New China Life Insurance announced today that it has increased its holdings of Haitong Securities' H shares, with its latest announcement holding a stake of 5.4846%. Industry association data shows that this is the first time this year that an insurance company has increased its holdings of brokerage stocks. It is also the first time in five years that an insurance company has increased its holdings of brokerage stocks. Yesterday (December 3), the latest announcement showed that New China Asset is still continuing to buy, buying another 8 million shares of Haitong Securities on December 2, each priced at HK$7.0024.

On December 4, Cailian News Agency (Reporter Zou Juntao) reported for the first time this year that an insurance company has increased its holdings of brokerage stocks, also the first time in five years.

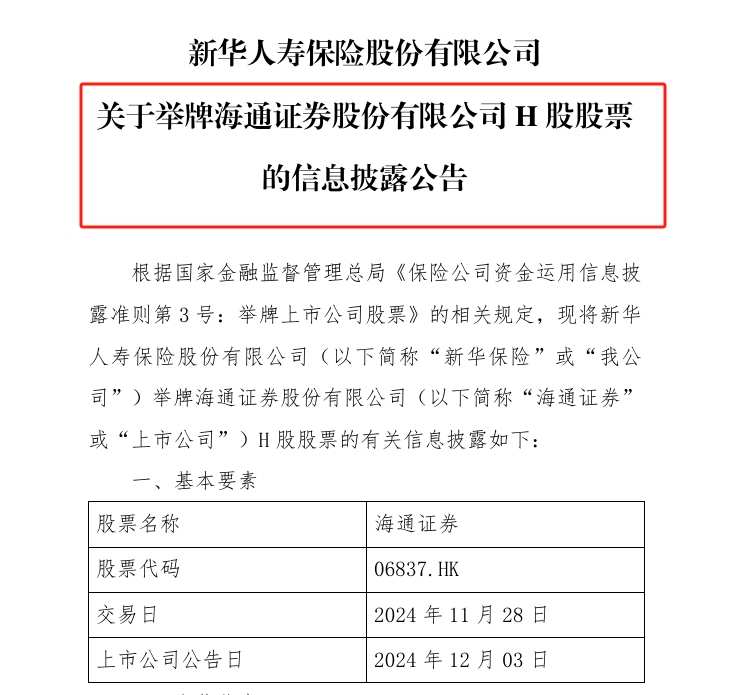

On December 4, New China Life Insurance Co., Ltd. (referred to as 'New China Insurance') announced on its official website the acquisition of Haitong Securities' H shares. The company increased its stake by 4,000,000 unrestricted tradable H shares of Haitong Securities through centralized bidding transactions on the secondary market on November 28, 2024, accounting for 0.12% of the issued H share capital of Haitong Securities. The related transactions were completed through the Hong Kong Stock Connect channel. After this equity change, New China Insurance holds 171,027,200 Haitong Securities H shares, representing approximately 5.02% of the listed company's H share capital.

Cailian News Agency noted that New China Insurance had previously participated in the acquisition of China National Medicines Corporation and Shanghai Pharmaceuticals, two medical stocks, and this is the first time they have acquired brokerage stocks recently. In addition, according to the China Insurance Association's website, this is also the first time this year that insurance companies have acquired brokerage stocks, and since China Life Insurance Group acquired Swhy H shares in April 2019, brokerage stocks have been acquired by insurance companies.

Cailian News Agency noted that New China Insurance had previously participated in the acquisition of China National Medicines Corporation and Shanghai Pharmaceuticals, two medical stocks, and this is the first time they have acquired brokerage stocks recently. In addition, according to the China Insurance Association's website, this is also the first time this year that insurance companies have acquired brokerage stocks, and since China Life Insurance Group acquired Swhy H shares in April 2019, brokerage stocks have been acquired by insurance companies.

New China Life Insurance announced the acquisition of Haitong Securities' H shares, and continues to buy after the acquisition.

According to New China Life Insurance's announcement, the participant in the acquisition of Haitong Securities' H shares is New China Asset Management Co., Ltd., with its affiliated company New China Asset Management (Hong Kong) Ltd. not participating in this increase. New China Asset and New China Asset Management (Hong Kong) only act as the delegated managers of New China Insurance.

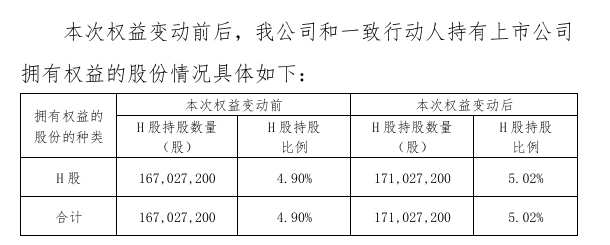

Before this change in equity, New China Insurance held 112,027,200 Haitong Securities H shares through New China Asset, accounting for about 3.29% of the company's listed Hong Kong share capital, and held 55,000,000 Haitong Securities H shares through New China Asset Management (Hong Kong), accounting for 1.61% of the company's listed Hong Kong share capital. New China Insurance and its concerted action parties New China Asset and New China Asset Management (Hong Kong) collectively hold 167,027,200 Haitong Securities H shares, representing approximately 4.90% of the listed company's H share capital.

New China Insurance stated that on November 28, 2024, the company increased its holdings of Haitong Securities' unrestricted tradable H shares by 4,000,000 shares through centralized bidding transactions on the secondary market, accounting for 0.12% of the issued H share capital of Haitong Securities. The related transactions were completed through the Hong Kong Stock Connect channel. After this equity change, New China Insurance holds 171,027,200 Haitong Securities H shares, representing approximately 5.02% of the listed company's H share capital.

In addition, according to the announcement, as of November 28, 2024, New China Life Insurance held a balance of 1.065 billion yuan in the H-share stocks of Haitong Securities, accounting for 0.07% of the company's total assets at the end of the third quarter of 2024. New China Life Insurance stated that this proportion complies with regulatory requirements.

However, based on the latest disclosure by Haitong Securities H (06837.HK) on December 3rd, New China Asset purchased 8 million shares again on December 2nd at a price of 7.0024 Hong Kong dollars per share. Currently, New China Life Insurance has increased its holding of H-share stocks of Haitong Securities through New China Asset to 187,000,000 shares, accounting for 5.4846% of the company's H-share stocks.

Insurance funds launched a takeover of brokerage stocks for the first time in five years.

It is worth noting that insurance funds have been actively taking over companies this year, reaching a historical high in the number of takeovers and listed companies in nearly four years. According to data released by the China Insurance Association, there have been 16 instances of takeovers by insurance funds so far this year.

In terms of industry types involved, it covers transportation, environmental protection, utilities, power equipment, banks, and medical fields. This is the first time insurance funds have taken over brokerage stocks in a year and also the first time in five years.

Looking at cases from this year, insurance companies take over companies seeking cost-effectiveness and high dividends, looking for assets with growth potential and long-term value. Industry analysts generally believe that insurance funds follow a high return on equity (ROE) and dividend style, aligning with patient capital seeking long-term stable cash flow.

The analysis by Huachuang Securities' Xu Kang team pointed out that insurance funds tend to take over companies with good quality and stable performance, reflecting the implementation of their long-term investment philosophy and the role of patient capital. From an accounting perspective, assets with high ROE and dividends are expected to continue to be favored by insurance funds. Considering solvency constraints, it is expected to be somewhat difficult for insurance funds to increase their holdings of equity assets under the large asset allocation framework, but structural opportunities focusing on high ROE and dividend assets are still recommended.

According to publicly available market information, in response to policy calls, the willingness of brokerage stocks to distribute dividends has strengthened. This year, many brokerages have joined the mid-year dividend distribution. On August 29, Haitong Securities announced the 2024 interim profit distribution plan, proposing a cash dividend of 0.03 yuan per share (pre-tax), marking the first increase in mid-term dividends since the company went public.

In addition, according to the views of institutions such as AVIC Securities, regulatory encouragement for brokerage mergers and acquisitions within the year is beneficial for the valuation repair of some top undervalued brokerage stocks; as well as expecting a significant improvement in the current capital market confidence dilemma under the support of policies and liquidity, forming substantial bullish factors for brokerage brokerage, wealth management, investment and other businesses, bullish on the trading opportunities of brokerages in the near future.

财联社记者注意到,新华保险此前连续参与举牌国药股份、上海医药两只医药股,此次为近期首次对券商股进行举牌。此外,根据中国保险业协会网站显示,这也是险资年内首次对券商股进行举牌,以及自2019年4月中国人寿集团举牌申万宏源H股以来,再现券商股被险资举牌。

财联社记者注意到,新华保险此前连续参与举牌国药股份、上海医药两只医药股,此次为近期首次对券商股进行举牌。此外,根据中国保险业协会网站显示,这也是险资年内首次对券商股进行举牌,以及自2019年4月中国人寿集团举牌申万宏源H股以来,再现券商股被险资举牌。