The "American exceptionalism" trade is making a roaring comeback, fueled by the potential resurgence of "America First" policies under the upcoming Trump administration, according to Bank of America.

Bank of America analyst Ohsung Kwon highlighted Tuesday the sharp rise in the three-month correlation between the S&P 500 and the U.S. dollar, which has surged to its highest level since 2017.

Correlation Between U.S. Stocks, Dollar Hits Highest Since 2017

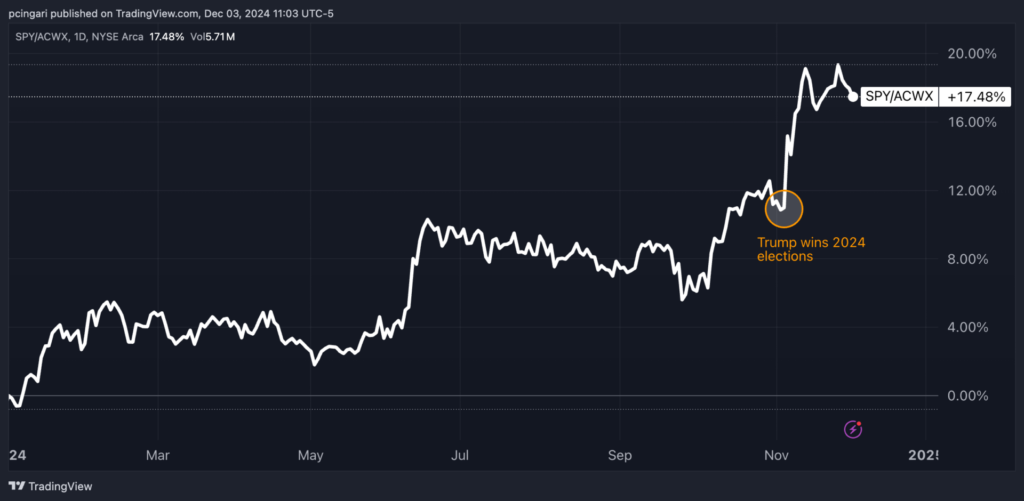

Since the election, U.S. equities have outperformed international stocks by three percentage points, while the U.S. dollar has appreciated 2.9%, signaling renewed investor confidence in America's economic resilience.

The correlation between international equities and the dollar has declined, creating a spread that reached its second-highest level in history, only behind the spike following Trump's 2016 election victory, the analyst said.

The correlation between international equities and the dollar has declined, creating a spread that reached its second-highest level in history, only behind the spike following Trump's 2016 election victory, the analyst said.

"The recent strength in the U.S. dollar suggests the U.S. economic outlook is improving relative to other countries, which is also driving U.S. equities higher versus the rest of the world," said Kwon.

Between the 2016 election and the end of 2017, the S&P 500, as tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), gained 25%, outperforming international stocks, tracked by the iShares MSCI ACWI EX U.S. ETF (NYSE:ACWX), by 7.6 percentage points.

The post-election rally this year — while more modest — still sees the S&P 500 ahead by three percentage points.

Chart: U.S. Stocks Sharply Outperform Rest Of The World In 2024

Jobs Report: The Next Catalyst For Markets?

The next test for the "American exceptionalism" trade could come Friday, with the release of the November employment report.

Bank of America economist Stephen Juneau said the report will likely be noisy, reflecting temporary factors like the end of the Boeing Co. (NYSE:BA) strike and hurricane-related recovery.

BofA expects nonfarm payrolls to jump by 240,000, bolstered by these one-off effects. To get a clearer sense of the labor market's health, Juneau suggested looking at the two-month average of payroll gains.

Adding to the strong labor market narrative, October job openings surprised to the upside. According to the official report released on Tuesday, job openings increased by 372,000 to 7.744 million in October, surpassing market expectations of 7.48 million.

The market reaction to the jobs report may be muted, with S&P options pricing in just an 86-basis-point implied move — the smallest expected reaction since July.

Analysts attribute this to a combination of waning macro volatility. "Likely a combination of high data volatility, extreme forecasting challenges, and the Fed's 'data-dependent' posture," Juneau wrote, adding that the SPY's flat reaction to last month's surprising inflation data "was not encouraging"

Photo: Shutterstock