It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like HEICO (NYSE:HEI). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is HEICO Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that HEICO has managed to grow EPS by 18% per year over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

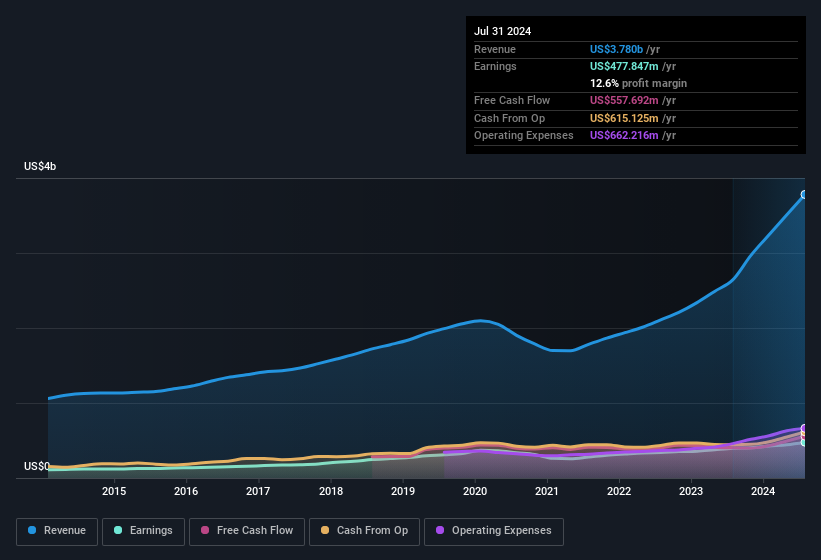

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note HEICO achieved similar EBIT margins to last year, revenue grew by a solid 43% to US$3.8b. That's a real positive.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note HEICO achieved similar EBIT margins to last year, revenue grew by a solid 43% to US$3.8b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of HEICO's forecast profits?

Are HEICO Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The US$436k worth of shares that insiders sold during the last 12 months pales in comparison to the US$2.0m they spent on acquiring shares in the company. This bodes well for HEICO as it highlights the fact that those who are important to the company having a lot of faith in its future. We also note that it was the Independent Director, Julie Neitzel, who made the biggest single acquisition, paying US$191k for shares at about US$263 each.

The good news, alongside the insider buying, for HEICO bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth US$4.6b. Coming in at 14% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add HEICO To Your Watchlist?

You can't deny that HEICO has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. You should always think about risks though. Case in point, we've spotted 1 warning sign for HEICO you should be aware of.

Keen growth investors love to see insider activity. Thankfully, HEICO isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.