インテルは再びCEOを交代しましたが、予兆はなかったものの、ある意味では予想通りのことです。この6年間で、彼らは3回CEOを交代しましたが、状況は逆に悪化し、危機は深刻さを増しています。このシリコンバレーの象徴的な半導体大手を救うためには何が必要でしょうか?おそらく彼らは自分たちのスー・チーフンを見つける必要があります。

ベテランに体面的なチャンスを与えてください。

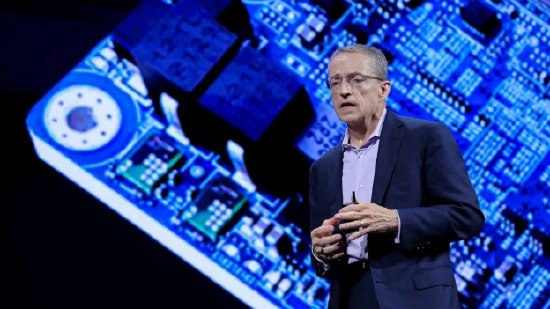

米国西部時間の日曜日、インテルの取締役会は突然CEOのパット・ゲルシンガーの退任を発表しました。63歳のゲルシンガーはCEO職を辞し、インテルの取締役会から退任し、即座に効力を発揮します。

インテルのCFOデイビッド・ジンズナーと製品責任者ジョンストン・ホルソスが共同で暫定CEOを務め、新しいCEO候補を取締役会が探す間を待ちます。一方で、ホルソスは新しく設立されたインテル製品CEOに任命されました。ゲルシンガーが退任した後、インテルの株価は月曜日に6%急騰しました。

インテルのCFOデイビッド・ジンズナーと製品責任者ジョンストン・ホルソスが共同で暫定CEOを務め、新しいCEO候補を取締役会が探す間を待ちます。一方で、ホルソスは新しく設立されたインテル製品CEOに任命されました。ゲルシンガーが退任した後、インテルの株価は月曜日に6%急騰しました。

インテルの取締役会の発表では、ゲルシンガーは「退任」(Retirement)と記載されています。これは明らかに微妙で体面的な表現です。ゲルシンガーは63歳ですが、この年齢は高齢者と見なされます。しかし、半導体業界のCEOたちは一般的に50歳を超えており、年上のエヌビディアのCEOのジェンスン・フアン、タイワンセミコンダクターマニュファクチャリングのCEOのウィ・ジェー・カ、ブロードコムのCEOのシェン・フー・ヤンは今もキャリアの絶頂期にあります。

さらに、CEOが正常に退任する場合、取締役会は前もって後任者を選定し、企業がスムーズに移行できるように過渡期を設定します。しかし、インテルのように即座にCEO職を解除し、役員がCEOを代理し、新しいCEOを選ぶ間の動乱の期間を待つことはありません。

また、キッシンジャーは先週、テスラとxAIのデータセンターがあるテネシー州メンフィスを訪れ、AIデータセンター分野でインテルのCPUを売り込もうと努力しており、退職の兆候は全く見えません。エヌビディアのGPUこそがAIデータセンターの戦略的武器ですが、データセンターは依然としてCPUが必要であり、インテルはこのビジネス分野でAMDと競い合う必要があります。

状況は明らかで、キッシンジャーはインテルの役員会に解雇されました。就任からまだ四年も経っておらず、彼が設定した業績回復のタイミングにも達していませんが、インテルの役員会は彼のもとでの業績と将来の回復の見通しに対して完全に信頼を失いました。

先月、外部からの噂では、インテルの役員会がモルガンスタンレーを戦略顧問として雇い、活発な投資家からの圧力に対する防御策を検討しているということです。四年前にもモルガンスタンレーに助けを求めましたが、最終的に機関投資家の圧力の下、CEOのボブ・スワンを解任し、VMwareからキッシンジャーを呼び戻して会社を指揮させました。

事情に詳しい情報源によると、インテルの役員会はキッシンジャーに見栄えの良いオプションを与えました:自ら退職を選ぶか、正式に解雇されるかです。結局、キッシンジャーは体面的に退く道を選び、インテルの役員会はこの会社に40年以上勤務してきた大物に対して「名誉退職」の挨拶をしました。

もちろん、インテルの役員会もキッシンジャーを不当に扱ったわけではありません。今年インテルの業績が非常に悪化していても、役員会はキッシンジャーにボーナスを支給しました。彼は合計1200万ドルの解約金を持って会社を去ります。その内訳は、18ヶ月分の基本給190万ドル、1.5倍の業績ボーナス510万ドル、および11ヶ月分の年次ボーナスです。

底に落ちて完全に耐えられなくなる

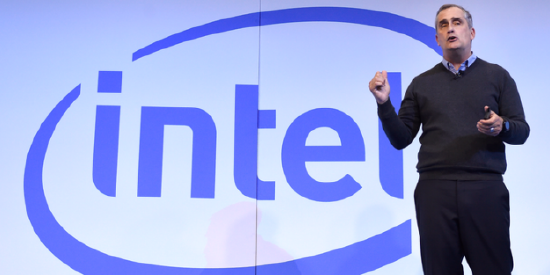

2021年、士気が低下したインテルは、かつて30年間働いたキッシンジャーを呼び戻し、インテルに久しぶりのエンジニア文化を再注入し、この技術を基にしたチップの巨人に技術的自信を取り戻させ、業種の頂点に戻るのを助けてほしいと考えていました。キッシンジャーはインテルのCTOであり、伝説のプロセッサ80486の主なアーキテクトで、社内外で非常に高い名声を持っていました。

当初、キッシンジャーをVMwareから引き戻すためにインテルの役員会は非常に強い意欲を持っていました。インテルが米国証券取引委員会(SEC)に提出した書類によれば、キッシンジャーの2021年の総報酬は1.786億ドルで、その約79%が株式報酬でした。2022年と2023年の報酬総額はそれぞれ1161万ドルと1686万ドルでした。たとえインテルの2023年度の収益が14%減少し、利益が79%減少しても、キッシンジャーは45%の昇給を得ました。

キッシンジャーが復帰した後、インテルにIDM 2.0の転換戦略を提案しました。彼は今後10年間で合計1,000億ドルを投入し、米国、ドイツ、アイルランドなどに8つのチップ工場を建設することを計画しており、業種最新のプロセス技術を採用して、インテルのチップ分野における技術的優位性を再活性化し、2030年までにはグローバルで台積電に次ぐ第2のチップ代理工メーカーになることを目指しています。

しかし、考えは美しいですが、現実は厳しいです。キッシンジャーがインテルを積極的に代工工場に転換させてからの3年間、インテルのコアビジネスは引き続き下降トレンドを描き、さらには悪化しました。2023年度、インテルはキッシンジャーが就任する前の2020年度に比べて30%減少し、237億ドルも減少し、当期純利益はなんと80%も減少しました。

同時に、キッシンジャーのIDM 2.0転換戦略も成果を上げていません。過去数年間、インテルは数百億ドルを投じてチップ工場を建設しましたが、今まで実際の収益をもたらすことができず、理想的な場合でも2025年まで顧客を持つことは難しく、2027年まで本当に損益相殺を達成することは困難です。昨年のチップ代工ビジネスは、70億ドル以上の損失を出しました。

2024年に入ると、インテルの状況はさらに悪化し、今年の第2四半期には16億ドルの損失が発生しました。キッシンジャーはグローバルで15%の人員削減と100億ドルのコスト削減を発表しました。決算発表後、インテルの株価は25%暴落し、会社の歴史的な最大の下落幅を記録しました。

さらにインテルにとって屈辱的なのは、今月彼らがnyダウの構成銘柄から除外され、半導体業種の新しい旗艦であるエヌビディアに取って代わられたことです。確かに、今のインテルは半導体業種を代表することができません。

今年に入ってから、インテルの株価は53%も暴落し、現在の時価総額は970億ドルしかなく、高通やAMDの半分であり、さらにチップを設計するArmよりも低いです。エヌビディアの時価総額が3.4兆ドルを超えて急上昇する中、持株3.5%の創業者兼CEOである黄仁勲の資産も1,000億ドルを超え、さらにはインテルの時価総額をも上回るほどです。

皮肉なことに、2005年にインテルはエヌビディアを20億ドルで買収する提案をしましたが、当時のインテルの取締役会はGPU小会社を急いで買収する必要がないと判断し、当時のCEOであるポール・オテリーニが買収計画を放棄し、インテル自身のグラフィックプロセッサの開発に投入しました。そのプロジェクトの責任者はキッシンジャーでした。

現在は時代が変わり、エヌビディアはAI時代の追い風によって半導体業界の第一株となったが、かつての巨人インテルは今や昔のことで、買収候補となっている。権威あるメディアが報じたところによれば、クアルコムはインテルに接触し、PCチップ設計業務の買収を提案したが、この取引は厳しい反トラスト審査の障害に直面しており、クアルコムも難しさを知って撤退せざるを得なかった。

キッシンジャーは常に投資家を慰めようとしてきたが、インテルのチップの受託生産は最終的には成功を収めるとされているが、明らかにインテルの取締役会はもはや忍耐を失い、キッシンジャーのビジネス回復計画を信じていない。株価を引き上げるために、インテルはCEOを交代し、戦略を再選択する必要がある。

六年間で三人のCEOを追い出した

キッシンジャーがインテルを率いてからまだ四年も経っていないが、彼の実績は明らかに失望をもたらしている。しかし、彼はインテルが短い六年間で追い出した三人目のCEOでもある。そして、インテルの取締役会は毎回後任者を設けることなく突然CEOの職を解任している。

インテルの56年の企業歴史の中で、合計八人のCEOしかいない。しかし、わずか過去六年で彼らは三人のCEOを交代させた。各CEOの解任にはそれぞれの理由があるが、その背後には同じ根源がある:インテルは深刻な技術とビジネスの危機に直面している。

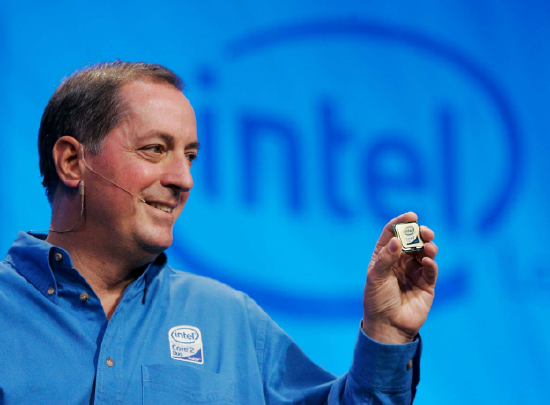

2018年6月、インテルの取締役会は当時のCEOブライアン・クラザニッチが会社の方針に違反したため辞任したことを突然発表した。インテルの調査によると、クラザニッチは一名の女性部下との親密な関係にあったが、これは両思いの関係であり、セクハラには該当しないものの、「役員が部下と親密な接触を持つことを禁止する」という倫理規定に違反していた。

クラザニッチはインテルで36年間勤務し、2013年にCEOに就任した。彼の前任者オデニンは自発的に引退したのであり、突如解任されたのではないが、外界では広くオデニンは市場の潮流にしっかりとついて来られず、インテルがモバイル時代の追い風を逃し、基本的にスマートフォン市場のシェアを獲得できなかったと見なされている。

注目すべきは、オデニンはiPhone用のプロセッサーの開発を拒否したことだ。彼はアップルのスマートフォンがどの程度の市場スペースを持つのか不確実で、アップルの提示した価格があまりにも低く、インテルに対する財務的リターンをもたらさなかったからだ。数年後、オデニンは自分が重大な間違いを犯したことを率直に認め、スマートフォン業界を完全にArm陣営のチップ製造業者に譲った。

科再奇が就任以来の重要な任務は転型です。彼は就任後、インテルをPC中心の企業からデータ中心の企業へと転換させ、自動運転や人工知能などの新興分野に拡張しようとしました。就任して5年の間に、700億ドル以上を投資し、MobileyeやAlteraなどの多くの戦略的買収を完了させ、インテルの未来戦略の構築を試みました。

しかし、これらの最先端技術の戦略的展開はインテルに明らかなリターンをもたらしませんでした。MobileyeとAlteraはインテルの陣営に入った後、発展も順調ではありませんでした。一方で、インテルは最も核心的なチップ事業で致命的なミスを犯しました:極紫外光刻(EUV)技術をタイムリーに追跡できず、チッププロセスが完全に台積電や三星に遅れをとりました。

このミスは過去10年間、インテルの核心事業の継続的な下落の根本的な原因です。インテルは10nm、7nm、5nmなどの多くのノードで遅延を続け、AMDやクアルコムなどの技術的な競争相手がプロセスの優位性で自社を追い越し、自社の市場シェアを徐々に侵食していくのをただ見守ることしかできませんでした。インテルは自社のフラッグシップチップさえも台積電に代工させざるを得なくなりました。

科再奇が解雇された後、CFOの司睿博が暫定CEOのポジションを担当し、翌年1月に正式なCEOに就任しました。彼の上位はインテルの交代の伝統を破り、インテルの歴史上初めてのテクニカルバックグラウンドを持たないCEOとなりました。予想外ではありませんが、司睿博はインテルの技術的後れの状況を逆転することができませんでした。

彼がCEOとしての短い2年半の間に、インテルは引き続き多くの課題に直面しました。これには、10nmプロセス技術の複数回の延期、競争相手に市場シェアを侵食されること、アップルのスマートフォンの基帯チップビジネスを失うこと、さらにMac製品ラインでのアップルによるインテルプロセッサの段階的な放棄が含まれます。

もしかしたら財務出身であることから、司睿博も致命的なミスを犯しました:彼はOpenAIへの投資を拒否しました。OpenAIが限られた利益機関に転型し、外部に資金調達を始めたとき、かつて英特尔への投資を積極的に求めてきました。インテルは10億ドルを投資すればOpenAIの15%の株式を取得でき、さらに低価でインテルCPUを提供すれば15%を引き続き購入することができました。

しかし、司睿博は生成式AIが短期的に商業化をもたらすことは難しいと考えており、この投資が実際のリターンをもたらすことは難しいかもしれないため、最終的にOpenAIの要求を拒否しました。現在、OpenAIの評価は1600億ドルに近づいており、インテルはまたもやテクノロジーの大潮流を逃しました。

この一連のネガティブな影響により、インテルの株価は低迷し続け、インテルの取締役会はThe Third Pointなどのアクティブな投資家からの圧力を受け、最終的に司睿博を交代させ、かつてインテルの技術責任者であったキッシンジャーを復帰させることになりました。彼がインテルに工程師文化を再注入し、半導体分野での技術的自信を取り戻すことを期待していました。

結果として、キッシンジャーも失敗しました。彼の任期内に、インテルの業績と株価は直線的に下落し、変化を遂げた半導体の代工場であるIDM 2.0戦略も資本市場を説得することはできませんでした。資本市場もインテルの取締役会も、明らかに信頼と忍耐を失っていることは明らかです。

インテルにはスー・ジーフォンが必要です。

インテルのビジネスの再編と戦略の転換は、テクノロジー業界で最も注目すべき挑戦です。このPC時代を切り開き、業界の頂点に立った半導体の巨人は、過去十年以上にわたってモバイルデバイス、半導体プロセス、人工知能などの多くのテクノロジーの波を連続して逃し、技術的に競合他社に全く遅れを取って、最終的に現在の谷底に陥りました。

現在、キッシンジャーも辞任し、誰がインテルを救い、このシリコンバレーの象徴的企業を再び正軌に戻すことができるのでしょうか。インテルの半導体代工業務は今後どのようになっていくのでしょうか。このすでに600億ドルが投入されたビジネスは、実際の収入をもたらすためにさらに数百億ドルの投入を必要としています。

さらに、米国政府から80億ドルの補助金や100億ドルの低利融資を受け取っているため、インテルは自社の半導体代工業務を売却することができません。また、このような重い業務を引き受ける後継者を見つけることも難しいかもしれません。

現在のインテルは自分たちのスー・ジーフォンが必要です。今年はちょうどスー・ジーフォンがAMDのCEOに就任してから10周年です。彼女は過去10年間で、AMDを倒産の危機に瀕し、時価総額が20億ドルしかない「死にゆく企業」から、時価総額2300億ドルを超える半導体の巨人へと変貌させ、スティーブ・ジョブズがかつて復活させた奇跡的な経験を作り上げました。

スー・チーフェンはAMDをどのように立て直したのか?技術を基にして着実に進めた。スー・チーフェンが就任して以来、まずはAMDのゲーム分野の収益を安定させ、会社を財政的な困難から救った。その後、彼女はAMDの核心的な取り組みを再構築し、核心アーキテクチャを作り直すことによって、AMDを「低価格の代替品」から真の市場競争者に変えた。RyzenシリーズはAMDをデスクトッププロセッサ市場に復帰させた。

インテルが製造工程の問題で連続して製品を発売できない中、AMDは常にタイワンセミコンダクターマニュファクチャリングの技術的優位性に頼り、7nmおよび5nmのチップを先行して発売し、最終的には性能と効率面でインテルを超え、インテルの背後を追う存在から全面競争が可能なライバルになった。

一方、生成式人工知能の時代における技術の潮流に対して、AMDはインテルよりも迅速に反応した。彼らはEPYCプロセッサの性能を引き続き向上させるだけでなく、自社の人工知能アクセラレーター製品を発表し、エヌビディアと全面的に競争を展開することを目指している。エヌビディアのCUDAエコシステムの優位性は依然として動かせないが、AMDは徐々に市場シェアを獲得しており、さらにXilinxやZT Systemなどの戦略的買収を通じて、自社のビジネスの短所を補っている。

スー・チーフェンが指導した10年間で、AMDは2014年の20%の市場シェアから現在の29%まで成長し、データセンター市場で24%のシェアを確保した。AMDの収益は依然としてインテルを下回っているが、資本市場は全く異なる期待の展望を示している:AMDの時価総額は2300億ドルに達し、インテルの2倍以上となっている。

スー・チーフェンの昨年の報酬は3050万ドルに達し、キッシンジャーの約2倍で、そのうちの株式とオプションの報酬は2779万ドルにのぼる。彼女が示した業績から見ると、「スーお母さん」はその給与に見合う働きをしている。

過去十年以上、インテルは技術のトレンドを何度も誤って予測し、多くの好機を逃し、最終的には衰退の谷に陥った。おそらく、彼らの伝説的なCEOアンディ・グローブの名言、「成功は自己満足を生む。自己満足は失敗を生む。偏執的でなければ生き残れない」(Success breeds complacency. Complacency breeds failure. Only the paranoid survive)が証明したことになる。

英特尔CFO辛斯纳(David Zinsner)和产品负责人霍尔豪斯(Johnston Holthaus)将共同出任临时CEO,等待董事会寻找新的CEO人选。与此同时,霍尔豪斯还被任命为新创建的职位英特尔产品CEO。基辛格下课之后,英特尔股价周一飙升了6%。

英特尔CFO辛斯纳(David Zinsner)和产品负责人霍尔豪斯(Johnston Holthaus)将共同出任临时CEO,等待董事会寻找新的CEO人选。与此同时,霍尔豪斯还被任命为新创建的职位英特尔产品CEO。基辛格下课之后,英特尔股价周一飙升了6%。