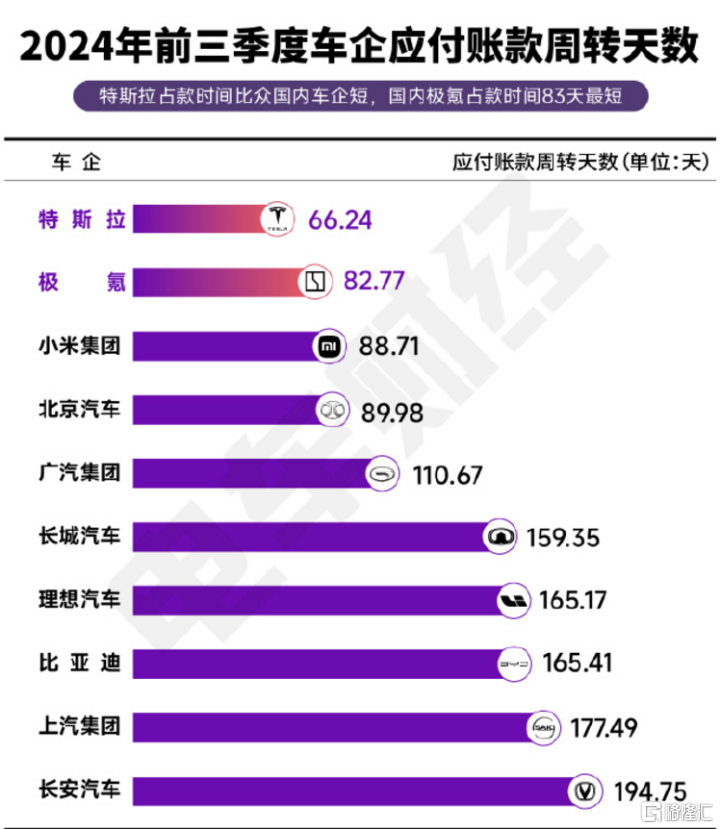

Recently, the demand for suppliers to lower prices by 10% in the auto market has sparked discussions, followed by Tesla releasing an image about "quick checkout," which has gained the brand some goodwill. Meanwhile, the outside world has also further reviewed the accounts payable turnover days of various car companies to see which performs better.

From the image above, it can be seen that in the first three quarters of 2024, Tesla's accounts payable turnover days were 66.24 days, zeekr's were 82.77 days, and Xiaomi Group's were 88.71 days. Tesla leads, which is easy to understand, while zeekr ranks first among Chinese independent brands; the fact that a newly established force leads the way in "checkout" in just four years and does not hamper financial improvement is indeed commendable.

This also reveals a deeper layer: in an environment with such strict control over per-car costs, new forces like zeekr are breaking through the industry chain's superficial competition and stabilizing the cash flow of the supply chain. The past prosperity of BBA was also the prosperity of the industry chain; if Chinese brands want to replicate this success, it is an essential path, which zeekr clearly understands.

So how can this be done better in the future? For new force brands, the only way to effectively optimize their costs and improve operational efficiency is through continuous self-transformation and collaborative development.

So how can this be done better in the future? For new force brands, the only way to effectively optimize their costs and improve operational efficiency is through continuous self-transformation and collaborative development.

The strategic integration of zeekr and Lynk & Co may partially signify this.

On December 3rd, after the strategic integration announcement, zeekr and Lynk & Co named the new company: zeekr Technology Group, which includes the double brands of zeekr autos and Lynk & Co autos, striving to create a globally leading high-end luxury new energy vehicle group with an annual production and sales scale of one million within two years.

By maximizing synergy, research and development investment will be reduced by 10-20%, BOM costs will decrease by 5-8%, capacity utilization will increase by 3%-5%, and support and service department expenses will decrease by 10-20%, which will naturally empower the industry chain better.

Specifically, what kind of grand occasion will arise after the two sides work together?

Zeekr and Lynk & Co join forces to break the deadlock and will lead the new trend of industry development.

Before discussing the benefits of strategic integration, let's first see what Zeekr and Lynk & Co each have.

Zeekr is positioned as a luxury technology brand and is a rare 'fast fish' in the booming new energy sector, with six models covering the high-end user group, achieving sales of 194,933 vehicles in the first 11 months of this year, a year-on-year increase of 85.3%. Zeekr has opened stores in 28 provinces, municipalities, and autonomous regions, primarily concentrated in first and second-tier cities. In terms of R&D, Zeekr has technical achievements such as the SEA architecture, golden brick batteries, and intelligent driving technologies.

Lynk & Co is positioned as a new energy high-end brand, with the 07 EM-P and 08 EM-P becoming industry hits, achieving cumulative sales of 259,356 units in the first 11 months of this year. Currently, Lynk & Co has a broader network in third and fourth-tier cities, with R&D achievements including the CMA Evo architecture, SPA Evo architecture, Lynk & Co EM-P super electric hybrid, and Flyme Auto intelligent cabin system.

Looking simply, both Zeekr and Lynk & Co have already established a foothold in the market, and strategic integration clearly is not just about who helps whom. From the capabilities held by both companies, there will be an exchange of strengths and a focused effort to accomplish major tasks.

For instance, the brand positioning of both can complement each other, further improving the product portfolio; the sales networks complement each other, and with Lynk & Co's empowerment, Zeekr can quickly establish a broader sales and service network, thereby covering a wider range of potential users; in the future, if a unified product architecture is achieved, R&D capabilities can be complementary.

It can be imagined that the integrated "zeekr technology group" will have multiple driving forms for its products, fully covering architecture, three electricity systems, intelligent driving, and intelligent cabins, possessing full-stack self-research and vertical integration capabilities. Thanks to this, zeekr will further consolidate its leading position in technology, build stronger competitiveness at the product level, and achieve cost reduction and efficiency improvement in production.

In addition, this will unleash larger scale effects. By the end of 2024, the integrated "zeekr technology group" will exceed an annual sales volume of 0.5 million units, meaning it will be the first Chinese car company to cross the 0.5 million unit threshold in the high-end luxury new energy market. Based on the differentiated positioning of the two brands, sales growth, and the scale after integration, the "zeekr technology group" is also most likely to become the first industry player to cross the annual sales volume of 1 million units in the future.

From a deeper perspective, this is responsible to consumers as well as the industry chain. In the future, zeekr will be able to provide consumers with products that offer better quality, technology, efficiency, and cost, achieving its own high-quality development while making greater contributions to the industry chain, with enough momentum to help the industry chain increase profits and accelerate the automotive industry towards a healthy and positive development track.

From the perspective of capital markets, what is the value of strategic integration?

Returning to the capital market to view zeekr as an investment symbol, how should zeekr and Lynk & Co's strategic integration be evaluated from the current standpoint? From the perspective that investors focus on, the analysis can be done from the following core aspects.

1. Valuation aspect: possessing market rationality and not violating the interests of small and medium shareholders.

It is understood that the strategic integration values Lynk & Co at 18 billion yuan, with an average price of the Lynk & Co EM-P series products around 0.22 million yuan. It is estimated that Lynk & Co will sell 0.17-0.18 million new energy vehicles this year, corresponding to a total new energy vehicle revenue of 37.4 billion yuan to 39.6 billion yuan. This means that in 2024, the 18 billion yuan valuation of Lynk & Co corresponds to a P/S multiple of approximately 0.45-0.48, lower than zeekr's P/S multiple of 0.7.

Combining the market cap and valuation indicators of zeekr and other auto companies, Lynk & Co's valuation is reasonable and can even be said to be at a low valuation point. As Lynk & Co continues to diversify high-end products and establish stronger competitiveness in the global market, the average price and profitability per vehicle are showing a gradual improvement trend, which means its valuation will continue to rise, and 18 billion yuan can be seen as the "turning point" of Lynk & Co's valuation.

For investors, the current situation means 'locking in early', and the fact that geely autos has chosen this time to integrate and make full cash payments undoubtedly aligns with the interests of market investors.

2. In terms of operation: better commercialization capability and cost control capability, possessing growth prospects.

For auto manufacturers, the commercialization capability and cost control capability in the market are key to surviving in fierce competition.

Currently, zeekr and lynk & co's operational quality and profitability show an improving trend, with zeekr's gross margin for the third quarter reaching 15.7%, achieving quarterly breakeven under the Hong Kong accounting standards for the first time. Its potential for commercialization and precise cost control align with industry development trends.

The strategic integration of zeekr and lynk & co will create synergistic development, and it is foreseeable that performance will reach a new level. With enhanced commercialization capabilities and continued optimization of its cost expenses, driving the prosperity of the upstream and downstream industry chain, the 'zeekr technology group' will achieve long-term sustainable development.

It is worth mentioning that the 'zeekr technology group' also has the two prominent labels of 'global strategy' and 'high-end intelligent driving technology' in the market. This means that it is expected to grasp the pulse of the global electric vehicles market and intelligent driving technology development, opening up a broader growth boundary. Therefore, there is reason to believe that the company will occupy a more solid leading position in future competition and win more market share.

3. In terms of stock price: short-term uncertainties are expected to be quickly eliminated, and long-term value growth is to be anticipated.

As is well known, on the day the integration news of zeekr and lynk & co was announced, zeekr's market cap experienced short-term fluctuations, which was inconsistent with zeekr's favorable performance.

The reasons behind this are actually not complex; it is simply because uncertainty is the biggest enemy in the stock market. From the perspective of market psychology, investors tend to panic in response to unexpected events. Additionally, this strategic integration is a precedent in the industry, and apart from Geometric merging with Galaxy, there are indeed no external reference samples. Thus, it is understandable that investors choose to cash out on stocks rather than make judgments from a value investment perspective.

As the factors suppressing valuations dissipate quickly, Zeekr is likely to continue to receive data validation in terms of performance, and the market's bullish sentiment will naturally warm up quickly, reversing the previous stock price performance and ushering in a round of value growth opportunities.

Conclusion:

In summary, Zeekr's willingness to take this step for strategic integration will not lead to a long-term loss cycle, as it aims to engage in a 'value battle' to enhance the profits of the industry chain. On the other hand, before the key juncture of 2025 arrives, it will enter the market with stronger overall competitiveness to provide users with quality products, which is expected to help maintain a stable market position in the long run.

Combining the perspectives of valuation, operation, and stock price regarding this strategic integration, it is clearly a multi-party win-win situation for the industry, brand, shareholders, and users. Therefore, as investors, there is reason to remain optimistic about the future of Zeekr and to hold higher expectations for its value growth.