Despite an already strong run, Tongdao Liepin Group (HKG:6100) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 45% over that time.

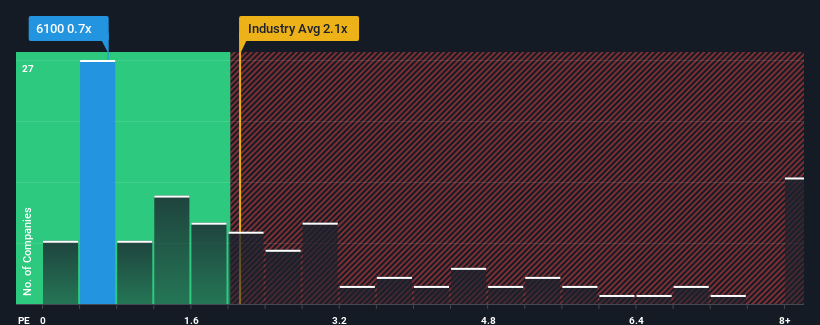

Although its price has surged higher, you could still be forgiven for feeling indifferent about Tongdao Liepin Group's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Interactive Media and Services industry in Hong Kong is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Tongdao Liepin Group Performed Recently?

Tongdao Liepin Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Tongdao Liepin Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Tongdao Liepin Group?

The only time you'd be comfortable seeing a P/S like Tongdao Liepin Group's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Tongdao Liepin Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 5.7% decrease to the company's top line. As a result, revenue from three years ago have also fallen 14% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 5.3% during the coming year according to the three analysts following the company. Meanwhile, the broader industry is forecast to expand by 9.4%, which paints a poor picture.

With this information, we find it concerning that Tongdao Liepin Group is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Tongdao Liepin Group's P/S

Tongdao Liepin Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While Tongdao Liepin Group's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Having said that, be aware Tongdao Liepin Group is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.