Tesla Inc (NASDAQ:TSLA) researcher Troy Teslike said on Tuesday that while the EV giant's sales in China are slated to rise this year as compared to the last, sales in the U.S. and Europe will drop, weighing down on the company's overall global deliveries.

What Happened: "There is no need for celebrations over the China numbers when sales are down in the U.S. and Europe," Teslike said.

While Tesla's sales in China are expected to increase by over 48,000 units, sales in the U.S. and Europe are expected to drop by over 30,000 units, Teslike said.

Cybertruck is unlikely to buoy overall sales in the U.S. given that the company is planning a three-day halt in production this month owing to too much inventory, he noted.

Cybertruck is unlikely to buoy overall sales in the U.S. given that the company is planning a three-day halt in production this month owing to too much inventory, he noted.

Based on the latest data, here's the situation for Tesla sales this year across all four quarters compared to last year:

— Troy Teslike (@TroyTeslike) December 3, 2024

• U.S. sales are expected to drop by over 30,000 units.

• European sales are also expected to decline by more than 30,000 units.

• Meanwhile, China sales...

Why It Matters: For the full year 2023, Tesla delivered 1,808,581 vehicles around the globe. To mark a growth over last year, the company has to deliver at least 514,926 vehicles in the three months through the end of December.

Tesla has never managed to deliver over 500,000 EVs in a quarter to date, making this an ambitious target.

In the third quarter, Tesla reported deliveries of 462,890 vehicles, up 6.4% year-over-year and up 4.3% quarter-over-quarter.

Deliveries fell 8.5% year-on-year in the first quarter and by 4.8% in the second quarter.

According to Teslike, the low sales in Europe will likely pull down Tesla's global delivery numbers despite a rise in China.

Price Action: Tesla stock closed at $351.42 on Tuesday, down 1.6% for the day. Year-to-date, Tesla's shares have risen 41.5%, according to Benzinga Pro data.

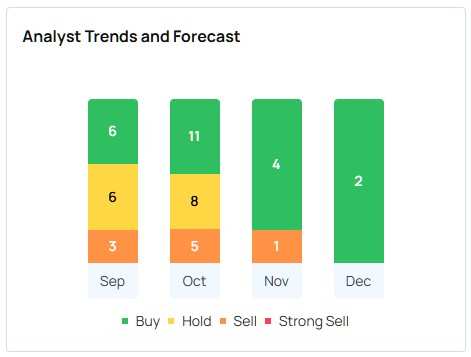

Overall, analysts have a consensus rating of "Buy" on the Tesla stock, with the highest price target being $411. The most recent analyst ratings by Roth MKM, Stifel, and UBS have an average price target of $339, implying a 3.5% downside.

Check out more of Benzinga's Future Of Mobility coverage by following this link.

- GM To Sell Stake In Michigan Battery Plant To JV Partner For Nearly $1B

Photo courtesy: Tesla