The top three net buy amounts on the dragon and tiger list are shenzhen h&t intelligent control, leo group co.,ltd., and yonghui superstores.

On December 4th, the market fluctuated and fell in the afternoon, with the Shanghai Composite Index declining by 0.42%, the Shenzhen Component Index falling by 1.02%, and the chinext price index dropping by 1.43%. More than 4,300 stocks in the all market declined, with a total trading volume of 1.66 trillion yuan in the Shanghai and Shenzhen markets. On the market, sectors like siasun robot&automation, coal, construction machinery, and oil & gas saw significant gains, while the film, media, gaming, and photovoltaic sectors experienced declines.

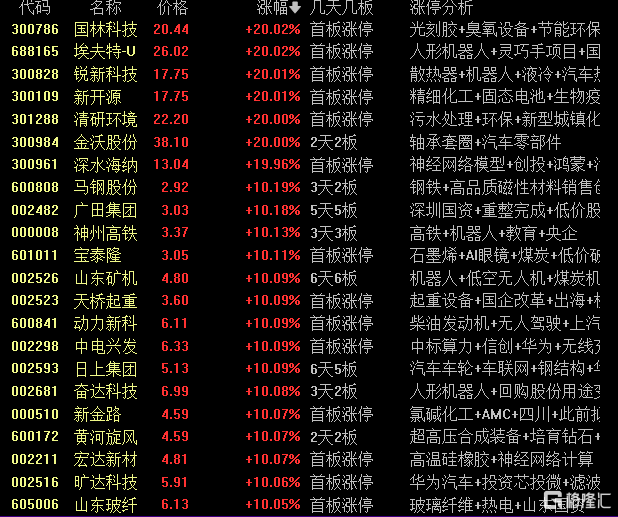

In terms of individual stocks, high-priced stocks continue to show divergence, with nanjing chemical fibre dropping nearly 7%; tianjin guifaxiang 18th street mahua food has seen a sky-and-ground limit trend, advancing to a 9-day consecutive limit; hainan huluwa pharmaceutical group, zhejiang yiming food, and fujian zhangzhou development have all achieved a 7-day consecutive limit, xiamen sunrise group has 5 limits in 6 days, guangtian group has 5 consecutive limits, shandong daye, zhejiang rifa precision machinery, and shandong ruyi woolen garment group have 4 consecutive limits, while jianshe industry group and shenzhen wongtee international enterprise have 3 consecutive limits.

Let's take a look at the Dragon Tiger List below:

Let's take a look at the Dragon Tiger List below:

The top three net buy amounts on the dragon and tiger list are shenzhen h&t intelligent control, leo group co.,ltd., and yonghui superstores, amounting to 0.262 billion yuan, 0.24 billion yuan, and 0.203 billion yuan respectively.

The top three net sell amounts on the dragon and tiger list for the day are sanfeng intelligent equipment group, guangbo group stock, and nanjing chemical fibre, with amounts of 0.264 billion yuan, 0.236 billion yuan, and 0.215 billion yuan respectively.

Among the stocks involved in institutional dedicated seats on the dragon and tiger list, the top three net buy amounts for the day are shanghai stonehill technology, leo group co.,ltd., and guotian group, with amounts of 0.304 billion yuan, 0.227 billion yuan, and 0.159 billion yuan respectively.

Among the stocks involved in institutional dedicated seats on the dragon and tiger list, the top three net sell amounts for the day are sanfeng intelligent equipment group, shanghai metersbonwe fashion & accessories, and weiman sealing, with amounts of 0.228 billion yuan, 66.6595 million yuan, and 15.4877 million yuan respectively.

Some of the top stock themes on the lists are:

Shenzhen H&T Intelligent Control (robots + satellite communication + stake in Moore Thread + automotive electronics)

Today it hit the daily limit, with a turnover ratio of 37.79%, a trading volume of 5.932 billion yuan, and an amplitude of 12.69%. According to the dragon and tiger list data, the net sell-off by deep stock connect was 10.2284 million yuan, while the total net buy by the brokerage seats was 0.273 billion yuan.

1. The company has mastered human-computer interaction technology and algorithms, visual recognition technology and algorithms, and electric machine drive control technology reserves, currently providing related control products and solutions for various service robots.

2. On November 18, during market interaction, the products T/R chips from the subsidiary Chengchang Technology are one of the core components of phased array antenna systems, with products already applied in bulk in spaceborne, ground, airborne phased array radar, and satellite communication fields.

3. On August 14, in an interaction, the company held a 1.244% stake in Moore Thread.

4. The company is focusing on the automotive electronics intelligent controller sector, with new project orders including international tier 1 new projects, mainly involving intelligent controllers for automotive radiators, coolant heaters, and other areas.

5. The intelligent controllers developed and produced by the company are one of the core components in household products, serving as computer units that independently accomplish specific functions, playing the role of heart and brain in home appliances and other household product assemblies.

Leo Group Co., Ltd. (AI marketing + semiconductors + TikTok agency + digital marketing)

Today it reached the daily limit, with a turnover ratio of 51.02% throughout the day, and a transaction amount of 13.717 billion yuan, with an amplitude of 16.19%. Data from the dragon and tiger list shows that 1 institution net bought 0.227 billion yuan, while hk->sz net sold 33.33 million yuan, and the total net buying amount from the securities firms was 46.1804 million yuan.

1. The company is leading in the layout of the AI marketing business, creating the ecological platform 'LEO AIAD', which enhances the efficiency and quality of content generation, launching the large model in the marketing field 'Leo Unity', which better meets clients' needs in intelligent deployment, and has been successfully applied in social media such as Xiaohongbook and Baidu, with significant results and business models recognized by clients.

2. The company is a TikTok agent, and its daily business scale has exceeded one million. The company will continue to pay attention to the development dynamics of TikTok, actively explore cooperation opportunities between both parties, and achieve the expansion of digital marketing business in overseas markets.

3. The wholly-owned subsidiary Leo Investment will invest 50 million US dollars in Tomales Bay Capital Anduril III, L.P. The investment target of the partnership is Space Exploration Technologies Corp. SpaceX is a globally leading aerospace technology company founded by Musk in 2002.

4. The company's main businesses are machinery manufacturing and digital marketing. Leo Group Pump Industry manages three major pump production bases in Wenling, Xiangtan, and Dalian.

Yonghui Superstores (retail + miniso IP cooperation expectations + Pang Donglai adjustment)

Today it reached the daily limit, with a turnover ratio of 15.36% throughout the day, a transaction amount of 8.565 billion yuan, and a fluctuation of 19.9%. According to the dragon and tiger list, the net buy from hk ->sh is 0.114 billion yuan, Chen Xiaoqun net bought 0.285 billion yuan, and Little Alligator bought 0.138 billion yuan.

1. The company's main business is to sell selected commodities through offline stores and online, covering consumers of all ages.

2. On the evening of September 23, an announcement was made that shareholders Milk Co., Ltd., Beijing JD.com Century Trading Co., Ltd. and Suqian Hanbang Investment Management Co., Ltd. plan to transfer 21.08%, 4.05% and 4.27% of Yonghui Superstores' shares respectively to Jun Cai International through a transfer agreement, totaling 29.4%. After this transaction is completed, the company's largest shareholder will change to Jun Cai International, which will hold a total of 29.4% of the company's shares. Jun Cai International is a subsidiary of Miniso. According to Yicai, Yonghui Superstores' vice president and national project leader Wang Shoucheng stated in an interview that next year Yonghui Superstores plans to have more than 100 self-managed adjusted stores, and is currently also communicating with Miniso to promote cooperation in IP business in the future.

3. In May of this year, Yonghui Superstores, a traditional supermarket leader, announced that it would start nationwide store adjustments with the assistance of the well-known commercial brand in Henan, Pang Donglai.

Key trading stocks of institutions:

Yanshan Technology: Today it reached the daily limit, with a turnover ratio of 24.30% throughout the day, a transaction amount of 6.315 billion yuan, and a fluctuation of 13.66%. According to the dragon and tiger list, 3 institutions net bought 0.304 billion yuan, and deep stock link net bought 0.215 billion yuan, while brokerage seats had a total net sell of 0.336 billion yuan.

Guangtian Group: Today it reached the daily limit, with a turnover ratio of 13.58% throughout the day, a transaction amount of 1.465 billion yuan, and a fluctuation of 21.69%. According to the dragon and tiger list, 4 institutions net bought 0.159 billion yuan, and brokerage seats had a total net sell of 52.0712 million yuan.

Global top e-commerce: Today it hit the price limit, with a turnover ratio of 55.31% for the whole day, and a transaction amount of 4.609 billion yuan, with an amplitude of 21.57%. Data from the daily trading leaderboard shows that institutions net bought 66.9067 million yuan, the hk->sz net purchase was 83.5186 million yuan, and the total net purchase from brokerage seats was 44.5028 million yuan.

Deepwater Haina: Today it hit the price limit, with a turnover ratio of 23.40% for the whole day, and a transaction amount of 0.46 billion yuan, with an amplitude of 20.41%. Data from the daily trading leaderboard shows that institutions net bought 46.3092 million yuan, and the total net purchase from brokerage seats was 23.2904 million yuan.

Sanfeng intelligent equipment group: Today it hit the lower price limit, with a turnover ratio of 18.20% for the whole day, and a transaction amount of 1.187 billion yuan, with an amplitude of 12.33%. Data from the daily trading leaderboard shows that institutions net bought 31.7968 million yuan, the hk->sz net purchase was 10.2444 million yuan, and the total net sale from brokerage seats was 22.391 million yuan.

Sanfeng intelligent equipment group: Today it rose by 2.44%, with a turnover ratio of 42.70% for the whole day, and a transaction amount of 4.024 billion yuan. Data from the daily trading leaderboard shows that institutions net sold 0.228 billion yuan, and the hk->sz net sale was 42.3724 million yuan.

Shanghai metersbonwe fashion & accessories: Today it hit the lower price limit, with a turnover ratio of 16.09% for the whole day, and a transaction amount of 0.918 billion yuan, with an amplitude of 8.18%. Data from the daily trading leaderboard shows that institutions net sold 66.6595 million yuan, and the total net purchase from brokerage seats was 10.1793 million yuan.

In the daily trading leaderboard, there are 9 stocks involved in the hk->sh special seat, with yonghui superstores having the largest net buying amount of 0.114 billion yuan.

In the daily trading leaderboard, there are 8 stocks involved in the hk->sz special seat, with shanghai stonehill technology having the largest net buying amount of 0.215 billion yuan.

Yoozoo operation dynamics:

Siming South Road: Net purchases of wenyi trinity technology 70.33 million yuan, qingdao guolin technology group 38.48 million yuan, net sales of nanjing chemical fibre 89.23 million yuan, guangbo group stock 68.72 million yuan, guangxi yuegui guangye holdings 50.18 million yuan.

Ningbo Sangtian Road: Net purchases of shanghai dzh limited 99.99 million yuan, net sales of spic yuanda environmental-protection 48.85 million yuan, greatoo intelligent equipment inc. 28.52 million yuan, aishida co.,ltd. 26.8 million yuan.

Chen Xiaoqun: Net purchases of yonghui superstores 0.285 billion yuan, greatoo intelligent equipment inc. 56.14 million yuan, spic yuanda environmental-protection 52.97 million yuan, net sales of tianjin guifaxiang 40.54 million yuan.

Chengdu Gang: Net sales of haoyun technologies 52.62 million yuan, weiwan sealing 32.25 million yuan.

Leisure group: Net purchases of shenzhen h&t intelligent control 69.19 million yuan, tianjin ruixin technology 49.88 million yuan.

Fang Xinxia: Net buy of shanghai dzh limited 0.133 billion yuan and greatoo intelligent equipment inc. 64.23 million yuan.

Hu Jia Lou: Net buy of spic yuanda environmental-protection 53.78 million yuan, net sell of shanghai stonehill technology 93 million yuan.

Shanghai Super Short: Net buy of boai nky medical 61.95 million yuan, net sell of haoyun technologies 57.65 million yuan.

Chengdu System: Net sell of haoyun technologies 52.62 million yuan and weiwan seal 32.25 million yuan.

Yue Wang Avenue: Net sell of yuanda environmental protection 55.89 million yuan and tianjin guifaxiang 27.57 million yuan.

Northeast Beast: Net sell of shanghai dzh limited 67.33 million yuan.

Beijing Centergate Technologies: Net buy of sanfeng intelligent equipment group 35.88 million yuan.

Little Crocodile: Net buy of yonghui superstores 0.138 billion yuan.

Zhang Mengzhu: Net sell of Leo Group Co., Ltd. 68.77 million yuan.

Yu Ge: Net sell of Guangbo Group Stock 0.102 billion yuan.

下面我们来看下龙虎榜情况:

下面我们来看下龙虎榜情况: