Morgan Stanley said that preparations for Nvidia's next-generation Rubin GPU have begun half a year early, and the launch is expected to be brought forward from the first half of 2026 to the second half of 2025. Thanks to the use of 3nm technology, CPO (co-packaged optical components), and HBM4 (sixth-generation high-bandwidth memory), the chip area of the next-generation GPU will be twice that of the previous generation Blackwell, and related industry chain companies are expected to benefit.

Daimo analyst Charlie Chan said in a December 2 report that although production of Blackwell chips is still growing, considering the complexity of the new chips, TSMC and the supply chain are already preparing for the launch of Nvidia's next-generation Rubin chips. The 3nm Rubin GPU is expected to enter the streaming stage in the second half of 2025, about half a year ahead of the previous schedule.

Damo said Rubin will be a powerful chip due to the migration of the 3nm process and the adoption of CPO and HBM4. According to the supply chain survey, Rubin's chip will be nearly twice the size of Blackwell's, and the Rubin chip may contain four computing chips, twice the size of Blackwell.

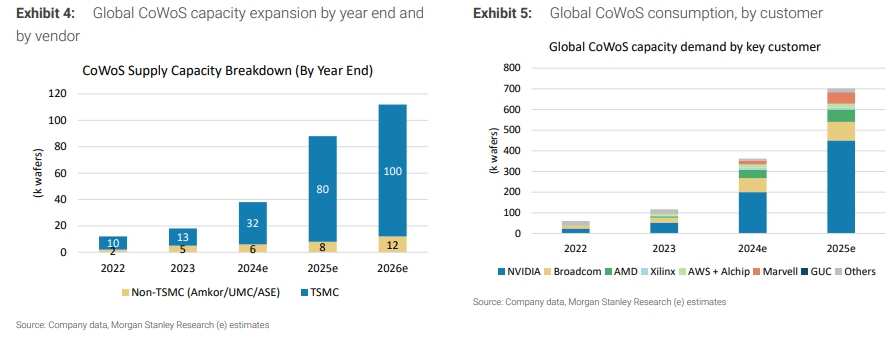

Analysts currently expect TSMC to further expand its CoWoS (Chip on Wafer Substrate) production capacity in 2026 due to the larger chip area. The company expects to begin placing 2026 orders with equipment suppliers in mid-2025, depending on the sustainability of AI capital expenditure.

Analysts currently expect TSMC to further expand its CoWoS (Chip on Wafer Substrate) production capacity in 2026 due to the larger chip area. The company expects to begin placing 2026 orders with equipment suppliers in mid-2025, depending on the sustainability of AI capital expenditure.

On the supply chain side, analysts believe ASMPT lags slightly behind Rubin's TCB tool certification. TCB (Hot Pressure Welding) is a process required for Rubin GPU CoW (Chip on Wafer). K&S previously announced that it had received a solderless TCB order from TSMC in November for CoW, while ASMPT said it is still communicating with TSMC about CoW certification.

Damo believes that ASMPT still has a chance to complete certification before the end of this year, and that low-volume procurement of the company's equipment may be realized in the second half of 2025. According to industry surveys, TSMC's first batch of CoW solderless TCB orders sold fewer tools through K&S, and it is expected that there will be less than 10 units in 2025. As Rubin GPUs are expected to enter mass production in 2026, order volume is likely to increase in 2026.

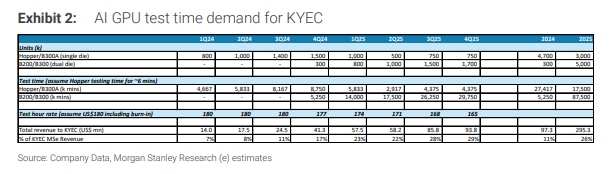

Another structural opportunity presented by the new GPU is the extension of testing time. Currently, Blackwell (testing time is three times longer than Hopper) and MI355 (twice as long) require longer testing time, according to Daimo analysts. Due to strong demand, the delivery period for the new Advantest tester was extended from 3 to 6 months.

In the long run, some AI-specific integrated circuits (ASICs), such as AWS's 3nm AI accelerator, may begin burn tests. According to supply chain surveys, all of Blackwell's final tests will continue to be carried out at KYEC. It is expected that by 2025, the B200/300 (dual-chip version) will be shipped to about 5 million units, based on TSMC's Cowos-L production capacity.

分析师目前预计,由于芯片面积变大,

分析师目前预计,由于芯片面积变大,