①机构超亿元买入多只高位股,其中利欧股份获一家机构买入2.27亿。②永辉超市获三家一线游资席位合计买入超6亿,获一家量化席位买入1.59亿。

沪深股通今日合计成交1872.5亿,其中赛力斯和宁德时代分居沪股通和深股通成交额个股首位。板块主力资金方面,石油石化板块主力资金净流入居首。ETF成交方面,科创创业ETF(159781)成交额环比增长308%。期指持仓方面,IM期指主力合约空头减仓数量明显大于多头。龙虎榜方面,广田集团获机构买入1.58亿;跨境通获机构买入超6000万;三丰智能遭机构卖出2.27亿;美邦服饰遭机构卖出超6000万;巨轮智能获四家一线游资席位合计买入超3亿;大智慧获两家一线游资席位合计买入超2.3亿,获一家量化席位买入2.35亿;和而泰获国泰君安上海海阳西路营业部买入2.09亿。

一、沪深股通前十大成交

今日沪股通总成交金额为904.53亿,深股通总成交金额为967.97亿。

今日沪股通总成交金额为904.53亿,深股通总成交金额为967.97亿。

从沪股通前十大成交个股来看,赛力斯位居首位;贵州茅台和工业富联分居二、三位。

从沪股通前十大成交个股来看,赛力斯位居首位;贵州茅台和工业富联分居二、三位。从深股通前十大成交个股来看,宁德时代位居首位;东方财富和北方华创分居二、三位。

二、板块个股主力大单资金

从板块表现来看,机器人、煤炭、工程机械、油气等板块涨幅居前,影视、传媒、游戏、光伏等板块跌幅居前。

从主力板块资金监控数据来看,石油石化板块主力资金净流入居首。

从主力板块资金监控数据来看,石油石化板块主力资金净流入居首。板块资金流出方面,计算机板块主力资金净流出居首。

从个股主力资金监控数据来看,主力资金净流入前十的个股所属板块较为杂乱,景嘉微流入居首。

从个股主力资金监控数据来看,主力资金净流入前十的个股所属板块较为杂乱,景嘉微流入居首。主力资金流出前十的个股所属板块较为杂乱,东方财富净流出居首。

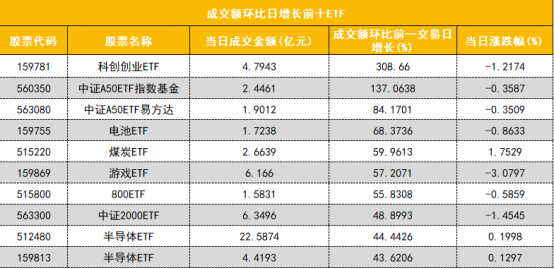

三、ETF成交

从成交额前十的ETF来看,香港证券ETF(513090)成交额位居首位;科创50ETF(588000)成交额位居第二位。

从成交额前十的ETF来看,香港证券ETF(513090)成交额位居首位;科创50ETF(588000)成交额位居第二位。 从成交额环比增长前十的ETF来看,科创创业ETF(159781)成交额环比增长308%位居首位;煤炭ETF(515220)成交额环比增长59%位居第五位。

从成交额环比增长前十的ETF来看,科创创业ETF(159781)成交额环比增长308%位居首位;煤炭ETF(515220)成交额环比增长59%位居第五位。四、期指持仓

四大期指主力合约多空双方均大幅减仓,且空头减仓数量均较多,IM合约空头减仓数量明显大于多头。

四大期指主力合约多空双方均大幅减仓,且空头减仓数量均较多,IM合约空头减仓数量明显大于多头。五、龙虎榜

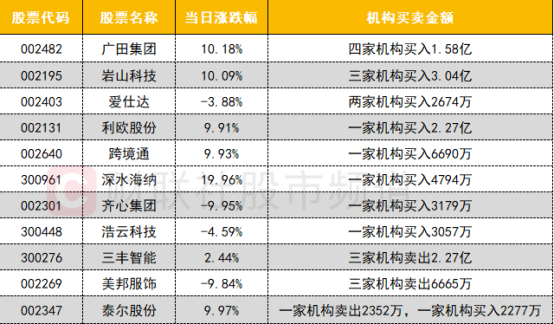

1、机构

今日龙虎榜机构活跃度有所提升,多只高位股获机构大幅买入,其中广田集团获机构买入1.58亿,岩山科技获机构买入3.04亿,利欧股份获机构买入2.27亿,跨境通获机构买入超6000万。

今日龙虎榜机构活跃度有所提升,多只高位股获机构大幅买入,其中广田集团获机构买入1.58亿,岩山科技获机构买入3.04亿,利欧股份获机构买入2.27亿,跨境通获机构买入超6000万。卖出方面,机器人概念股三丰智能遭机构卖出2.27亿;美邦服饰遭机构卖出超6000万。

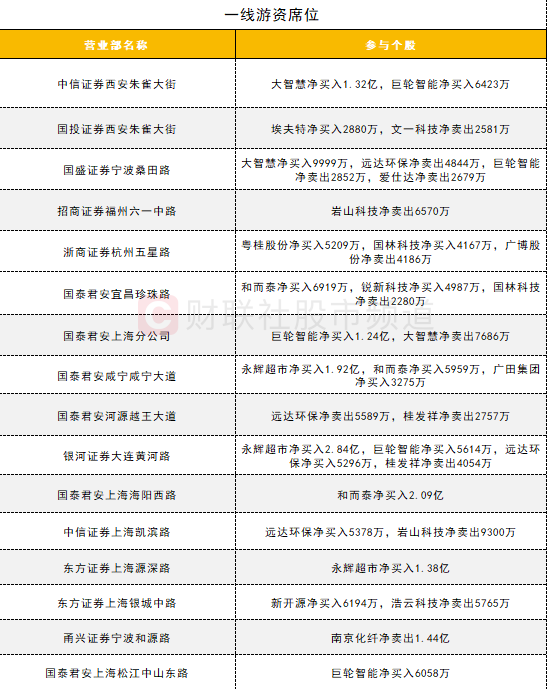

2、游资

一线游资活跃度有所提升,机器人概念股巨轮智能获四家一线游资席位合计买入超3亿;永辉超市获三家一线游资席位合计买入超6亿;大智慧获两家一线游资席位合计买入超2.3亿;和而泰获国泰君安上海海阳西路营业部买入2.09亿;南京化纤遭甬兴证券宁波和源路营业部卖出1.44亿。

一线游资活跃度有所提升,机器人概念股巨轮智能获四家一线游资席位合计买入超3亿;永辉超市获三家一线游资席位合计买入超6亿;大智慧获两家一线游资席位合计买入超2.3亿;和而泰获国泰君安上海海阳西路营业部买入2.09亿;南京化纤遭甬兴证券宁波和源路营业部卖出1.44亿。 量化资金活跃度较高,大智慧获一家量化席位买入2.35亿;永辉超市获一家量化席位买入1.59亿。

量化资金活跃度较高,大智慧获一家量化席位买入2.35亿;永辉超市获一家量化席位买入1.59亿。