investors who are re-emerging in arbitrage trading.

Some industry insiders are currently worried that the narrowing of interest spreads will return to a sluggish trend in yen arbitrage next year, especially after Bank of Japan Governor Kazuo Ueda opened the door to interest rate hikes in December. Many Japanese officials have also been paying close attention to the trend of yen depreciation recently. Japan's finance minister said last month that since late September, the yen has fluctuated sharply in one direction.

The Bank of Japan will announce its interest rate decision at noon on December 19 — just a few hours after the Federal Reserve announced its December interest rate decision. Many industry insiders have now anticipated that the Bank of Japan will raise interest rates by 25 basis points to 0.5% at this meeting, and if this expectation is finally fulfilled, it will mark the first time since the asset bubble peaked in 1989 that Japan has tightened its policy three times in a year.

On Friday, in an excerpt from an interview published in Japan, Bank of Japan Governor Kazuo Ueda said “they are getting closer” in response to “whether it can be understood that the next rate hike is gradually approaching,” because economic data is moving in the right direction.

Jane Foley, head of foreign exchange strategy at Rabobank London, wrote in a research report, “The market is encouraged that the Bank of Japan may raise interest rates in December, and the latter may be unwilling to disappoint.”

However, considering the large liquidation of the Japanese yen arbitrage deal in August of this year, it occurred after the Bank of Japan made an “interest rate hike+QT” austerity policy combination. Whether the Bank of Japan's interest rate hike would cause the same damage this time is clearly worth being wary of investors.

Foley said that Japan's Ministry of Finance has re-engaged with speculators through verbal intervention, and the Bank of Japan Governor's remarks continue to raise market concerns about the Bank of Japan's interest rate hike in December. As a result, although arbitrage trading has recently received further support, it may lack the confidence and motivation to operate further until next spring.

Of course, given that the Bank of America and Japan's final position is still unclear, whether arbitrage trading will actually close positions is still far from settled. Investors are likely to have a better understanding of arbitrage trading after the Bank of Japan and the Federal Reserve meeting in December. If the Bank of Japan raises interest rates in a pigeon style or the Federal Reserve cuts interest rates in the hawk style, then yen arbitrage traders may still remain above the market.

Shoki Omori, chief strategist at the Japan Department of Mizuho Securities, pointed out, “The Bank of Japan is expected to raise interest rates very slowly. If Powell does not plan to cut interest rates quickly, then interest spreads will still be very attractive for arbitrage transactions.”

日元套利交易的规模已逐渐恢复向当初的“全盛之时”,而日本央行加息的“铡刀”,也很可能会在本月晚些时候落下!

日元套利交易的规模已逐渐恢复向当初的“全盛之时”,而日本央行加息的“铡刀”,也很可能会在本月晚些时候落下!