Will recruit 1,400 employees in the fourth quarter to help meet the growing demand for Agentforce.

On Tuesday local time, benefiting from strong spending on corporate cloud investments, cloud software giant Salesforce announced that its revenue for the last fiscal quarter exceeded expectations and raised the lower limit of its annual revenue guidance.

As a result, Salesforce's stock price rose by 10% in post-market trading, closing at $366.5 per share.

RPO increased by 10% year-on-year.

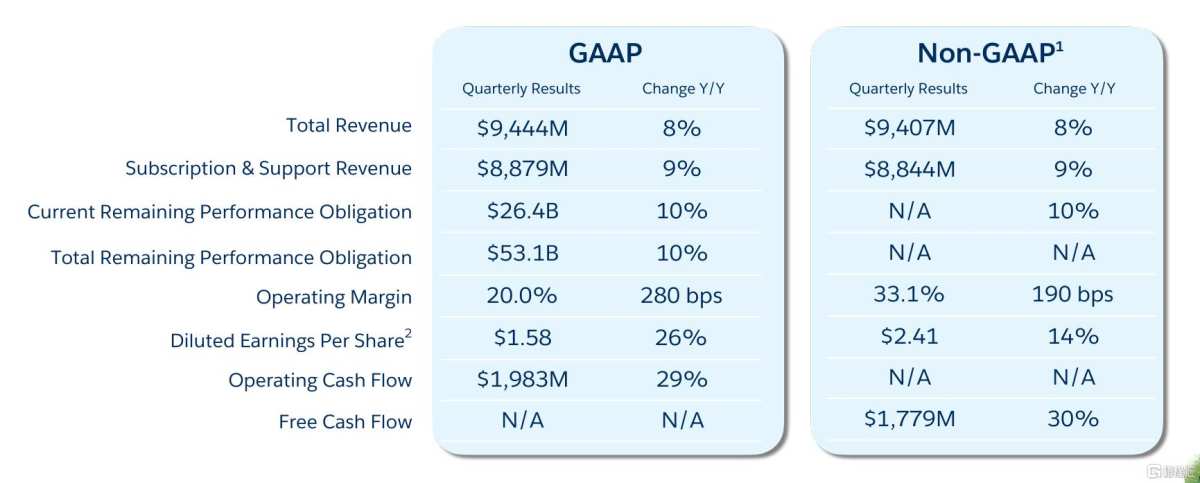

Specifically, Salesforce's revenue for the last fiscal quarter grew by 8% year-on-year to $9.44 billion, surpassing the analyst expectation of $9.35 billion.

Specifically, Salesforce's revenue for the last fiscal quarter grew by 8% year-on-year to $9.44 billion, surpassing the analyst expectation of $9.35 billion.

GAAP diluted EPS was $1.58, a year-on-year increase of 26%, exceeding the analyst expectation of $1.44; the operating margin was 20%, an increase of 2.8 percentage points year-on-year.

The adjusted EPS was $2.41, a year-on-year increase of 14%, below the expected $2.44. The adjusted operating margin was 33.1%, higher than the expected 32.2%.

Additionally, Salesforce achieved subscription revenue of 8.88 billion USD in the last fiscal quarter, a year-on-year growth of 9%.

Notably, Salesforce's RPO (Remaining Performance Obligations) reached 53.1 billion USD in the last fiscal quarter, an increase of 10% year-on-year.

Looking ahead, Salesforce currently expects revenues for the fiscal year 2025 to range between 37.8 billion USD and -38 billion USD, representing a year-on-year growth of 8%-9%, compared to the previous forecast range of 37.7 billion USD to 38 billion USD, which is above the analysts' expectation of 37.86 billion USD.

Specifically, sales for this fiscal quarter are expected to be between 9.9 billion USD and -10.1 billion USD, a year-on-year increase of 7%-9%, with the analysts' median expectation set at 10.05 billion USD; EPS is projected to be between 2.57 USD and 2.62 USD, with the analysts' median expectation at 2.65 USD.

Demand for the AI Agent product is strong.

Salesforce has long placed a major bet on its new product Agentforce, hoping to revitalize its growth rate and, along with other technology companies like Microsoft, has opened new avenues in developing AI agents that can independently complete tasks.

Last October, Salesforce launched the Agentforce product, with an initial price of about $2 per conversation.

In August, Salesforce stated that the Agentforce platform is based on the company's data cloud, which continues to perform strongly and is the fastest-growing product in its history.

According to morgan stanley, the conservative market expectation for Agentforce among usa customer service representatives is $2 billion, while the optimistic market expectation is $20 billion.

During Tuesday's earnings call, Salesforce executives revealed that they will hire 1,400 employees in the fourth quarter to help meet the growing demand for Agentforce.

It's worth noting that under pressure from investors, Salesforce has been cutting costs, including layoffs, over the past two years. This shows that demand for its AI Agent products is strong.

Marc Benioff stated: "Agentforce is a complete ai system built for enterprises on the Salesforce platform, and it is at the core of a groundbreaking transformation."

Wall Street has expressed a bullish sentiment regarding Agentforce.

Analyst Charlie Miner from Third Bridge said: "The real turning point for Salesforce depends on the execution and adoption of Agentforce."

Analyst Tyler Radke from citigroup wrote before the earnings announcement: "Agentforce has surpassed customer relationship management at an astonishing pace."

However, some analysts believe that Salesforce needs to strongly promote the adoption of its services in order to break through single-digit percentage growth and achieve around 15% growth.

Jeremy Goldman from Emarketer pointed out: "Salesforce's 8% annual growth rate is stable but does not reach the astonishing speed that technology investors prefer. To achieve around 15% growth, the most realistic timeline might be fiscal year 2027 or later."

具体来看,Salesforce

具体来看,Salesforce