Despite an already strong run, Jiangsu Jujie Microfiber Technology Group Co., Ltd. (SZSE:300819) shares have been powering on, with a gain of 34% in the last thirty days. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

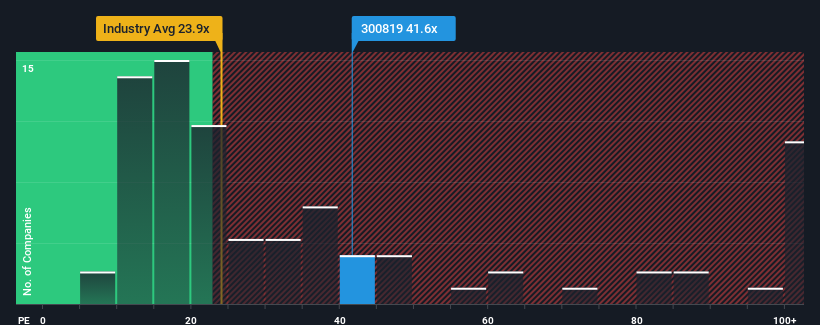

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 36x, you may consider Jiangsu Jujie Microfiber Technology Group as a stock to potentially avoid with its 41.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

As an illustration, earnings have deteriorated at Jiangsu Jujie Microfiber Technology Group over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Jiangsu Jujie Microfiber Technology Group would need to produce impressive growth in excess of the market.

In order to justify its P/E ratio, Jiangsu Jujie Microfiber Technology Group would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. Even so, admirably EPS has lifted 160% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is predicted to deliver 39% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it interesting that Jiangsu Jujie Microfiber Technology Group is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

What We Can Learn From Jiangsu Jujie Microfiber Technology Group's P/E?

The large bounce in Jiangsu Jujie Microfiber Technology Group's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jiangsu Jujie Microfiber Technology Group currently trades on a higher than expected P/E since its recent three-year growth is only in line with the wider market forecast. When we see average earnings with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Jiangsu Jujie Microfiber Technology Group that you should be aware of.

You might be able to find a better investment than Jiangsu Jujie Microfiber Technology Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.