Zhejiang Xidamen New Material Co.,Ltd. (SHSE:605155) shares have continued their recent momentum with a 28% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

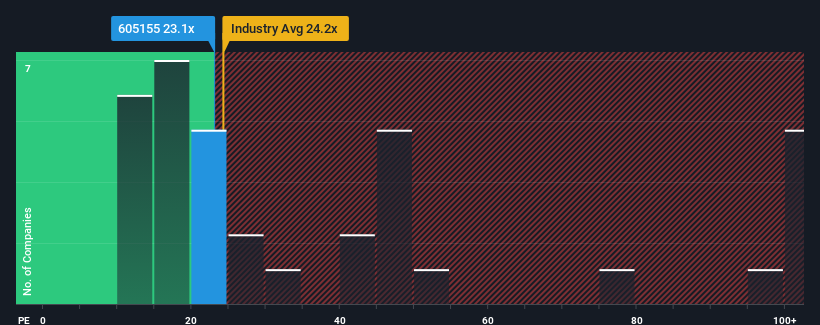

Although its price has surged higher, Zhejiang Xidamen New MaterialLtd's price-to-earnings (or "P/E") ratio of 23.1x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 73x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Zhejiang Xidamen New MaterialLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is Zhejiang Xidamen New MaterialLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Zhejiang Xidamen New MaterialLtd's is when the company's growth is on track to lag the market.

The only time you'd be truly comfortable seeing a P/E as low as Zhejiang Xidamen New MaterialLtd's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 12% gain to the company's bottom line. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 19% over the next year. Meanwhile, the rest of the market is forecast to expand by 39%, which is noticeably more attractive.

In light of this, it's understandable that Zhejiang Xidamen New MaterialLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Zhejiang Xidamen New MaterialLtd's P/E?

The latest share price surge wasn't enough to lift Zhejiang Xidamen New MaterialLtd's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Zhejiang Xidamen New MaterialLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Zhejiang Xidamen New MaterialLtd with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Zhejiang Xidamen New MaterialLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.