Liao Kaiyuan, the majority shareholder of Tesla, recently posted that a stock market crash similar to the 1929 style is approaching. He wants to hedge his portfolio risks. Fearing that Tesla shares will soon be sold off, he chose to sell some Tesla shares and instead invest in relatively safe short-term treasury securities to protect his investment.

Liao Kai, one of Tesla's largest individual shareholders, is no longer in all Tesla shares.

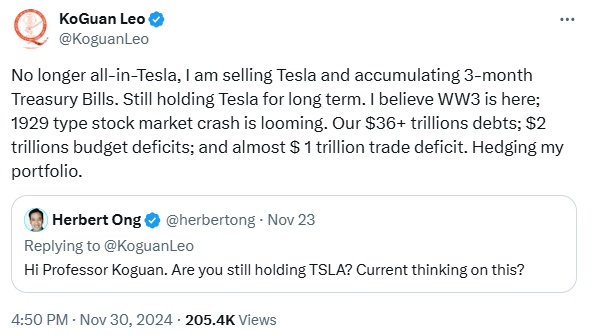

Recently, in response to questions from netizens on the social media platform X, he said that he is reducing his Tesla holdings because he is worried that the stock will soon be sold off, and he is investing part of the proceeds from the sale into government bonds:

“I'm not betting on Tesla anymore. I'm selling Tesla shares and buying 3-month US Treasury notes. A major stock market crash similar to 1929 is imminent. The US government has more than 36 trillion dollars in debt, a budget deficit of 2 trillion dollars, and a trade deficit of nearly 1 trillion dollars. I want to hedge my portfolio's risks.”

The analysis points out that although Liao Kaiyuan did not respond to inquiries about the exact amount and speed of his Tesla stock holdings reduction, this behavior indicates that his attitude towards Tesla may have changed significantly.

Liao Kai originally became a major shareholder of Tesla during the full rise in the stock market in 2021. He has publicly expressed his trust in Musk and is ambitious to increase his holdings in Tesla to at least 100 billion US dollars. According to the Bloomberg Billionaires Index, Tesla shares made up a major portion of Liao Kai's original $13.5 billion wealth. As of May, he held 27.7 million Tesla shares, or about 0.9% of the company's shares.

Liao Kai, 69, was originally born in Indonesia. He was educated in New York and currently lives in Singapore. He first started his career through SHI International, an enterprise software company based in Somerset, New Jersey, which he co-operated with his ex-wife.

Since 2019, Liao Kaiyuan has been buying Tesla shares and has quickly established a huge shareholding through stock options. However, since Musk acquired social media platform X (formerly Twitter), Liao Kaiyuan has criticized Musk more and more. He believes that the platform has distracted Musk's time and energy and affected Tesla's affairs.

Liao Kai originally opposed Musk's controversial salary plan in a shareholder vote in May of this year, which had previously been rejected by a Delaware judge.

“我不再全押特斯拉了。我正在出售特斯拉股票并买入3个月期美国国库券。类似1929年的股市大崩盘即将到来。美国政府债务超过36万亿美元,预算赤字2万亿美元,贸易赤字近1万亿美元。我要对冲我投资组合的风险。”

“我不再全押特斯拉了。我正在出售特斯拉股票并买入3个月期美国国库券。类似1929年的股市大崩盘即将到来。美国政府债务超过36万亿美元,预算赤字2万亿美元,贸易赤字近1万亿美元。我要对冲我投资组合的风险。”