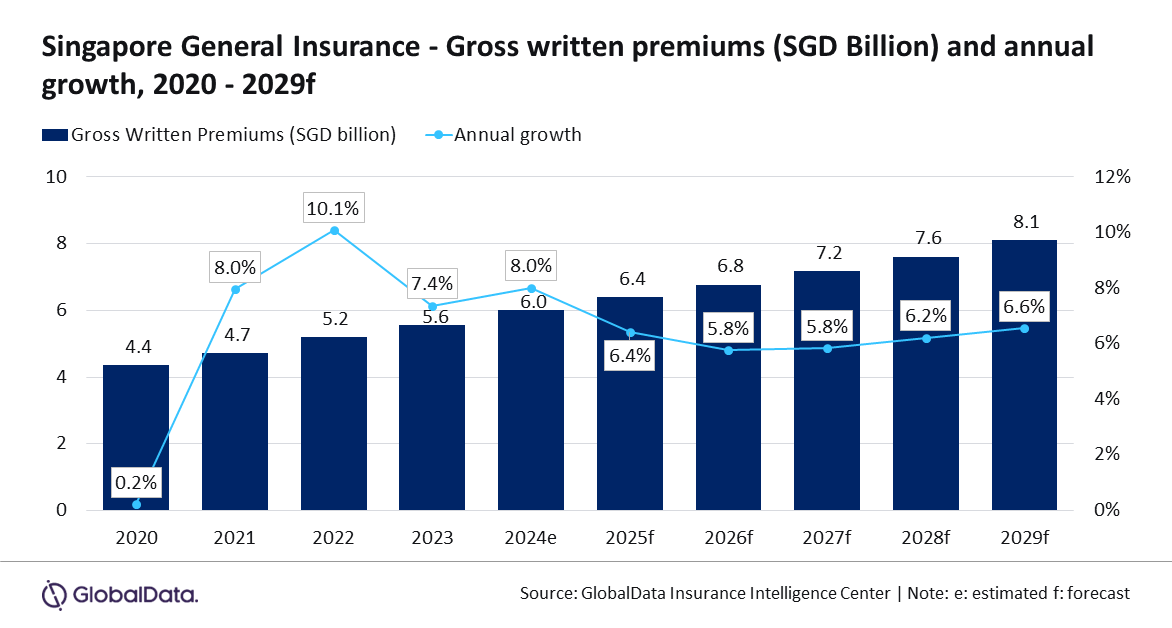

Singapore General Insurance Market to Reach $8.1b by 2029: Report

Singapore General Insurance Market to Reach $8.1b by 2029: Report

The industry is expected to grow by 8.0% in 2024.

預計行業在2024年將增長8.0%。

Singapore's general insurance industry is projected to grow at a compound annual growth rate (CAGR) of 6.2% from $6.0b in 2024 to $8.1b in 2029, in terms of gross written premiums (GWP), GlobalData reported.

根據GlobalData的報告,新加坡的綜合保險業預計將以6.2%的複合年增長率(CAGR)從2024年的60億美元增長至2029年的81億美元,以保險總保費(GWP)計算。

According to GlobalData, Singapore's general insurance industry is expected to grow 8.0% due to economic recovery, escalating healthcare costs, and rising premium rates across general insurance lines.

根據GlobalData的數據,由於經濟復甦、醫療成本上升和綜合保險領域保費率上漲,預計新加坡的綜合保險業將增長8.0%。

PA&H insurance is forecast to grow by 9.0% in 2024, primarily due to escalating medical costs. It is the largest line of business in the Singaporean general insurance industry and is estimated to account for a 23.5% share of the general insurance GWP in 2024.

根據預測,PA&H保險預計將在2024年增長9.0%,主要是因爲醫療成本不斷攀升。這是新加坡綜合保險業中最大的業務板塊,預計將佔2024年綜合保險GWP的23.5%。

Motor insurance is the second-largest business line, which is anticipated to account for a 19.8% share of general insurance GWP in 2024. For 2024, it is expected to grow by 9.4% due to an increase in vehicle sales.

機動車保險是第二大業務板塊,預計將在2024年佔綜合保險GWP的19.8%。預計2024年將增長9.4%,這主要是由於車輛銷量增加。

Property insurance is the third-largest business line, which is projected to account for an 18.1% share of general insurance GWP in 2024 and is forecast to grow by 5.4% in 2024, driven by an increase in construction activities.

財產保險是第三大業務板塊,預計將在2024年佔綜合保險GWP的18.1%,預計2024年將增長5.4%,這主要是由施工活動增加驅動的。

Meanwhile, liability insurance is projected to account for a 17.6% share of the general insurance GWP in 2024. It is expected to grow at a CAGR of 6.0% during 2024-29.

與此同時,責任保險預計將在2024年佔綜合保險GWP的17.6%。預計在2024年至2029年期間將以6.0%的複合年增長率增長。

In addition, Marine, Aviation, and Transit (MAT), financial lines, and other general insurance products are estimated to account for the remaining 20.9% share of the general insurance GWP in 2024.

此外,海洋、航空和交通(MAT)、金融業務以及其他一般保險產品被預計在2024年佔綜合保險全球繳費20.9%的份額。

"The general insurance industry in Singapore is well-positioned for sustained growth over the next five years. However, global economic volatility and geopolitical uncertainties might pose a challenge for insurers to maintain profitability," Swarup Kumar Sahoo, senior insurance analyst at GlobalData said.

「新加坡的綜合保險行業在未來五年內將處於良好的增長位置。然而,全球經濟的不穩定性和地緣政治的不確定性可能對保險公司維持盈利能力構成挑戰,」全球數據公司的高級保險分析師Swarup Kumar Sahoo表示。

PA&H insurance is forecast to grow by 9.0% in 2024, primarily due to escalating medical costs. It is the largest line of business in the Singaporean general insurance industry and is estimated to account for a 23.5% share of the general insurance GWP in 2024.

PA&H insurance is forecast to grow by 9.0% in 2024, primarily due to escalating medical costs. It is the largest line of business in the Singaporean general insurance industry and is estimated to account for a 23.5% share of the general insurance GWP in 2024.